Forex Weekly Outlook March 23-27

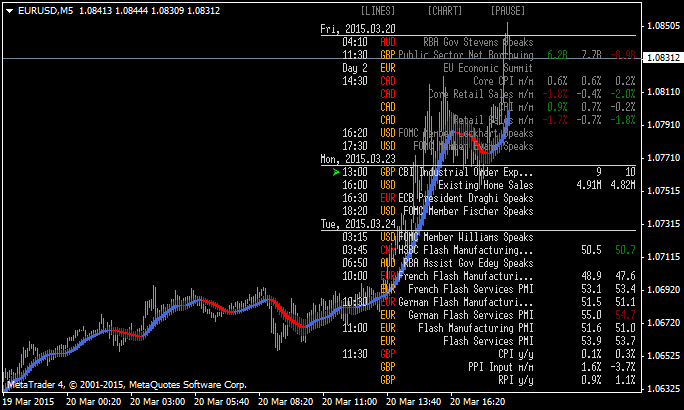

Inflation data in the UK and the US, housing data from the US, German Ifo Business Climate, US Core Durable Goods Orders, Us Unemployment Claims and Stephen Poloz’ speech. These are the highlights of this week. Follow along as we explore the Forex market movers.

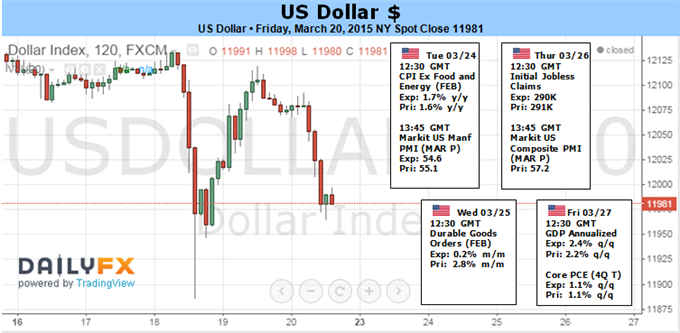

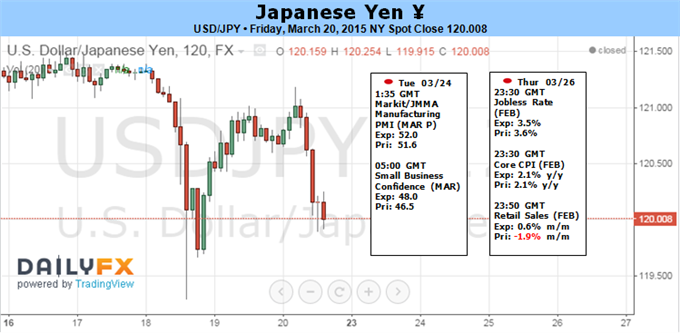

Last week, The Federal Reserve removed the word “patient” from its policy statement, increasing the odds for a rate hike in the coming months. However, the Fed also downgraded its economic growth and inflation projections. The Policy makers’ rate hike decision depends on mixed economic data, on one-hand strong job gains and robust consumer demand, while on the other hand, falling oil prices and a strong dollar, reducing exports and lowering inflation. Will the Fed raise rates on its June meeting?

- Mario Draghi speaks: Monday, 14:30. ECB President Mario Draghi will testify before European Parliament’s Economic and Monetary Affairs Committee, in Brussels. He may talk about the new QE program aimed to boost growth in the euro countries and about his growth prospects for the bloc. Market volatility is expected.

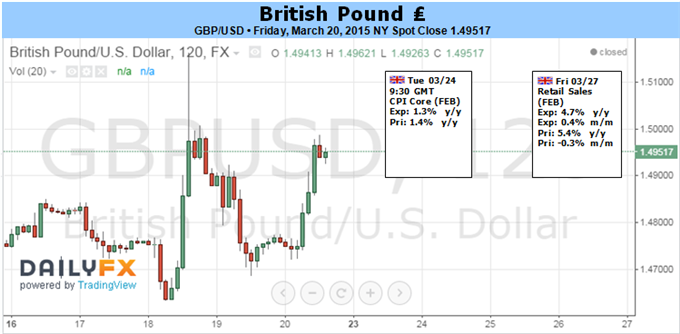

- UK inflation data: Tuesday, 9:30. UK inflation declined to the lowest level on record, reaching 0.3% in January, compared to 0.5% in December 2014, amid a sharp depreciation in global oil prices as well as falling food costs. Most economists were not concerned about this drop since core CPI excluding the more volatile prices such as food and energy actually rose to 1.4% in January. Inflation is expected to decline further to 0.1%.

- US inflation data: Tuesday, 12:30. US consumer price index declined 0.7% in January after dropping 0.3% in November and December. Energy prices shed 9.7% while the gasoline index plunged 18.7%. However, excluding the volatile food and energy sectors, core inflation increased 0.4% in January and over 2% on a yearly base. However, economists believe the subdued inflation is temporary held down by the sharp fall in oil prices. Analysts expect consumer prices to gain 0.2%, while core prices to increase by 0.1%.

- US New Home Sales: Tuesday, 14:00. New U.S. single-family home sales declined only mildly in January, reaching 481,000 from 482,000 in December, despite bad weather conditions in winter. Economists expected a decline to 471,000 in January. Analysts believe the housing market will continue to recover in the coming months due to stronger employment data. US new home sales are expected to reach 475,000 in February.

- Eurozone German Ifo Business Climate: Wednesday, 9:00. German business sentiment improved in February to 106.8 from 106.7 in January. The reading was below market expectations, but the continuous growth suggests rising confidence in light of economic growth and optimism over European Central Bank stimulus. German growth was boosted by lower oil prices as well as a weaker euro. However, the Greek ordeal still clouds business sentiment. Business climate is expected to rise further to107.4.

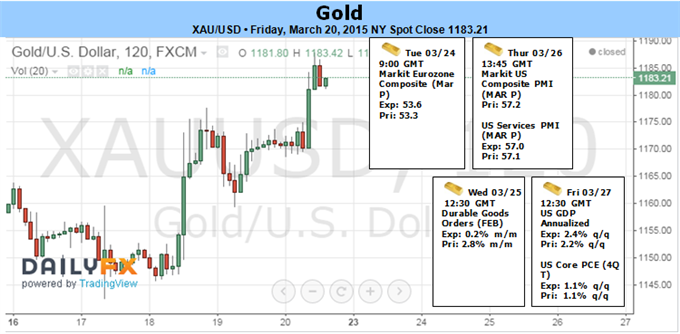

- US Core Durable Goods Orders: Wednesday, 12:30. Orders for durable goods edged up in January for the first time in three months, rising 2.8% suggesting the manufacturing sector is stabilizing. The reading was higher than the 1.7% increase forecasted by analysts and was preceded by a 3.3% fall in December 2014. Meanwhile Core durable goods orders excluding transportation items increased 0.3%. Durable goods orders are expected to gain 0.6%, while core orders are predicted to rise 0.5%.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing new claims for unemployment benefits increased by 1000 last week, reaching 291,000, indicating the job market remains strong. The four-week moving average, rose 2,250 to 304,750 last week. Despite some volatility, the number of claims still indicate a growth trend in the US labor market. The number of jobless claims is expected to reach 295,000 this week.

- Stephen Poloz speaks: Thursday 13:30. BOC Governor Stephen Poloz is scheduled to speak at a press conference in London. Poloz may refer to the recent BOC surprising rate cut decision, following the global oil price crush and its possible effect on the Canadian economy.

- US Final GDP: Friday, 12:30. Following an incredible growth rate of 5% in the third quarter of 2014, the last three months of 2014 are expected to be much weaker. According to the preliminary GDP reading for the fourth quarter, growth reached 2.2%. Analysts expect the final reading to be 2.4%.

- Janet Yellen speaks: Friday, 19:45. Federal Reserve Chair Janet Yellen will speak in San Francisco and talk about the Fed’s monetary policy. On the last policy meeting the Fed omitted the word “Patience” from the statement, preparing markets for a near rate hike despite lowering its forecast on growth and inflation. Market volatility is expected.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks