Why Traders Hold On to Losing Positions

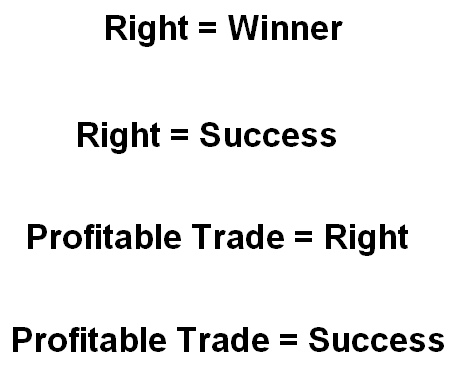

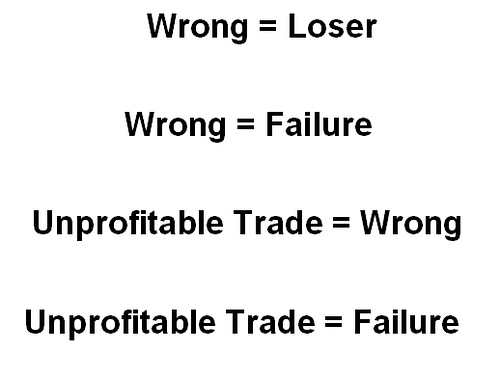

Humans in general grow up being taught by their environment of the importance of always being right. Those who are right are envied as the winners in society and those who are wrong are cast aside as losers. A fear of being wrong and the need to always be right will hold you back in general, but will be deadly in your trading.

How Most People Associate Profitable Trades:

How Most People Associate Unprofitable Trades:

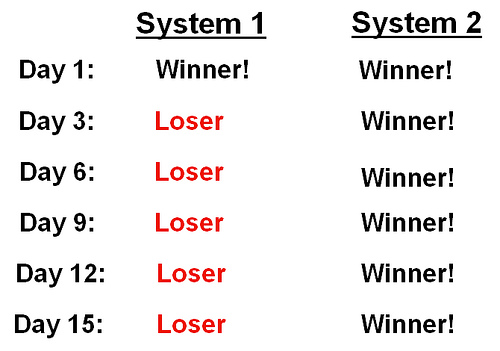

So now ask yourself this question. If you were really the trader in this example which system would you rather have?

Most of the successful systems that I have seen fall into the category of the first one we looked at in that they take a lot of small losses and make their gains for the year on a few big winners. As in this example however most traders do not have the mental toughness to stay with these types of systems during the long loosing streaks and give up on them prematurely, and throwing a profitable methodology in the trash without giving it a chance.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks