Hello!

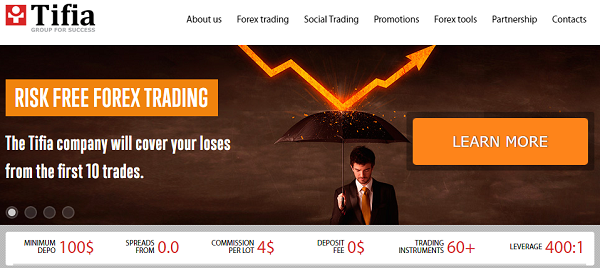

There is analytics and trading recommendations from the company Tifia in this thread.

And we'll be glad to share our opinion about the Forex market. You are our best motivation for further development. Everything we do, we do it in your interests!

Thanks and welcome!

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks