Forex Weekly Outlook June 2-6

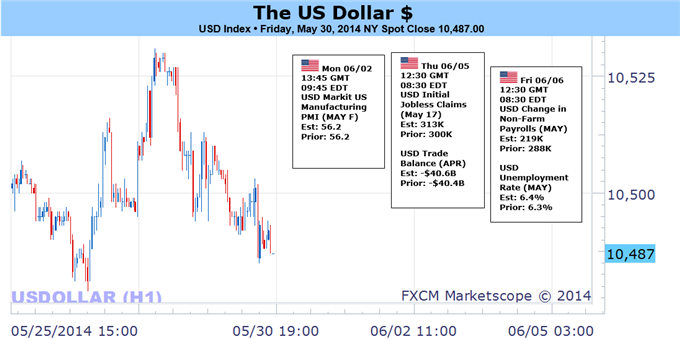

Currency movements were mixed in the last week of May, and now a very busy week awaits traders: rate decision in Australia, Canada, the UK and the Eurozone are due alongside top-tier US events culminating in the all-important NFP report on Friday are the market movers on FX calendar. Here is an outlook on the highlights of this week.

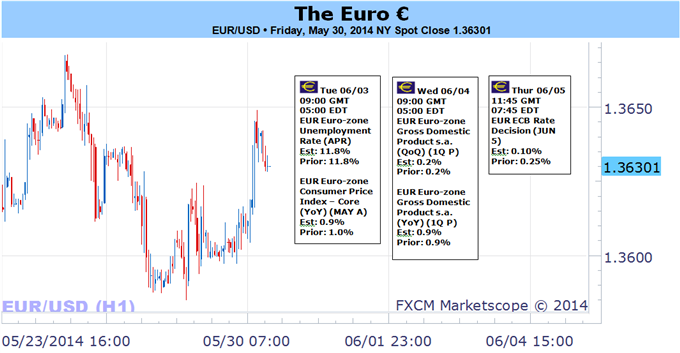

The ECB kept the pressure on the euro with comments pointing to action. Also the data weighed on the common currency. In the US, the theory of a terrible first quarter and an improvement afterwards was reinforced by the news of contraction in Q1, while fresh jobless claims were encouraging. Apart from that, the pound was pounded and the Aussie recovered. And now, we have the top tier indicators in the first week of the month. Let’s start,

Updates:

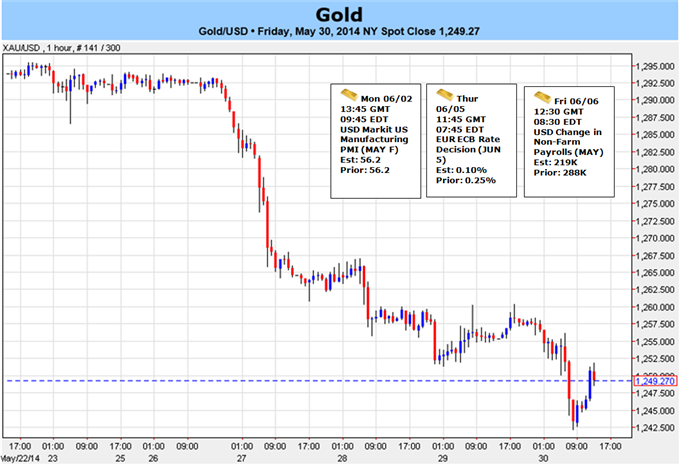

- US ISM Manufacturing PMI: Monday, 14:00.US manufacturing sector activity edged up in April to 54.9 from 53.7 in March, beating forecast of a 54.3 reading. According to the report, new orders remained unchanged at 55.1, while employment climbed to 54.7 from 51.1 in the previous month. Most responders were positive mainly due to strong demand out of China. US manufacturing activity is expected to advance to 55.7 this time.

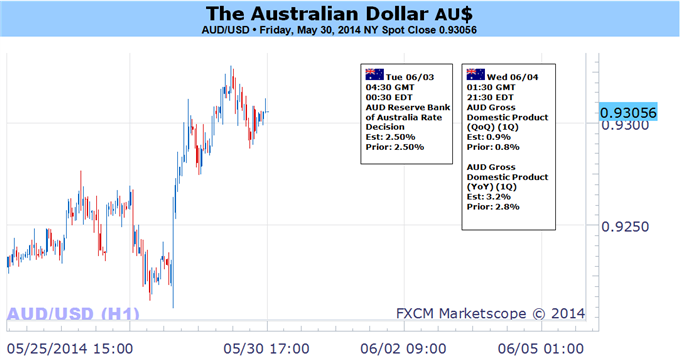

- Australian rate decision: Tuesday, 14:00. The Reserve Bank of Australia signaled it would maintain low interest rates in the coming months as inflation is contained and the economy adjusts to fewer resource projects. Growth is expected to slow down after mining investment sharply plunged. Therefore, the 2.5% rate and the accommodative monetary policy are expected to stay for the rest of the year. No change in rates s expected now.

- Australian GDP: Wednesday, 1:30. The Australian economy expanded faster than expected last quarter, despite a decline in business investment. GDP edged up 0.8% in the last quarter of 2013, beating expectations for a 0.7% rise. Consumer spending picked-up as well as exports and housing transactions. Low interest rates and a recent decline in the exchange rate had a significant positive impact on growth. GDP growth in the first quarter of 2014 is expected to advance by 0.9%.

- US ADP Non-Farm Employment Change: Wednesday, 12:15. Private sector employment in the US expanded by 220,000 jobs in April following 209,000 in the prior month. The majority of new positions were created in the construction industry gaining 19,000 jobs over the month, compared to 21,000 in March. Manufacturing remained slow adding 1,000 jobs in April, down from 4,000 in March. Analysts expected a lower job addition of 203,000. The impressive gain was well above the twelve-month average, indicating the US job market is improving. Private sector employment is expected to show a 217,000 jobs addition in May.

- US Trade Balance: Wednesday, 12:30. The U.S. trade deficit contracted in March to $40.4 billion from $49.8 billion in February thanks to a rise in exports but the small improvement did not help GDP in the first quarter, plunging into negative territory posting the first contraction in three years. U.S. trade deficit is expected to widen to $40.8 billion.

- Canadian rate decision: Wednesday, 14:00. The Bank of Canada maintained its overnight interest rate at 1%, keeping it unchanged for the last 29 policy meetings. However, the bank left the door open for a rate cut. Bank of Canada governor Stephen Poloz was less concerned with low inflation, high house prices and household debt, claiming recovery is consistent and will improve amid stronger US demand. Rates are expected to remain unchanged at 1%. Canadian GDP slightly disappointed.

- US ISM Non-Manufacturing PMI: Wednesday, 14:00. The U.S. service sector continued to advance in April, expanding to 55.2 from 53.1 in March. Analysts expected a lower reading of 54.3% in March. Responders were positive about business conditions and the current state of the US economy. The strong release indicates that the US economy is advancing and strengthening in Q2. Manufacturing activity in the US private sector is expected to gain further momentum and reach 55.6.

- UK rate decision: Thursday, 11:00. Stronger voices calling to raise rates were heard in the last BoE meeting in May. BoE Governor Mark Carney, who has supported the low rate policy, said that the Bank is getting close to raise borrowing costs. However the estimates suggest a hike may come in a year’s time while other analysts believe a higher rate will executed in the first three months of 2015. Rates are expected to remain unchanged at 0.50%.

- Eurozone rate decision: Thursday, 11:45, press conference at 12:30. The ECB is likely to act as promised and to keep the pressure on the euro. While the euro dropped throughout May due to Draghi’s comment last time, the exchange rate is probably still too high. This keeps inflation low. In addition, money supply is squeezing. A cut of 10 to 15 basis points is likely in both the main lending rate and the deposit rate. In addition, the ECB could accompany this move with some new kind of LTRO. While the governing council is likely to keep the QE powder dry, Draghi could certainly provide some more details about such a potential program, making it clear that the option is on the table. A negative rate by such a major central bank is uncharted territory. In addition and despite all the preparations, Draghi’s action and words are not fully priced in. Draghi could drag the euro down once again.

- US Unemployment Claims: Thursday, 12:30. The number of initial jobless claims dropped drastically last week to nearly the lowest level in seven years reaching 300,000 claims. The 27,000 drop was far better than the 321,000 forecasted by analysts, indicating hiring is picking up despite the GDP contraction posted in the first quarter. Employers are confident enough to keep staff reducing the number of layoffs. Unemployment claims is expected to reach 314,000 this time.

- Canadian employment data: Friday, 12:30. Canada’s unemployment rate remained unchanged in April at 6.9%, despite a loss of 29,000 jobs compared to March. Employment worsened in the provinces of Quebec, New Brunswick, Newfoundland and Labrador and in Prince Edward Island, while it increased in Saskatchewan. The unemployment rate remained the same because labor force participation fell 0.2% to just over 66%.Canada’s labor market is expected to increase by 12,300 jobs with no change in the unemployment rate.

- US Non-Farm Employment Change and Unemployment rate: Friday, 12:30. The US labor market created 288,000 jobs in April, well above the consensus forecast of 215,000 new positions, posting the best reading since January of 2012. The surprising addition pushes the unemployment rate down to 6.3% from 6.7% in March, much better than the 6.6% estimated by analysts. Private sector job creation strengthened and the government started hiring again after many months of layoffs. Overall, the US job market is stronger and consumer spending also improves boosting economic activity. US economy is expected to show a 219,000 jobs addition in May, while the unemployment rate is predicted to rise to 6.4%.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks