Forex Weekly Outlook November 10-14

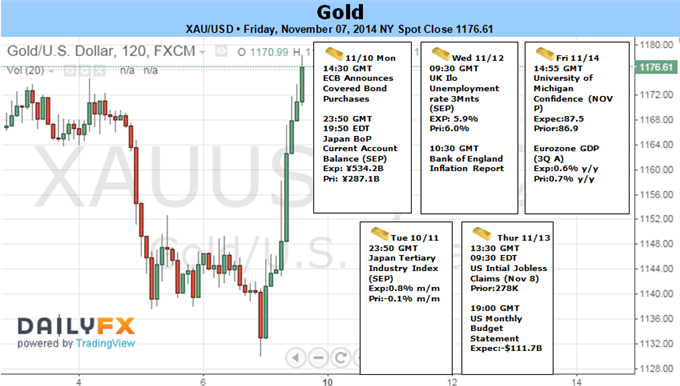

UK jobs data, Inflation report followed by Mark Carney’s speech, US Unemployment Claims, Retail sales and consumer confidence are the major market movers for this week. Here is an outlook on the highlight events.

Last week, the October Non-Farm Payrolls release was mixed with a lower than expected jobs gain of 214K compared to 256K in the previous month, while Unemployment reached the lowest level since July 2008 with a 5.8% rate, beating estimates for a 5.9%. Overall the report stayed positive backing the Fed’s decision to end its massive bond-buying program aimed to stimulate the economy. However, the job market participation rate increased mildly to 62.8% from 62.7% in September, remaining at its lowest level in nearly four decades, taking some shine away from the official NFP report.

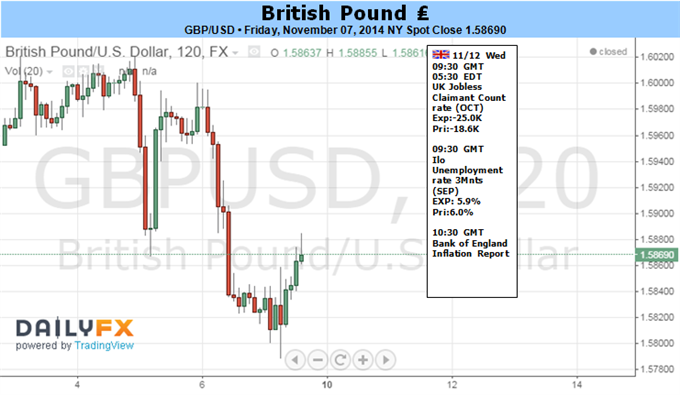

- UK Employment data: Wednesday, 8:30. Britain’s labor market continues to recover at a slower pace. The unemployment rate fell more than expected in the three months to August reaching 6.0%. The number of jobless claims declined by 18,600 in September, following a 37,200 contraction in the previous month. Analysts expected a higher figure of 34,200. Furthermore, wage growth lags behind inflation having negative effects on living standards and job creation posted the weakest rise since the spring of last year. The number of jobless claims in Britain declined by 24,900 in October.

- Mark Carney speaks: Wednesday, 9:30. BOE Governor Mark Carney will speak about the Inflation Report in London. Carney stated in September that the BoE will start raising rates next spring, if the labor market continues to improve. However in case inflation risks build up, the bank will act to contain excess pressures. Market volatility is expected.

- UK BOE Inflation Report: Wednesday, 9:30. The Inflation Report released in August, the Bank raised its 2014 growth forecast to 3.5% from 3.4% amid continuous improvement in the labor market. However wage growth projections declined 1.25% below inflation levels. Rate hikes are likely to be gradual and limited due to the slowdown in recovery and poor wage growth.

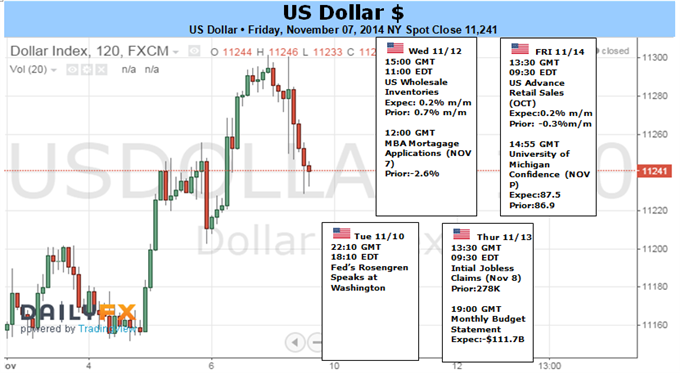

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment benefits declined further last week, reaching 278,000 from 288,000 in the prior week. The reading was better than the 285,000 figure forecasted by analysts, indicating the US job market continues to strengthen boosting consumer confidence. US jobless claims is expected to reach 282,000 this week.

- US Retail sales: Friday, 12:30. Retail sales declined 0.3% in September amid lower spending after a 0.6% gain in the previous month. Economists projected a minor drop of 0.1%. Sales declined at automobiles, furniture, building-supply outlets and clothing merchants. The lack of substantial wage gains limited consumer spending. The manufacturing sector weakened along with concerns of slower global growth. Meantime, retail sales excluding volatile categories such as food services, auto dealers, home-improvement stores and service stations declined 0.2%, the first drop since January, after increasing 0.4% in the prior month. Economists expected a 0.2% gain. Both retail sales and Core sales are expected to gain 0.2% in October.

- US Prelim UoM Consumer Sentiment: Friday, 13:55. U.S. consumer sentiment edged up in October to 86.4, the highest in more than seven years, amid positive response on personal finances and the national economy. This 1.8 point rise was better than the 84.3 forecasted by economists. The survey’s one-year inflation expectation declined to 2.8 from 3.0, while five-to-10-year inflation remained at 2.8. U.S. consumer confidence is expected to increase further to 87.3 this time.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks