Forex Weekly Outlook Apr. 21-25

The pound and the dollar emerged as winners in a week that saw the euro and the yen retreat. US housing data, the rate decision in New Zealand, German business sentiment, US Durable Goods Orders and Unemployment Claims are the main highlights on Forex calendar. Here is an outlook on the market-movers for this week.

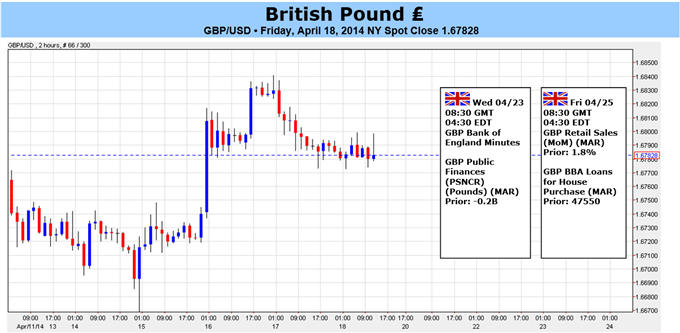

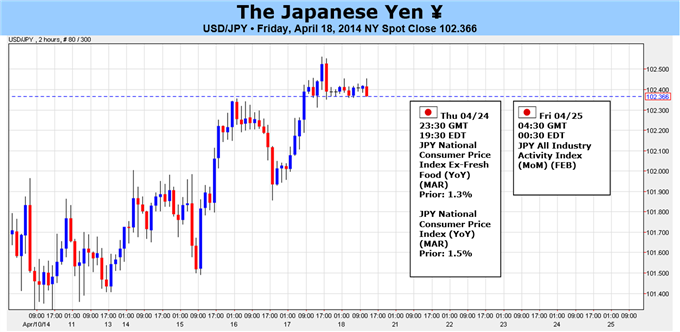

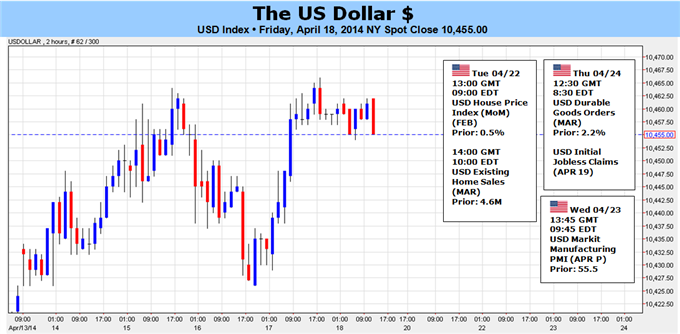

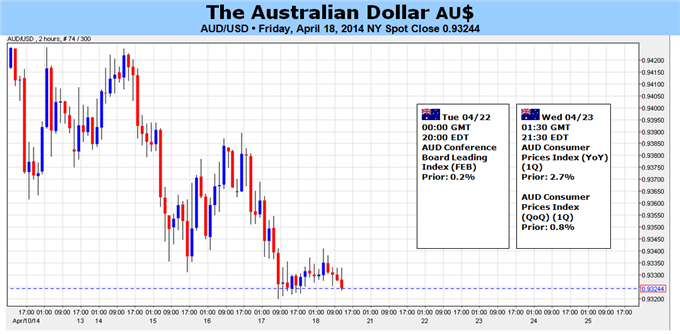

The US economy emerged from the cold winter registering gains in retail sales and manufacturing activity as well as continuous improvement in the labor market. . The Philly Fed Index exceeded expectations in April, providing more evidence of a spring bounce. Overall, the US economy is steadily advancing. In the euro’zone, Mario Draghi managed to send the euro down in a Sunday gap, and the common currency never recovered. GBP enjoyed a sharp drop in the UK unemployment rate to reach new multi year highs. The kiwi stayed behind after weak inflation figures and the loonie took the other direction on positive ones

- US Existing Home Sales: Tuesday, 14:00. U.S. existing home sales declined slightly in February to a 19 month-low reaching an annual rate of 4.60 million units, following 4.62 million in January. A combination of cold weather and dwindling inventory of homes for sake, discouraged potential buyers. Economists expected a higher figure of 4.65 million. However, as the cold winter is over, analysts believe the pace of sales will accelerate this time. U.S. home sales are expected to rise to 4.57 million.

- Chinese HSBC Flash Manufacturing PMI: Wednesday, 1:45. The independent purchasing managers’ index is considered one of the most reliable gauges for the Chinese economy, the world’s no. 2 economy. After a disappointing drop to 48 points, a small rise to 48.4 is expected. Note that this is below the 50 point mark separating growth and contraction.

- US New Home Sales: Wednesday, 14:00. The number of transactions for buying new U.S. homes in February declined to 440,000 (annualized) due to the unusually cold winter. Sales of new homes declined 3.3% from a revised rate of 455,000 in January. Nevertheless, economists forecast a pick-up in sales this spring. A further improvement in the US job market and a better consumer confidence will help boost numbers in March. New home sales are expected to reach 455,000.

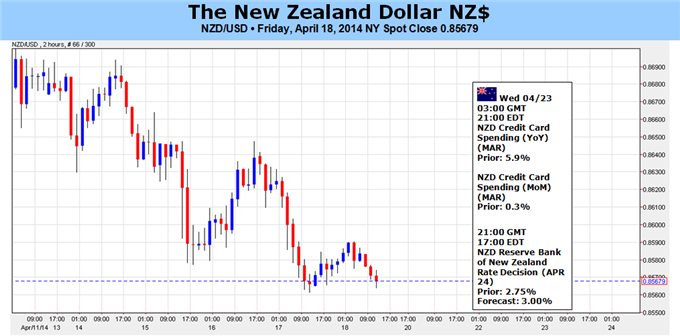

- NZ rate decision: Wednesday, 21:00. The Reserve Bank of New Zealand raised its official cash rate by 25 basis points to 2.75%, in line with market forecast. RBNZ Governor Graeme Wheeler said in a statement that inflation pressures have increased and expected to continue doing so over the next two years. Raising rates was important to keep inflation under control. Wheeler left the door open for further rate hikes within the next two years. The Reserve Bank of New Zealand is expected to raise its benchmark rate to 3%. Recent weak inflation data suggests that the RBNZ may become somewhat more dovish.

- German Ifo Business Climate: Thursday, 8:00. German business sentiment declined for the first time in five months in March reaching 110.7 from 111.3 in February, amid the Russian- Ukraine conflict. Businesses are worried that this ongoing crisis might affect Germany’s economic recovery since Germany receives more than a third of its gas and oil from Russia. In case of conflict escalation, many German firms are at danger. German business sentiment is expected to edge down to110.5.

- Mario Draghi speaks: Thursday, 9:00. ECB President Mario Draghi will speak at a conference in Amsterdam. He may comment on the low inflation in the Eurozone. Market volatility is expected. We have seen his heavy hand on the euro and we might see this happen again.

- US Core Durable Goods Orders: Thursday, 12:30. Orders for long-lasting U.S. manufactured goods regained strength in February with a 2.2% increase following a 1.3% decline in the previous month. Meantime, Core durable goods orders increased by 0.2% after posting a 0.9% rise in January, falling below expectations of a 0.3% rise. Economic growth in the first quarter is expected to be weaker than the fourth quarter’s annualized 2.4% rise, due to the cold weather. Orders for transportation equipment increased 6.9% while transportation orders had declined 6.2% in January. Durable goods orders are expected to climb 2.1%, while Core durable goods orders are expected to edge up 0.6%.

- US Unemployment Claims: Thursday, 12:30. The number of new jobless claims registered last week remained low at 304,000, near their pre-recession levels, following 302,000 posted in the previous week. Manufacturing activity has accelerated in April, indicating growth momentum after the cold winter. Economists forecasted jobless claims to reach 315,000. The four-week moving average for new claims, dropped to its lowest level since October 2007 with a 312,000 claims. Jobless claims are expected to increase by 5,000 to 309,000.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks