Talking Points

-Huge event risk this week with ECB monetary policy statement and the US jobs report

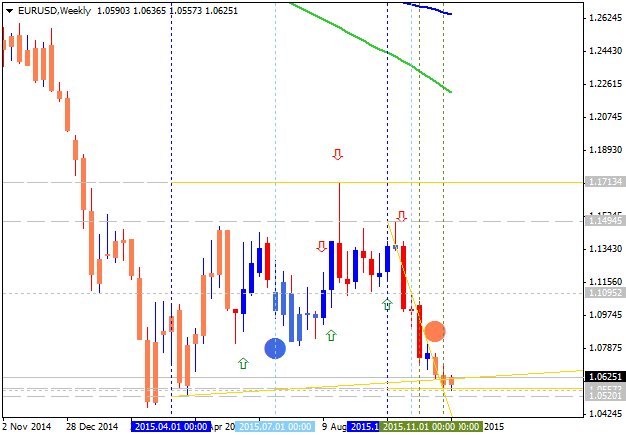

-Bullish patterns suggest a minimal move back towards 1.08-1.09

-On Balance Volume and Sentiment readings suggest a mature trend ripe for a reversal

For those who don’t closely watch the FX markets, this is a big week for the EUR/USD and a big month for the US Dollar Index. On Thursday, ECB President Mario Draghi will provide a statement regarding the ECB’s monetary policy. Economists are expecting a shift towards expansion of the QE program which could weigh heavily on the EUR.

Additionally, we have the US Non-Farm Payroll report coming out on Friday. One month ago, the NFP report was a surprise to the upside which fueled additional expectations for a Fed rate hike coming up December 16.

On the one hand, you have a central bank (ECB) which is leaning towards more easing. On the other hand, you have the Fed contemplating when to raise rates. FX traders love diverging monetary policies between two central banks as it can create strong trends. This is in large part why the EUR/USD has sold off aggressively for the past 5 weeks. However, these fundamental stories have yet to unfold and even if they do, is this the beginning of the trend or a buy the rumor then sell the news type of trade?

As we look through the technical patterns, it appears the higher probability move is for a couple hundred pips of US Dollar weakness. This could send the EUR/USD higher towards 1.08-1.09.

Bullish Scenario – Completion of the Ending Diagonal

Until November 18, 2015, the moves lower have appeared impulsive. However, the sustained move below 1.0615 has occurred in sloppy over lapping waves. As we pointed out in Monday’s US Opening Bell webinar, one pattern we keep an eye on in that situation is a diagonal pattern (image 1 above). Since the diagonal is appearing towards the end of a long move lower from August, we believe it is taking shape as an ending diagonal pattern. This pattern typically retraces to the origination which happens to be near 1.0830. A move above 1.1090 suggests the correction lower is complete with a likely retest towards 1.17 down the road.

Bearish Scenario – Wave iii of (iii)

A break below 1.0440 would leave the chart as labeled in Image 1 as incorrect. That is because on an immediate drop below 1.0440, wave iii would be the shortest of waves i, iii, v which is not allowed under Elliott’s rules.

Therefore, we shift the patterns towards being in the middle of a wave iii of (iii) lower. Since 1.0440 is the point of invalidation for longs, a stop and reverse order could be considered near there.

more...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks