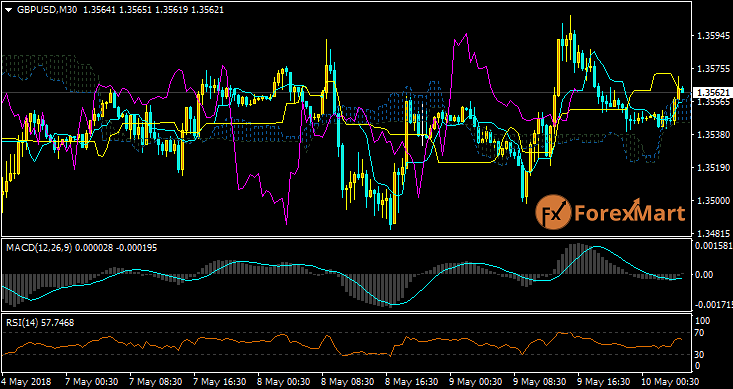

GBP/USD Fundamental Analysis: March 7, 2018

The British pound resumes its uptrend amid the weakened dollar across all market in the past 24 hours. Although the increase was not as high as it can be, it was able to move steadily which has assisted the British currency to recover from its lows and have a steady uptrend over the past few days. These gave the investors more confidence during the said period of time.

Meanwhile, the sterling pound has been moving steadily and further boosted by the lack of economic data. The ongoing Brexit negotiation following the set plan also supports the pound. Euro leaders have been busy with their domestic concerns and at the same time, rumors and commentaries about them have also lessened At the same time, the Brexit negotiation has assisted the dollar to move steadily.

The dollar got behind against other currencies following the resignation of Trump’s economic advisor, John Cohn, which is not favorable for the president and his team as they have had some difficulties in handling situation in the past few months. On the other hand, this is advantageous for the dollar as the overall market which is the reason for the dollar’s decline during this period of time.

The market is getting ready for the slew of data in the upcoming days with a new month has begun. The ADP employment report expected to be released today will hint at the results of another incoming data of Friday. If the data came out weakly, this would further push the GBP/USD pair towards the area of 1.40.

8Likes

8Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks