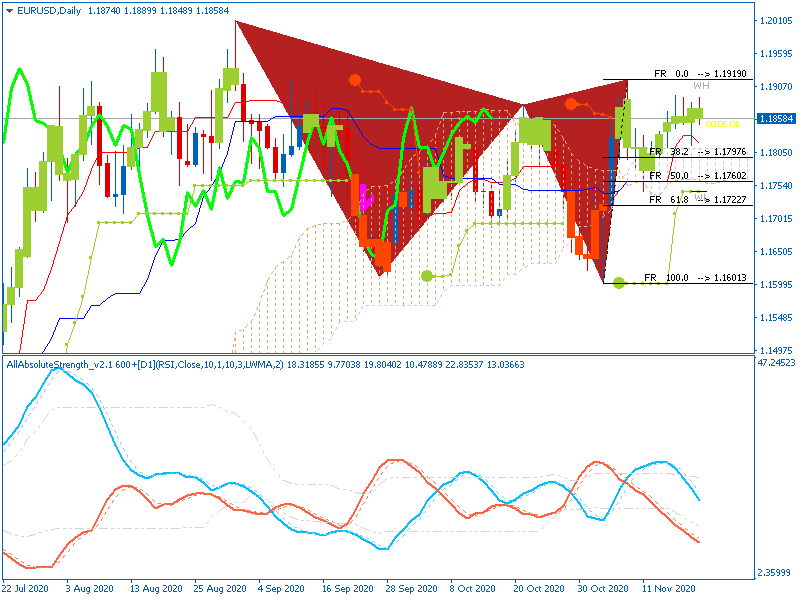

The euro shouldn’t be kicking around U.S. companies’ earnings any more.

It caught fire on Thursday, jumping 1.8% against the dollar after the European Central Bank announced a fresh round of stimulus measures while playing down the potential for more rate cuts. That caught traders who had forecast a widening divergence between ECB and Federal Reserve policies off guard, making for a violent swing.

For equity investors, however, what happened to the euro last week matters less than what happened to it about a year ago. That was when its sharp decline, which had started in mid-2014, finally abated. Indeed, as of Friday the euro was up 6.2% from a year earlier.

The euro matters far more for U.S. multinationals than the overall economy. While the currency area counts for just 15% of U.S. exports, Commerce Department figures show that as of 2013 euro-area operations account for about 40% of the sales of majority-owned affiliates of U.S. multinationals abroad. Japan, by contrast, accounted for about 4% of those sales.

the source

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks