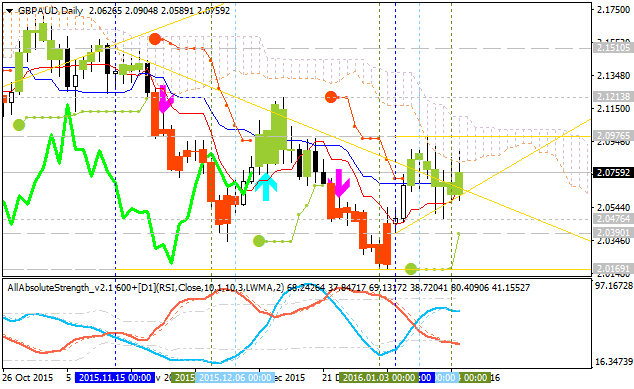

GBP/AUD: bearish ranging near bullish reversal waiting for breakout. Daily price for this pair is located near and below Ichimoku cloud and Senkou Span line which is the border of the cloud and the virtual border between the primary bearish and the primary bullish trend on the daily chart. Symmetric triangle pattern was formed by the price to be crossed for direction, and Chinkou Span line is in the crossing the price to above for the good possible breakout with the bullish reversal. There are 3 simple scenarios for the price movement for the week:

- breakout with the bullish reversal in case the price breaks 2.0976 resistance,

- bearish trend to be continuing in case the price breaks 2.0169,

- or the ranging will be continuing within the levels.

There are the following news events which will be affected on GBP/AUD price movement for the week:

- 2016-01-18 00:30 GMT | [AUD - New Motor Vehicle Sales]

- 2016-01-19 02:00 GMT | [CNY - GDP]

- 2016-01-19 09:30 GMT | [GBP - CPI]

- 2016-01-20 09:30 GMT | [GBP - Jobless Claims]

- 2016-01-20 13:30 GMT | [USD - Core CPI]

- 2016-01-22 09:30 GMT | [GBP - Retail Sales]

2.0976 2.0390 2.1213 2.0169

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks