Hi,

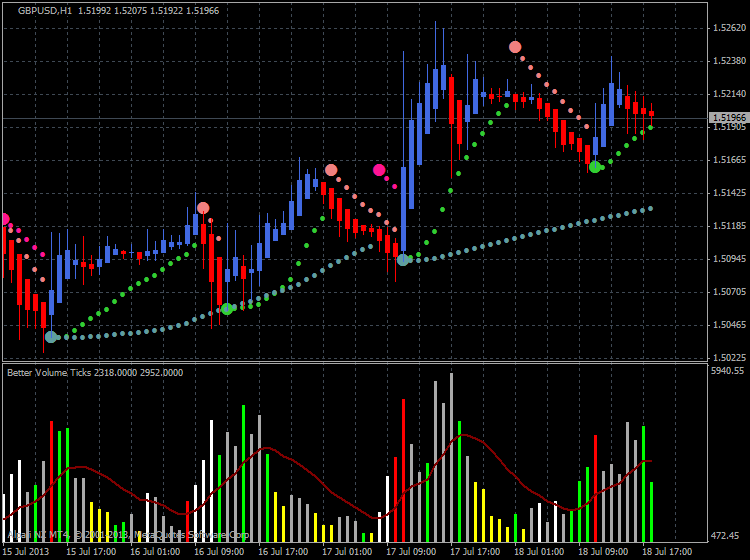

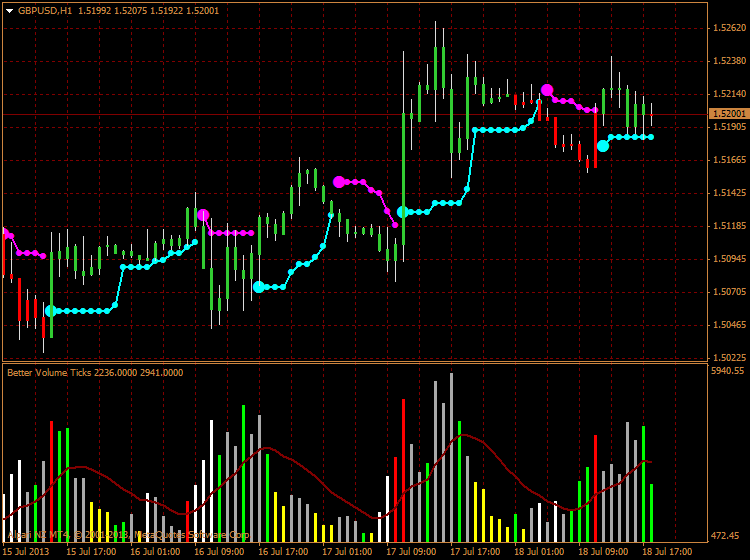

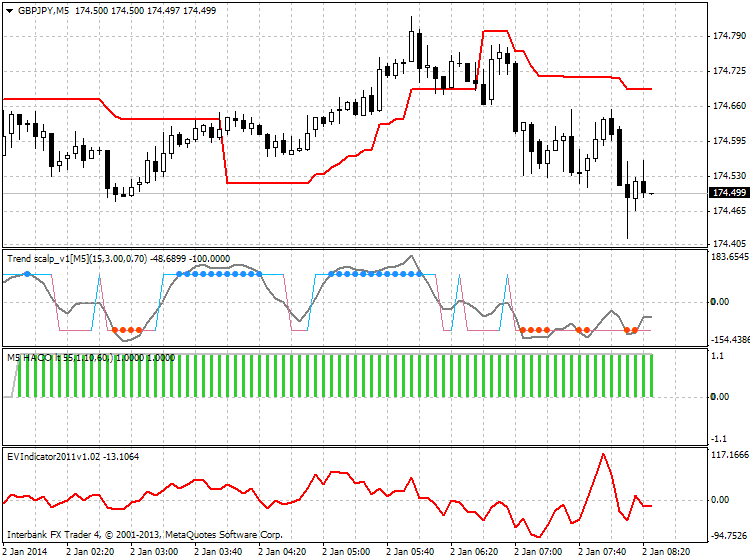

Please take a look at the AllVolumeAverage_v2 indicator which helps to detect Volume Breakouts at the market and can also be used to confirm the signal. This is upgrade of well-known VolumeAverage which I ported from EasyLanguage version. Plus you can find Buy/Sell signals with advanced Box alerts.

Code:extern int TimeFrame = 0; // TimeFrame in min extern int FastLength = 3; // Fast MA Period extern int FastMode = 0; // Fast MA Mode extern int SlowLength = 20; // Slow MA Period extern int SlowMode = 0; // Slow MA Mode extern int BreakoutPct = 50; // Breakout Percent extern int AlertMode = 0; // 0-off,1-on extern int SoundsNumber = 5; // Number of sounds after Signal extern int SoundsPause = 5; // Pause in sec between sounds extern string UpSound = "alert.wav"; extern string DnSound = "alert2.wav"; extern int EmailMode = 0; // 0-off,1-on extern int EmailsNumber = 1; // Number of emails after Signal

Attachment 768

Regards,

Igor

15Likes

15Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks