Week Ahead by Crédit Agricole: FOMC, BoJ, RBNZ, Buy USD, Sell JPY & Commodity FX

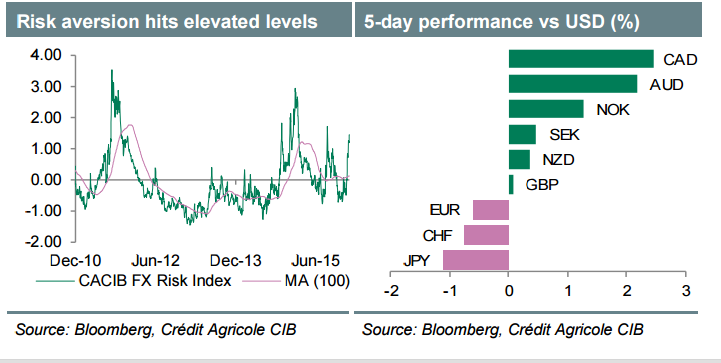

- "Risk sentiment by the end of the week has stabilised, mainly in reaction to ECB President Draghi making a case of considering additional policy action as soon as March. Even if China-related growth uncertainty is likely to keep cross market volatilities high, further stabilising conditions cannot be excluded in the short-term. This is especially true as a relatively empty Chinese economic data calendar is keeping investors focused on developed markets next week."

- "Elsewhere, it will be about the Fed to drive markets further. Considering already decreased central bank monetary policy expectations since the start of the year, we see limited room of the Fed surprising on the dovish side. As such we stick to the view that the greenback should be bought on dips, versus the franc for instance. It must be noted too that a less dovish than anticipated rhetoric may not dependently dampen risk sentiment, as it may be taken as a signal of confidence."

- "When It comes to commodity currencies, we remain of the view that rallies should be sold. This is especially true as central banks such as the RBNZ may reiterate a more dovish policy stance, especially after the most recent inflation data surprised lower."

- "Last but not least we increased our JPY forecast profile, mainly due to more elevated than anticipated risk aversion and as our economists see little scope of the BoJ turning more aggressive ahead of the April meeting. However, we remain of the view that the currency should gradually trend lower."

- USD – 'Given already low Fed rate expectations, we see little scope of the Fed surprising on the dovish side. We remain USD buyers on dips.'

- JPY – 'The BoJ is unlikely to surprise next week, especially as central bank Governor Kuroda reiterated this week that inflation will gradually trend higher.'

- NZD – 'Even if the RBNZ were to keep monetary policy unchanged, a more dovish rhetoric should keep currency downside risks intact.'

the source

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks