Talking Points:

-High-Leverage & Low-Cost of FX

-Intermarket Moves Keep FX Always Relevant

-24-Hour/5 Access To an Active Market

This article will give you a 10,000 ft. view of why retail or individual traders come to the Forex Market. Since the Forex Market became available to non-bank traders in 1999, the popularity relative to other markets have exploded. Even though there are too many reasons in all to list here, you will come to a better understanding to see if this market is for you.

Before we get our hands dirty and our minds working about the benefits of FX, you should keep one thing in mind. All markets, whether it is private equity, real estate, stocks, options, or FX are really about one thing. Markets are about seeking a satisfactory return of capital relative to the level of risk you’re taking on at any one time.

High-Leverage & Low-Cost of FX

The Forex Market allows you to trade with large amounts of leverage. Leverage allows to control a position or trade that is larger than your capital base. Therefore, with a $5,000 account, you could open up a trade of $10,000, $50,000, or $100,000, if you so desire.

Learn Forex: A Simple Look at How Leverage Can Affect You

Of course, there is always a trade off in any market and Forex is no different. Your profit or loss on any trade is dependent on the trade size open. Therefore, if you open a trade that is too large relative to your account balance and that trade goes against you, the effect can be more than you bargained for.

The other side of the coin to the Forex Market is the low cost to start an account. The brokerage that you decide to trade with will set the required start-up account balance. However, as a trader, less isn’t more as we found it is far better to find an appropriate balance over the lowest possible balance.

The other aspect of low costs is displayed in the transaction costs. The transaction costs in Forex is known as the spread and is found by taking the different of the bid and ask measured in pips. All things being considered, the lower the spread, the quicker you will realize a profit should the market move in the direction of your analysis.

Intermarket Moves Keep FX Relevant

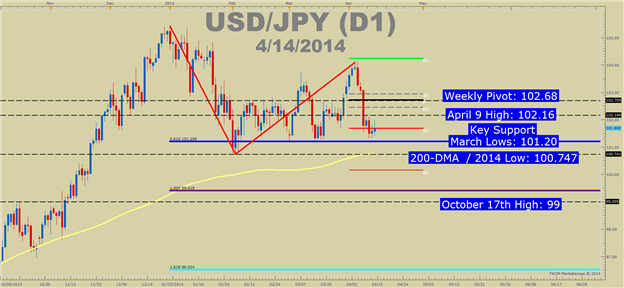

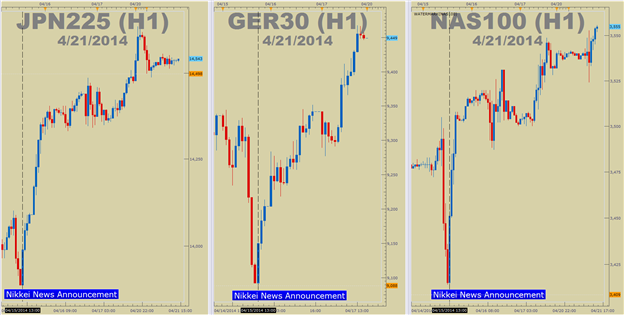

In 2013, the hottest stock market in the world was the Nikkei 225. The Nikkei 225 is Japan’s stock market which was boosted by an aggressive monetary policy via the Prime Minister of Japan and the Bank of Japan. As the world becomes more and more interrelated, it shouldn’t surprise you that the JPY was similarly one of the biggest performers in 2013 which assisted in the Nikkei 225’s 57% return in 2013.

Learn Forex: FX Is Correlated To Many Markets

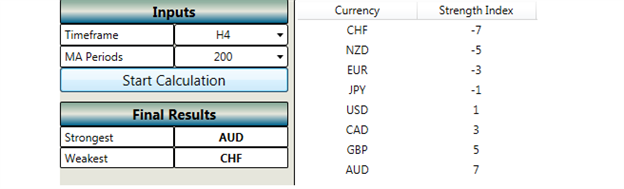

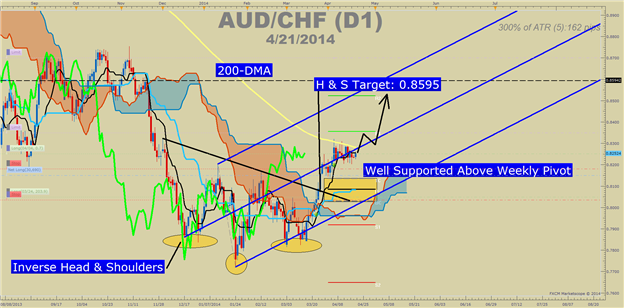

As you can easily imagine, because every other financial market is priced in global currencies, a shift of global capital flow into a new market in a different country would could massive buying or selling of currencies. This type of thinking or analysis is known as Intermarket analysis or Intermarket correlations. The reason that this natural occurrence is seen as a major benefit of trading this market is because it can add rocket fuel to your trade idea. Excellent trends can develop in the Forex Market for a myriad of reasons but if a global capital flow shift begins to develop, you may find the trend your trading moving faster and further than you imagined which makes this a great market to trade.

24-Hour/5 Access to an Active Market

Trading stocks isn’t kind to those who work for a living and want to actively trade. The New York Stock Exchange opens after most start their work day and almost certainly end before their day ends. Stock trading hours in the US are open from Monday through Friday 9:30 a.m. to 4:00 p.m. ET. This means that if you want to have an active trading style, you’ll likely need to pay someone else to do the trading for you.

This dilemma doesn’t exist in the Forex Market. Living in the Western Hemisphere, you can easily trade the Japanese Consumer Price Index or Reserve Bank of Australia Rate announcement in the evening. What’s more, there are three distinct zones in any given trading day with distinct trading opportunities so that regardless of your preference on how to trade, there’s likely a few opportunities a day for you to try and capitalize on.

Happy Trading!

---Written by Tyler Yell, Trading Instructor

More...

10Likes

10Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks