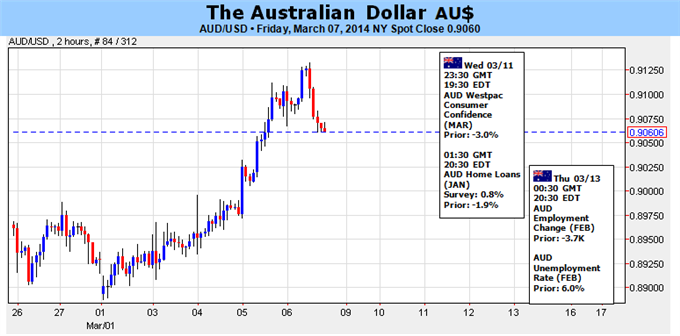

Australian Dollar Facing Conflicting Domestic, External Forces

Fundamental Forecast for Australian Dollar: Neutral

- Upbeat Jobs Data May Reinforce Positive Shift in the RBA Policy Outlook

- Fading Doubts About Fed “Taper” Continuity May Undermine the Aussie

The Australian Dollar launched a brisk recovery last week, pushing to the highest level in three months against its US counterpart. While the RBA monetary policy announcement repeated the now-familiar status quo, a round of supportive economic data proved to be a potent catalyst. The central bank once again argued in favor of a sustained period of stability in monetary policy.

That has re-framed speculation to focus on which direction rates are likely to go once that period runs its course, and last week’s news-flow seemed to argue for tightening. The fourth-quarter GDP report topped economists’ forecasts, showing the year-on-year growth rate accelerated to 2.8 percent and marked the highest reading since the three months through December 2012. Meanwhile, retail sales unexpectedly jumped 1.2 percent in January to yield the largest increase in 11 months.

Investors’ RBA policy expectations notably shifted following these upbeat outcomes, with a Credit Suisse gauge of the priced-in outlook jumping to a three week high. While an outright interest rate hike is still not being telegraphed over the coming 12 months, a meaningful hawkish shift in the underlying bias for what the RBA’s next move will be is clearly perceptible. Looking ahead, speculation will be further informed by February’s employment figures. The economy is expected to have added 15,000 jobs, which would amount to the largest gain since November. Data from the Australian Industry

Group showed hiring in the service sector, which employs close to three quarters of the labor force, expanded for the first time in three months in February. This increases the probability of an upbeat outcome, bolstering bets on a rate hike cycle to be initiated after the current standstill. A strong-enough result may even hasten the timeline for its expected commencement in the minds of investors. Needless to say, such a scenario would bode well for Aussie.

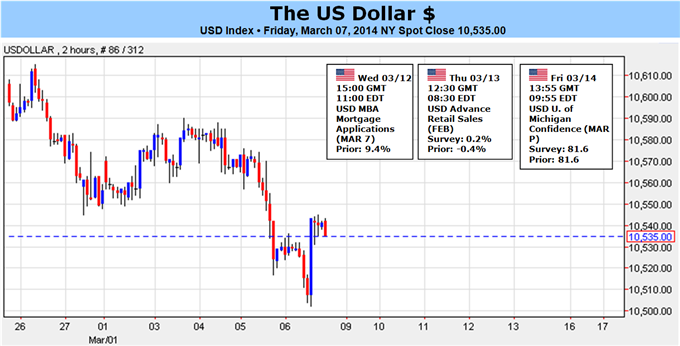

External factors remain an important consideration however and may undermine the Australian unit’s prospects. The US economic calendar is expected to yield a pickup in retail sales and an improvement in consumer confidence. On the “fed-speak” docket, the spotlight will be on Senate confirmation hearings for Stanley Fischer, Lael Brainard and Jerome Powell. The former is nominated for Fed Vice Chair while the latter two are to be Governors. Comments from Mr Fischer – until recently the Governor of the Bank of Israel and formerly a high-ranking official at both the IMF and the World Bank – will be in focus. He has vocally supported US monetary policy normalization in recent months, suggesting he will add to the chorus of pro-“taper” rhetoric from other Fed officials.

Taken together, the arrival of these catalysts on the heels of Friday’s upbeat US payrolls data has scope to significantly reduce speculation about a possible deceleration of the QE cutback cycle. That may undermine risk appetite, weighing on the Aussie in the process.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks