Forex Weekly Outlook Sep 29-Oct 3

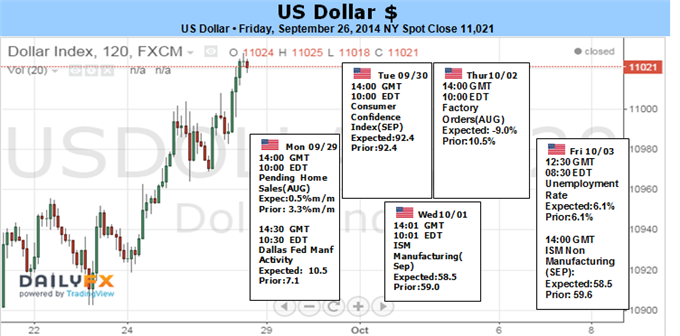

Canadian GDP, US Consumer confidence, ISM Manufacturing PMI, Rate decision in the Eurozone and important employment figures from the US including the all-important NFO report. These are the major events on Forex calendar. Here is an outlook on the main market-movers ahead.

Last week, the Scottish referendum threatening to quit the UK, resulted in a vote against independence pushing the pound higher after sharp drops. Likewise, the US dollar gained momentum as ECB Chairman Mario Draghi, RBA’s Stevens and Chinese policy makers considered using the Fed’s tactics to fight downturn economic trends. Finally the US GDP release showed the economy expanded at an annual rate of 4.6% in the second quarter, better than the 4.2% estimate made a month ago, providing momentum for strong growth the rest of the year. Will the US continue its growth trend?

- Eurozone Inflation data: Tuesday, 9:00. Euro zone inflation edged up in August 0.3% after posting 0.4% rise in the previous month. The increase was in line with market forecast. The main price increase occurred in rents and car-repair. The Euro area remained in the “danger zone” of below 1% for 11 straight moths. The recent rate cuts and asset purchases are expected to stimulate the economy and boost inflation. ECB next step may involve a more massive bond-buying program. Euro zone inflation is expected to gain 0.3% this time.

- Canadian GDP: Tuesday, 12:30. Canadian economy expanded 0.3% on a monthly base in June, following a 0.5% gain in May. The reading was better than the 0.2% expansion anticipated by analysts. The increase was driven by an increase in mining and oil and gas extraction offsetting the fall in the manufacturing sector. On a yearly base, GDP edged up 3.1% in June the highest growth rate since September 2011. The Central Bank expects that the economy will expand 2.2% in 2014 and 2.4% in 2015. GDP is forecasted to increase by 0.2% in July.

- US CB Consumer Confidence: Tuesday, 14:00. US consumer confidence picked up in August, reaching 92.4 from a downwardly revised 90.3 the prior month. The reading was higher than the 89.1 reading projected by analysts and posted the fourth straight rise. Better business conditions and strong job growth boosted consumer’s moral. Consumers also forecasted an inflation rise of 5.5% in the coming 12 months. Consumer confidence is expected to reach 92.2 this time.

- US ADP Non-Farm Employment Change: Wednesday, 12:15. ADP payroll numbers plunged in August to 204,000, from 212,000 in the previous month. However the ADP figures have proved to be volatile, showing only the general trend of the Non-Farm payrolls coming later that week. Economists expected a stronger release of 218,000. Overall, employment figures remained high, posting the fifth straight month of job gains above 200,000. US job market is expected to expand by 206,000 positions in September.

- US ISM Manufacturing PMI: Wednesday, 14:00. U.S. manufacturing activity edged up to its highest level in nearly 3-1/2 years in August, rising to 59, after a 57.1 release in July, amid a strong jump of a 3.4% in consumer spending during July, indicating a growth trend in the US economy. Economists expected a reading of 57 points. Private construction, the largest portion of construction spending, rose 1.4%, its highest level since November 2008. U.S. manufacturing is predicted to reach 58.6.

- Eurozone rate decision: Thursday, 11:45. The European Central Bank cut its benchmark rate to 0.05% in September from 0.15% in August. ECB President Mario Draghi noted the rate cut reached the lower bound following a downturn trend in the Eurozone economy with low inflation, sinking deeper below the ECB’s target of just under 2 %. The ECB also lowered the rate on bank overnight deposits to -0.20%. No change in rates is expected now.

- US Unemployment Claims: Thursday, 12:30. The number of people filing initial claims for unemployment benefits increased by 12,000 last week to 293,000, after contracting sharply two weeks ago. However despite the sharp rise, the level of applications remains near pre-recession levels, indicating that hiring remains strong. Over the past year, the four-week average for applications has fallen 7.1%. The total number of people receiving benefits ticked up by 7,000 to 2.4 million. He number of claims is expected to rise to 299,000.

- US Non-Farm Employment Change and Unemployment rate: Friday, 12:30. The US economy added 142,000 jobs in August, the lowest figure this year after a 212,000 rise in July. The sharp fall came as a surprise to analysts, expecting a gain of 226,000. However, the unemployment rate declined to 6.1% from 6.2% in the previous month, in line with market forecast. The US had added an average of 212,000 jobs each month over the prior 12 months. While the monthly release was weaker than anticipated, the longer-term trend remains positive. Gains now average 207,000 over the last three months. A gain of 216,000 jobs is expected in the NFP report.

- US Trade Balance: Friday, 12:30. The U.S. trade deficit narrowed in July to its lowest level since January, reaching to a seasonally adjusted $40.5 billion, from $40.8 billion in June.

Exports of automobiles, telecom equipment, industrial machines and semiconductors increased. Imports of oil products increased, but rising domestic production reduced the trade deficit in petroleum to its lowest in more than five years. The decline in trade deficit reinforces views that the US economy continues to strengthen. The U.S. trade deficit is expected to decline further to $41.0 billion in July.- US ISM Non-Manufacturing PMI: Friday, 14:00. The U.S. service sector continued to expand in August, reaching 59.6 after gaining 58.7 in July, beating forecast of 57.3. The majority of responders were optimistic regarding business conditions. The business activity index showed a reading of 65, up from July’s reading of 62.4; the new orders index hit 63.8, down from the previous reading of 64.9 and the employment index rose to 57.1, from July’s reading of 56. Overall, the ISM manufacturing and non-manufacturing reports suggest a continued improvement in the U.S. economy. US ISM Non-Manufacturing PMI is forecasted to reach 58.5.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks