Forex Weekly Outlook Jun 30-Jul 4

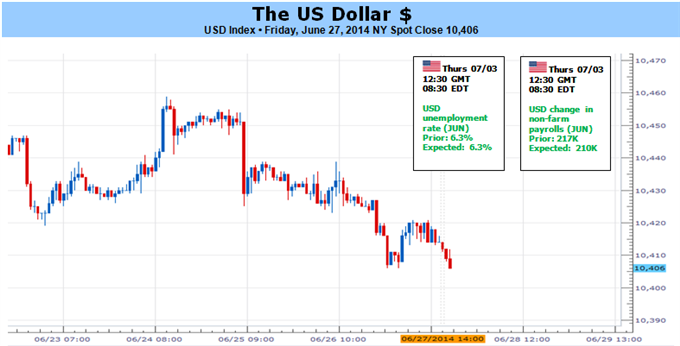

The US dollar was on the back foot in a week that saw quite a few breakouts. As the new quarter begins, top tier events are due in the busy calendar. The peak is the early Non-Farm Payrolls release, which happens at the same time that Draghi begins talking. Here is an outlook on the highlights of this week.

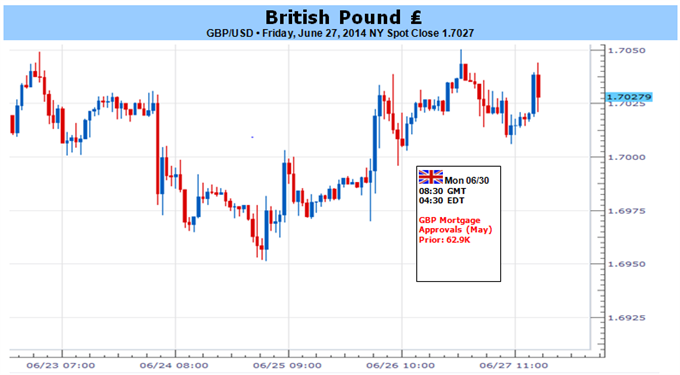

The divergence between past and present data became extreme: Q1 contraction was revised to a terrible 2.9% and it certainly hurt the dollar. How will the US reach 2.2% growth in 2014 this way? Well, Q2 continues to look good, with excellent home sales and rising consumer confidence. In the euro-zone, data remains weak, while in the UK, the BOE watered down its comments and sent GBPUSD down. NZD/USD stood out with a challenge of the yearly highs and the loonie continued recovering.

- Canadian GDP: Monday, 12:30. The Canadian economy continued to expand in March rising 0.1%, after a 0.2% increase in the previous month while growing at a yearly rate of 2.1% following 2.5% in February. The reading was in line with market forecast. The Bank of Canada maintained its interest rate in its last meeting in June but is under pressure to deliver some policy tightening in the face of an asset bubble that is forming in the housing market. The Canadian economy is expected to grow by 0.2% in April.

- US Pending Home Sales: Monday, 14:00. The index of pending U.S. home sales increased modestly in April up by 0.4% to 97.8, indicating the housing market is stabilizing after the harsh winter. The increase was below market forecast of 1.1% and followed a 3.4% jump in the previous month. The index has risen for two consecutive months. However, they fell 9.2% in the 12 months through April. U.S. pending home sales is expected to rise 1.4% this time.

- Australian rate decision: Tuesday, 4:30. The Reserve Bank of Australia (RBA) kept the cash rate unchanged at 2.50% in its June meeting. The reading was in line with market expectations posting the eight consecutive meeting of unchanged rates. The Bank’s statement was also the same as in the previous month. Financial conditions are accommodative and price volatility is low. Domestic economy is adjusting to the sharp decline in the resource sector investments and unemployment reaches record highs. No change is expected now.

- US ISM Manufacturing PMI: Tuesday, 14:00. The U.S. manufacturing sector continued to expand, in May reaching a revised 55.4 from an initial reading of 53.2. The figure was better than the 54.9 release posted in April, slightly below the 55.7 expected by analysts. This improvement indicated that the manufacturing sector had advanced more rapidly in May compared to April. The U.S. manufacturing sector is predicted to rise further to 55.6 .

- US ADP Non-Farm Employment Change: Wednesday, 12:15. US employers hired fewer workers than expected in May adding 179,000 positions from 215,000 in the previous month, but a growth trend was visible in the services sector suggesting the pick-up in economic growth continues after a sluggish start early this year. Nevertheless the ADP release did not forecast the strong job addition of 217,000 posted later that week in the Non-farm Payrolls. US employment market is expected to grow by 206,000 this time.

- Janet Yellen speaks: Wednesday, 15:00. Federal Reserve Chair Janet Yellen will speak in Washington D.C. at the International Monetary Fund. Fed Chair Yellen delivered mixed messages after the FOMC meeting leaving investors puzzled about a possible rate hike. Market volatility is expected.

- Eurozone rate decision: Thursday, 11:45. The European Central Bank decided to act in its last meeting in June agreed to impose a negative interest rate of -0.10% on its overnight depositors, to encourage banks to lend rather than hoard cash with their central banks and prevent the euro zone from falling into deflation. The ECB was the first central bank to set negative interest rates on banks. The Central bank also cut rates to 0.15% from 0.25%. Economists expected the ECB to cut its rate to 0.10% and reduce deposit rate to -0.10% from zero. The ECB is not expected to make further changes at this point but we Draghi always rocks the markets, as he did last time by closing the door to more cuts.

- US Non-Farm Employment Change and Unemployment Rate: Thursday, 12:30. The U.S. economy created 217,000 jobs in May, backing claims that the five-year-long recovery accelerated this spring. The reading cane above forecast for a 214,000 addition, following a huge increase of 282,000 posted in the prior month. The jobless rate remained unchanged at 6.3% beating forecasts for a rise to 6.4%. An addition of 211,000 positions is expected, while the unemployment rate is expected to remain unchanged at 6.3%

- US Trade Balance: Thursday, 12:30. US trade deficit edged up 6.9% in April to a two-year high of $47.2 billion, amid a sharp increase in imported goods such as cars, cellphones, computers and networking gear, indicating consumer spending is picking up. However, slower than expected growth in the second quarter increases deficit. The 4-week moving average edged up 2,000 reaching 314,250. US trade deficit is expected to reach 45.1 million this time.

- US ISM Non-Manufacturing PMI: Thursday, 14:00. The U.S. service sector continued to expand in May, rising to 56.3 from 55.2 in April, exceeding market forecasts by 0.7 points. The majority of respondents were positive about current and future conditions. The employment index edged up to 52.4, from 51.3 in April, new orders rose to 60.5, from the previous reading of 58.2 and the business activity climbed to 62.1, from 60.9. The U.S. service sector is expected to reach 56.2.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks