Weekly Trading Forecast: Will Volatility and Dollar Rallies Continue?

by

, 08-03-2014 at 11:56 PM (1807 Views)

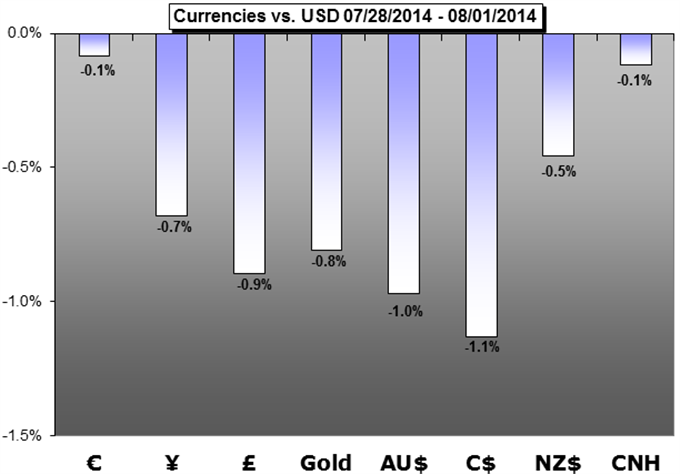

US Dollar Rally at the Mercy of Volatility, Interest Rate Trends

The Dow Jones FXCM Dollar Index (ticker = USDollar) mounted its biggest rally in six months this past week. That is a serious reversal of fortune from the technical collapse the currency was facing in the first half of July. Yet, the transition from rebound to full-blown rally is a jump the dollar may not be able to make. After grinding out hard-fought gains against its major counterparts, the greenback’s top fundamental drivers are starting to show the tell-tale signs of doubt. Will US interest rate expectations finally hit the same stride that carried the Pound to seven-year highs? Are we on the brink of an all-out risk aversion move?

British Pound Likely to Continue Lower Unless Bank of England Reacts

The British Pound tumbled further versus the US Dollar, and the sharp shift in momentum all but confirms that the GBPUSD likely topped and is likely to continue lower. Traders sent the Sterling lower for the fourth-cocutive trading week, and whether it can recover into the new month may depend on the upcoming Bank of England monetary policy decision on the 7th and Inflation Report due the 13th.

USD/JPY Risks Larger Pullback as BoJ Refrains From Expanding QE

The USD/JPY broke out of the bearish trend from earlier this year as the Federal Open Market Committee (FOMC) scaled back its dovish tone for monetary policy, but the Bank of Japan (BoJ) interest rate decision on August 8 may boost the appeal of the Japanese Yen as the central bank remains confident in achieve the 2% inflation target over the policy horizon.

Gold Trades Heavy as USD Goes Bid on Fed, GDP- August Open In Focus

Gold prices are lower for a third consecutive week with the precious metal off by 0.90% to trade at $1295 ahead of the New York close on Friday. The losses mark a 2.47% decline for the month of July and come amid renewed strength in the greenback with the Dow Jones FXCM Dollar Index breaking through trendline resistance dating back to the 2013 high on the back of a stellar 2Q GDP print and a more upbeat assessment of the economy from the Federal Reserve.

Australian Dollar May Bounce Before Selling Pressure Builds in Earnest

The Australian Dollar faced heavy selling pressure last week, with prices dropping through the bottom of a range that contained price action since the beginning of June. The force behind the move lower came from external factors: an impressively strong second-quarter US GDP figure and an easing of the FOMC’s concern about persistently low inflation hinted Janet Yellen and company may move swiftly to raise rates after the QE3 asset purchase program is wound down in October.

More...

Email Blog Entry

Email Blog Entry