Technical Analysis for Gold, GBPUSD and USDJPY

by

, 08-20-2014 at 04:02 AM (1177 Views)

Talking Points

- GBP/USD breaks key long-term support level

- USD/JPY nearing critical resistance area

- Gold meanders

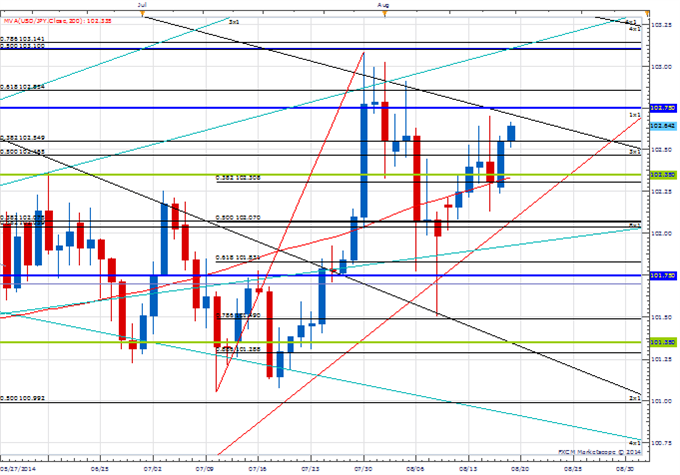

Price & Time Analysis: USD/JPY

- USD/JPY continues to edge higher off the 101.50 78.6% retracement of the July range

- Our near-term trend bias is higher in the exchange rate while above 101.50

- The 61.8% retracement of the April/May decline near 102.85 reamins an important upside pivot with a close over this level needed to confirm more serious move higher is underway

- A minor cycle turn window is seen on Wednesday

- A move under 101.50 would turn us negative on the rate

USD/JPY Strategy: We like the long side while above 101.50.

Instrument Support 2 Support 1 Spot Resistance 1 Resistance 2 USD/JPY 101.50 102.10 102.60 102.85 103.15

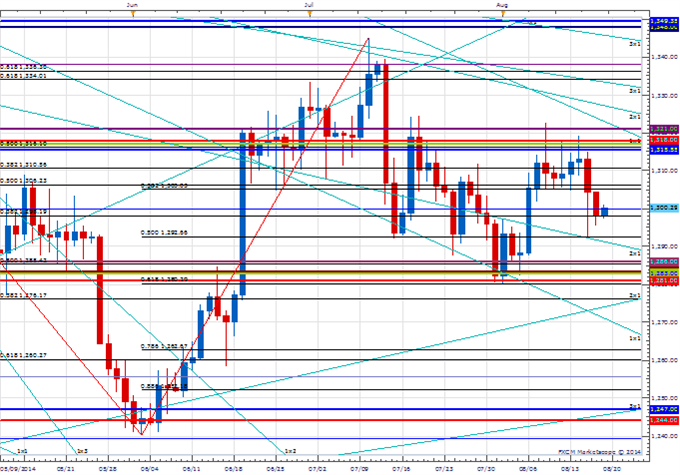

Price & Time Analysis: GOLD

- XAU/USD continues to chop around key Gann levels between 1321 and 1280

- Our near-term trend bias is positive on the metal while over 1280

- A move through 1321 is needed to confirm that a more meaningful move higher is in fact underway

- A cycle turn window of importance is seen around the start of next month

- A daily close under 1280 will turn us negative on Gold

XAU/USD Strategy: Like the long side while 1280 holds.

Instrument Support 2 Support 1 Spot Resistance 1 Resistance 2 XAU/USD 1280 1290 1300 1321 1327

Focus Chart of the Day: GBP/USD

The price action in Cable has been very interesting over the past few days. On Thursday the pound reversed from the 200-day moving average near 1.6660 almost to the pip. A gap higher was then seen on Monday morning after newspaper comments from the head of the Bank of England over the weekend. This strength proved short-lived, however, as the gap has been filled this morning with GBP/USD falling sharply lower and below the 200-day MA for the first time in almost a year. This action is a little surprising. We say this because we have noticed over the years that currency rates that spend an extended period of time over the 200-day MA tend to find support on the first test of the moving average. We like giving the pound a little more room as there is a decent chance this is just a slight undercut of the 200-day MA and part of some sort of larger temporary bottoming process. Tuesday and Wednesday’s close should prove important in this regard as a failure to get back over 1.6660 would turn the medium-term picture even more negative and undermine further the potential for a correction before September.

More...

Email Blog Entry

Email Blog Entry