Euro Risks Market-wide Collapse as EURUSD, EURJPY Break Lower

Fundamental Forecast for Euro: Bearish

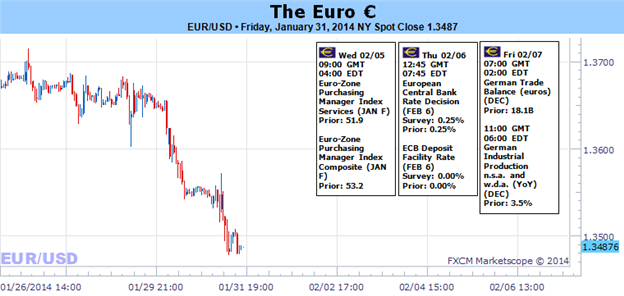

- Monetary policy concerns were stoked by record low inflation last week, and the ECB will deliberate on policy Thursday

- Strong capital inflows into riskier Eurozone assets have yet to be reversed, but are imminently endangered by volatility

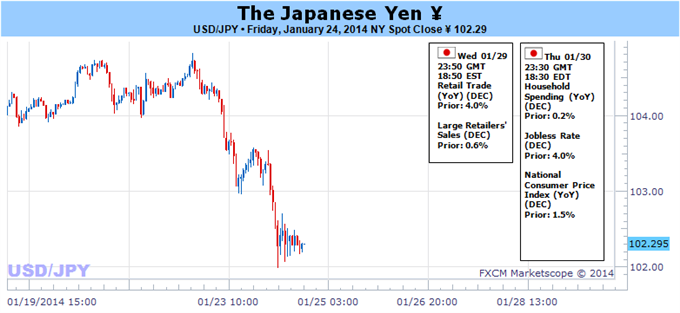

A mild slip by the euro this past week started to evolve into a serious tumble through Friday’s close. With the EURUSD closing below 1.3500 and EURJPY well south of 140, the world’s second most liquid currency is at risk of a more pervasive and directed selloff in the week ahead. While the technical cues were important to start the ball rolling, a dive of magnitude and persistence requires key fundamental development. As it happens, the baseline for both of the most pressing fundamental issues – financial market stability and relative monetary policy bearings – carry a bearish predilection for the euro.

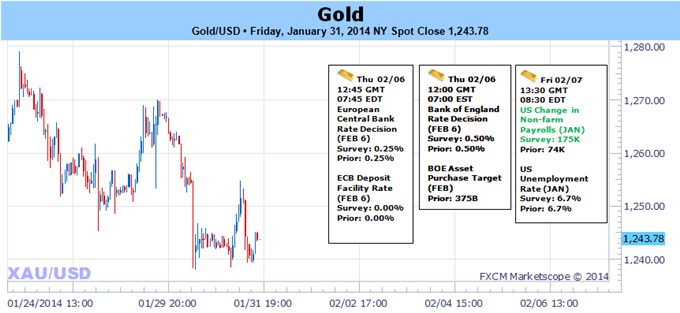

The greatest risk to the Euro moving forward is the same danger that the S&P 500 and yen crosses are fixated on: concerted risk aversion. Why would we list the world’s second most liquid currency with high-yield and fundamentally unstable currencies? Excessive capital inflows. Similar to the performance of the US equity markets – but to a smaller scale – some of Europe’s riskiest assets have drawn a steady tide of foreign investment. Specifically, the sovereign bonds of the Eurozone’s periphery (Spain, Italy, Greece, etc) have attracted global investors who are seeking out higher returns.

In a speculative landscape where global yields were historically deflated, the risk of adverse market shocks have been checked by central bank stimulus and money managers have to beat impossible benchmarks like S&P 500; Eurozone government debt looked particularly attractive. After policy officials finally curbed panic of an imminent bankruptcy or departure from one of its Union’s members (the turning point seems the introduction of the ECB’s OMT program), ambitious investors found significant discounts (high yields) on the region’s debt. Investors funneled capital into the depressed assets reassured by global volatility levels at their lowest levels since 2007 and the perceived safety of ‘sovereign’ debt.

Yet, like the record highs notched by equities and leverage, there is a point of ‘oversaturation’. Yields in the periphery are now pushing multi-year lows while Spanish and Italian 2-year rates are at record lows. That is remarkable given the formers record unemployment rate (above 25 percent) and the latter’s unprecedented debt load. Further gains on these assets – along with many other Euro-area markets – are likely to be limited moving forward. If everything were to remain steady in the global financial markets, the euro would likely slowly deflate to find equilibrium. However, recent tumult suggests we are unlikely to have such a smooth adjustment.

The jump in volatility and increasingly correlated corrections across different asset classes over the past few weeks suggests sentiment is wavering and at risk of a more dramatic correction. If confidence falters, over-leveraged, fundamentally-unsound, and over-valued assets will be unwound rather quickly. The recent swell of European appetite will certainly fall victim to such a tide change.

In the absence of a concerted risk aversion drive – admittedly, I have been waiting for some time – the Euro’s outlook may still carry a bearish bias. The other fundamental theme of prominence for the FX market is relative monetary policy. At their last rate decision in November, the ECB decided to cut lending rates in response to a sudden drop in inflation. This past week, the Eurozone’s CPI reading hit a 0.7 percent record low while unemployment held at a record high 12.1 percent.

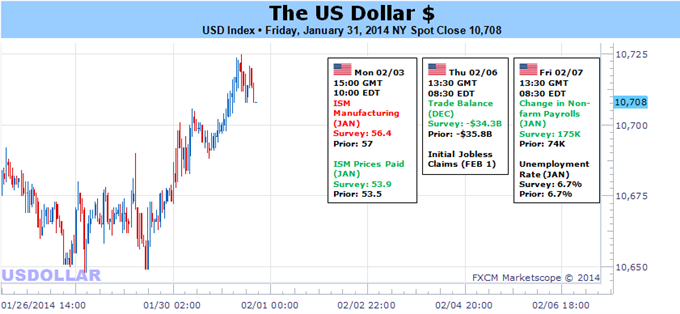

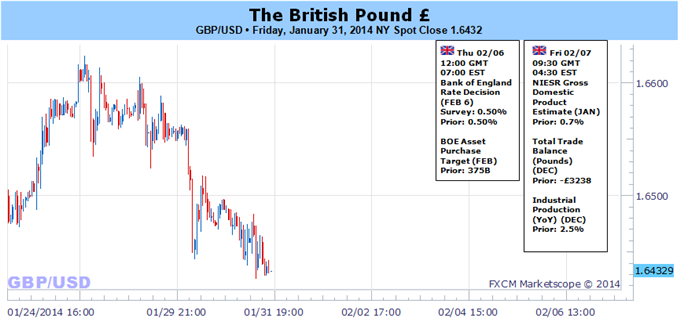

Heading into this week’s policy meeting, there is virtually no expectation of further rate cuts – whether to the benchmark or deposit rate (which has garnered significant attention as a negative rate was entertained as an option). Further easing of this type would likely be ineffective. Furthermore, it wouldn’t answer the more prominent concern. With Troika-bailed countries exiting their rescue programs (some refusing precautionary lending lines), growth still severely imbalanced, business lending contracting, short-term yields rising and liquidity shrinking; there is ample reason for the ECB to introduce a new, targeted stimulus program. In the end, whether the policy lean is aggressive or passive, it is still dovish. And, against a Fed Taper and BoE hike speculation, that is a bearish contrast.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks