USDCHF declines: a correction is necessary

The USDCHF pair is declining; the market requires a correction. Find out more in our analysis for 29 October 2024.

USDCHF technical analysis

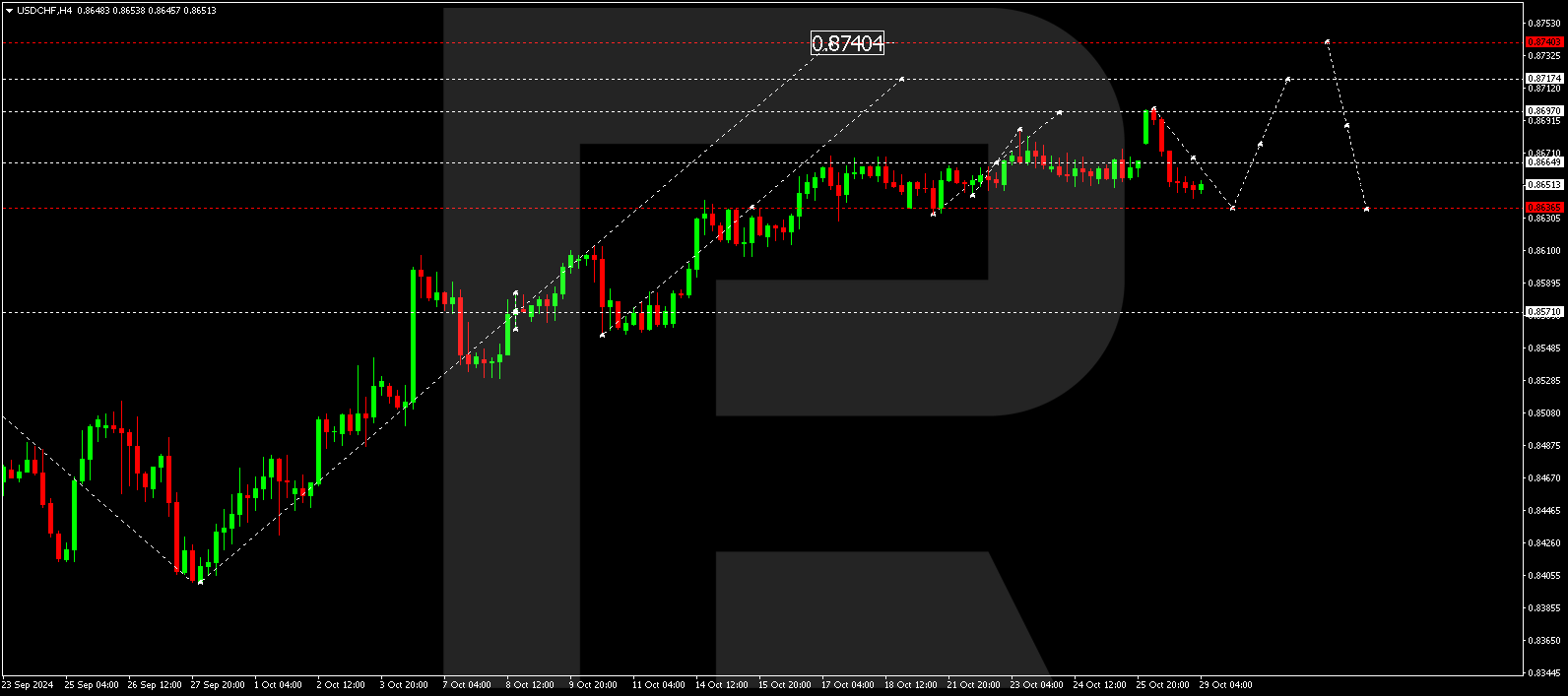

The USDCHF H4 chart shows that the market has formed a growth wave structure towards 0.8697. A correction is expected to develop, aiming for 0.8636 today, 29 October 2024. After reaching this level, the price could rise to 0.8717, potentially extending the growth wave to 0.8740.

The USDCHF pair is poised for a correction after previous steady gains.

Read more - USDCHF Forecast

Attention!

Forecasts presented in this section only reflect the authorís private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks