Forex Weekly Outlook November 24-28

German Ifo Business Climate, Haruhiko Kuroda’s speeches, US and Canadian GDP data, US Core Durable Goods Orders, Unemployment claims and Housing data are the most important economic releases for this week. Here is an outlook on the highlights coming our way.

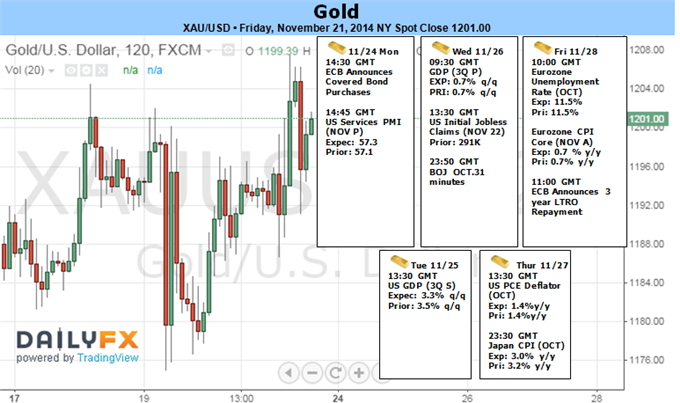

Last week, the FOMC Meeting Minutes release showed the Fed is concerned with low inflation but expects firming further out. Since quantitative easing ended, the key issue is the timing of the first rate hike. Some FOMC participants wanted to remove “considerable time” in the statement while others did not. Global economic issues such as the weakening in Europe, China and Japan and their possible impact on the US market, were also discussed. The Fed also noted the US economy continues to improve gradually. The December statement may shed more light on the timing of policy changes.

- Eurozone German Ifo Business Climate: Monday, 8:00. German business sentiment declined for the sixth month in October, reaching 103.2 after September’s reading of 104.7. Economists expected a smaller decline to 104.6. Growth in the third quarter was worse than expected with a predicted gain of 0.3%. The survey revealed a drop in current conditions to 108.4 from 110.5 in September and the outlook gauge declined to 98.3 from 99.2. Analysts predict business climate will reach 103 in November.

- Haruhiko Kuroda speaks: Tuesday, 0:00, 3:45. BOE Governor Haruhiko Kuroda will speak in Nagoya and in Tokyo. Kuroda warned inflation could fall below 1% the disappointing GDP release in November showing the economy slid into recession. BOE Governor started to implement the unprecedented asset purchases decided in the last policy meeting, despite Prime Minister Shinzo Abe’s decision to delay a sales-tax increase. Kuroda may provide clues on further easing measures to boost inflation towards the 2% target.

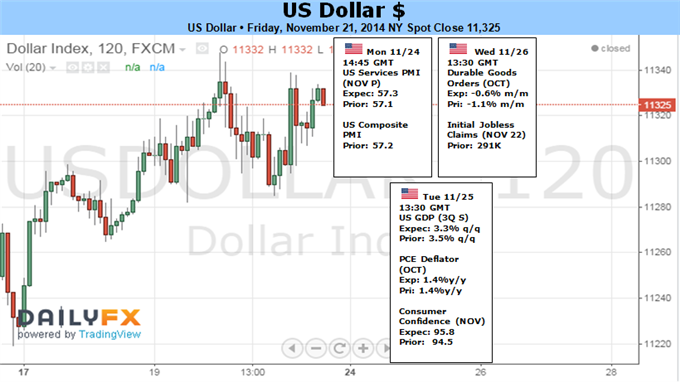

- US GDP data: Tuesday, 12:30. The US economy grew at a faster pace in the second quarter than estimated earlier. Gross domestic product grew at an annualized rate of 4.2%, 0.2% higher than expected. Business spending turned out better than initially estimated. Corporate profits after tax totaled a seasonally adjusted annual rate of $1.840tn, up 6% from $1.735tn in the first quarter. Personal consumption expenditures rose 2.5% in the second quarter, compared with an increase of 1.2% in the first. Durable goods increased 14.3%, compared with an increase of 3.2% in the previous period. Economists expect GDP to reach 3.3%.

- US CB Consumer Confidence: Tuesday, 12:30. U.S. consumer confidence edged up strongly in October, hitting a seven-year high of 94.5 from 89 in the previous month amid a further improvement in the Job market raising expectations for higher economic growth. In light of falling gas prices and better job figures, consumer spending is expected to rise in the coming months. U.S. consumer sentiment is predicted to rise to 95.9 this month.

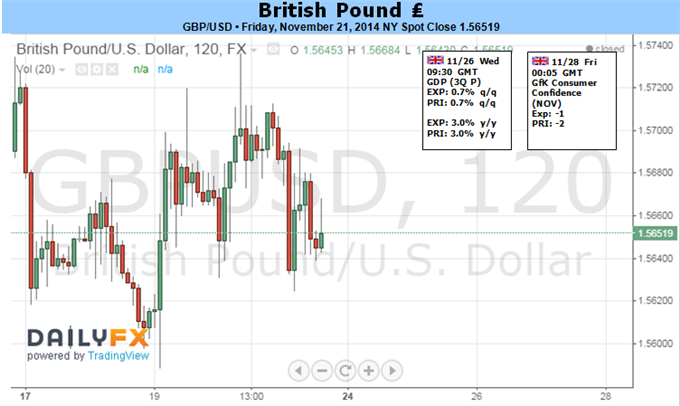

- UK GDP data: Wednesday, 8:30. The U.K. economy kept growing in the second quarter, expanding by 0.8% as in the previous quarter. The reading was in line with market forecast, rising a revised 3.2% from a year earlier. Economists expect the Ukraine crisis will have negative bearings on the manufacturing sector due to a reduction in foreign demand. However once tensions ease, business confidence and investment will rebound across Europe, and the UK will return to full growth. The third quarter growth rate is expected to be 0.7%.

- US Core Durable Goods Orders: Wednesday, 12:30. Orders for long lasting goods fell unexpectedly by 1.3% in September, while expected to gain 0.4%. Excluding transportation orders, durable goods orders declined 0.2% and fell 1.5% excluding defense orders. Nondefense new orders for capital goods in September fell 5.4%, while defense new orders for capital goods rose 7.4%. However, the general trend is positive showing a stronger market demand, while aircraft orders tend to be less trustworthy. Analysts expect a decline of 0.4% in Durable Goods Orders and a 0.5% gain in core orders.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing claims for unemployment benefits fell last week to 291,000 from 293,000 in the week before. Economists expected a sharper decline to 286,000. The reading continues to suggest an ongoing improvement in the US labor market. The four-week moving average, a more stable gauge, increased 1,750 to 287,500, still showing job growth. Economists forecast 287,000 new claim this week.

- US New Home Sales: Wednesday, 14:00. Sales of new U.S. single-family homes reached a six-year high in September, rising to a seasonally adjusted annual rate of 467,000. Economists expected an even higher reading of 473,000. August’s reading was sharply revised for the worse to 466,000, indicating the housing recovery remains uncertain. The housing market regained momentum after stalling in the second half of 2013 when mortgage rates soared. Mortgage rates have declined hand in hand with the contraction in the U.S. Treasury debt yields, but slow wage growth weighs on the pace of recovery. Analysts expect new home sales to reach 471,000.

- Canadian GDP: Friday, 12:30. Canada’s economy contracted unexpectedly 0.1% in August, declining for the first time in eight months, amid a decline in energy and manufacturing activity. Economists expected a flat reading as in the previous month. The disappointing figure suggests pickup has stalled in the third quarter. Manufacturing output fell 1.2%, reversing the 1.2% gain in the prior month. Service industries gained 0.2% for the month, with wholesale trade gaining 0.5% and the finance and real estate sectors both rising 0.3% in August. Retail activity, however, declined 0.1% and transportation and warehouses dropped 0.3%. Economists forecast a 0.4% gain in September.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks