Price Patterns & Time: USD Head Fake?

by

, 11-18-2014 at 11:59 PM (1507 Views)

- EUR/USD rallies back above 1.2500

- Monday’s range extremes critical in the Aussie

- USD/CAD sentiment close to neutral

EUR/USD

- EUR/USD failed yesterday near the 2nd square root relationship of the year’s low at 1.2580

- Our near-term trend bias is negative in the exchange rate while below 1.2580

- A close under 1.2440 is now needed to confirm a resumption of the broader decline

- Yesterday was a minor turn window

- A close over 1.2580 would turn us positive on EUR/USD

EUR/USD Strategy: Like the shot side while below 1.2580.

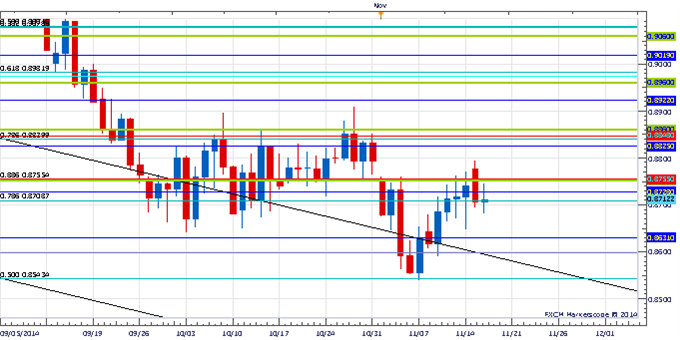

AUD/USD

Instrument Support 2 Support 1 Spot Resistance 1 Resistance 2 EUR/USD 1.2355 1.2440 1.2510 1.2535 1.2580

- AUD/USD rallied to its highest level in two-weeks yesterday before stalling just shy of .8800

- Our near-term trend bias is higher in the Aussie while above .8695

- A move through .8800 is needed to trigger a more important leg higher in the exchange rate

- A minor turn window is eyed today

- A close under .8695 would turn us negative on AUD/USD

AUD/USD Strategy: Square

Instrument Support 2 Support 1 Spot Resistance 1 Resistance 2 AUD/USD .8630 .8695 .8710 .8750 .8800

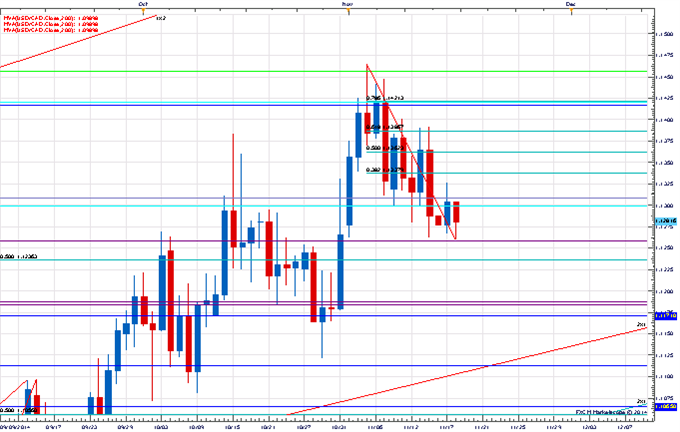

USD/CAD

The extreme positive sentiment picture in some of the main USD pairs at moment remains a concern and has us wondering whether the Buck can develop any real upside momentum with so much of the market looking for the same thing? This contrarian skepticism is countered a bit by our cyclical analysis which continues to point to general dollar upside in the weeks ahead. What to do? We like shifting some attention to the USD pairs that aren’t exhibiting sentiment extremes as they should be able to develop upside momentum a bit easier if the dollar does turn back up in earnest. One of the more interesting exchange rates on that front at the moment is USD/CAD. Following a successful break of the March high and test of the 127% extension of the March-July decline the pair has undergone what looks like a healthy correction. This has cleared out the negative sentiment situation pushing DSI figures in the CAD to a more neutral 36% Bulls (compared to 9% in GBP or 11% in JPY). A move back through 1.1355 (and possibly even 1.1325) over the next few days would get us excited about an upside resumption. However, sustained weakness under 1.1250 would warn the correction has more room to run.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

More...

Email Blog Entry

Email Blog Entry