USDJPY to rise towards our end-2016 target of 134 - BNP Paribas

- "The Bank of Japan maintained its annual monetary base expansion target of JPY 80trn, but outlined some changes to the composition of purchases."

- "The BoJ extended the average maturities of JGBs it buys to 7-12 years (from 7-10 currently), announced JPY 300bn of additional ETF purchases and increased the maximum amount of each REIT issue it can buy to 10% from 5% currently."

- "These operational changes to the purchases do not directly have particularly pronounced FX implication, but nonetheless they act as a reminder of the BoJs clear easing bias. USDJPY initially rallied on the announcement, but has since come off temporarily trading below 122, in sympathy with a pullback in the Nikkei."

- "In our view the BoJ do not need to increase their monetary base expansion target or cut rates further for USDJPY to rise towards our end-2016 target of 134. We think the combination of rising US front-end yields, continued JPY portfolio outflows and FX positioning should provide a backdrop against which USDJPY can rise."

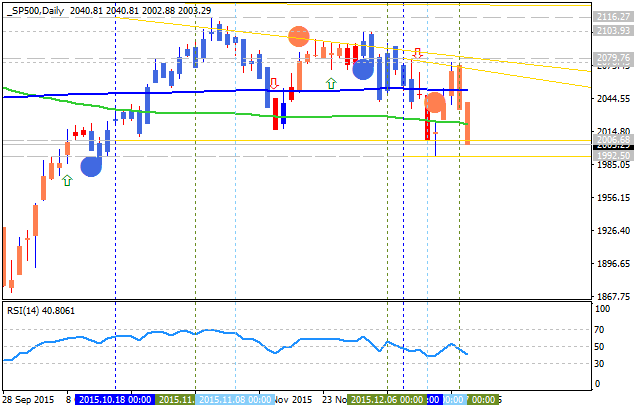

As we see from the chart above - the weekly price is on bullish market condition located to be above 100 period SMA and 200 period SMA with the ranging within the following key reversal support/resistance levels:

- 125.85 resistance level located far above 100 SMA/200 SMA in the primary bullish area of the chart, and

- 116.13 support level located near the border between the primary bearish and the primary bullish area.

If W1 price will break 125.85 resistance level so the primary bullish trend will be continuing.

If W1 price will break 116.13 support level so the reversal to the primary bearish market condition will be started with the secondary ranging (the price will be 100 SMA/200 SMA in this case).

If not so the price will be ranging within the levels.

- Recommendation for long: watch close W1 price to break 125.85 for possible buy trade

- Recommendation to go short: watch W1 price to break 116.13 support level for possible sell trade

- Trading Summary: ranging bullish

the source

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks