GBP/AUD & the Expected Explosion

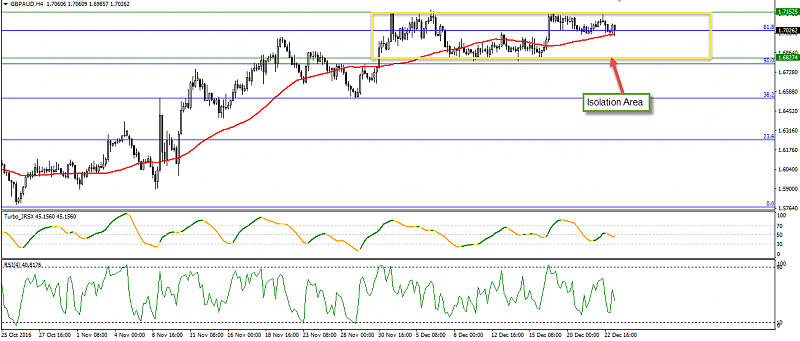

We have a rule on the Forex market that says that after any isolation comes an explosion in prices - either up or down - and many traders always search for isolation areas and wait for the price to break this area to enter the market.

The GBP/AUD currency pair has been trading within a tight trading area between 1.6827 and 1.7152 for a month. We saw the current account from the UK which came this morning in positive figures at -25.5B compared with the previous one at -28.7B and most of the news released in the past few days came in positive. This means the GBP currency is still steady against the AUD at 1.7026 at this moment and we see the pair touching the SMA 50 which represents a support area for the pair.

If we drew the Fibonacci retracement from 1.7796 to 1.7560 we will see the pair is trading around 61.8% which is telling us the pair will decline in the next few days but we have the wait for the breaking down the referred area on the chart below.

The turbo trend indicator in the middle window gave us a brown color signal, so we can expect the pair to start a down wave, and the RSI indicator confirmed that.

The Next Few Days

From this analysis we can give you our expectations about the pair's movement: it may decline to 1.6850 after breaking the SMA and if it breaks the 1.6820 it might decline to 1.6580 as a first target.

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks