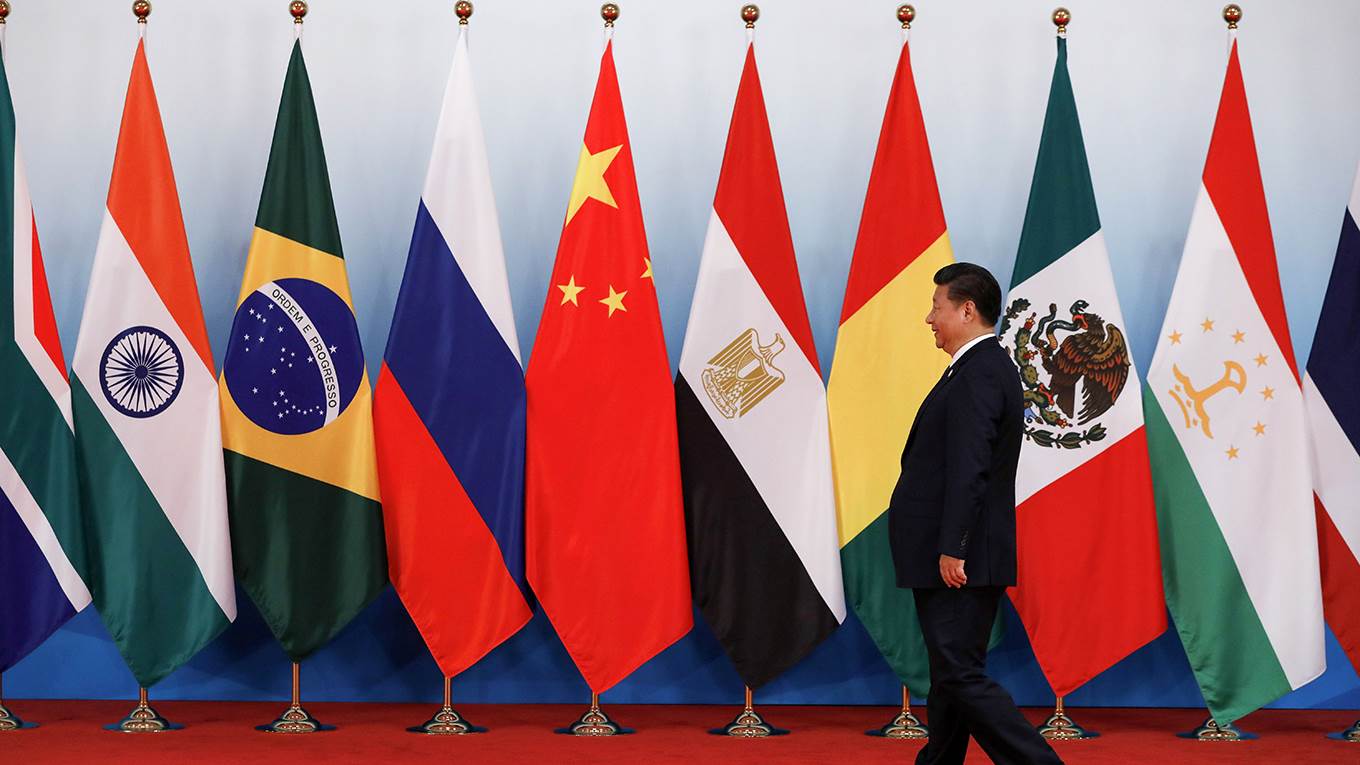

“No Winner” in Trade Battle, says China

The BRICS (Brazil, Russia, India, China and South Africa) leaders will have a three-day meeting in Johannesburg, South Africa. According to China, no nation could be declared as the winner in the global trade dispute, as Chinese President Xi Jinping appealed to the developing countries to refuse protectionism. While South African President Cyril Ramaphosa cautioned about the effect of tariff threats by the American President Donald Trump. The BRICS consists of more than 40% of the world population but never work together as a coordinated economic bloc.

Furthermore, Xi stated that the consolidated expansion of developing countries and emerging market is continuous and will balance more the global growth. In the previous week, Trump spoke that he was ready to set upon $500bn worth of tariffs on all imported Chinese goods.

While South Africa is currently suffering from collateral damage due to US tariffs on steel and aluminum which affects 7,000 jobs, said the country’s Trade Minister Rob Davies. And the attempt to impose an exemption from the US administration ended up failing.

There were 22 more countries expected to participate in the summit this week, 19 of them is from Africa. China pledged $14.7bn worth of investments to South Africa, according to the announcement of President Ramaphosa after the opening ceremony.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks