Friday June 20 Market Update and Stock Scan

by

, 06-20-2014 at 07:05 PM (1882 Views)

Friday June 20 Market Update and Stock Scan

After a continuation of the Fed-Day rally, stocks paused today in a consolidation range.

Let’s take a quick moment to update our mid-day charts, hear the message of Breadth, and highlight our top trending stock candidates for the day.

Today’s session saw additional Fed-fueled buying pressure from a short-squeeze already in motion.

The index is divergent in momentum and internals into the 1,965 resistance level and we’ll frame the remainder of the trading day as such:

We’ll be neutral/cautious between the 1,961 and 1,964 levels (yellow highlight)

Bearish for a potential breakdown (target 1,955) on a trigger-break under 1,960

Otherwise pro-trend short-squeeze bullish above 1,965.

Sector Breadth sends a mixed message today:

Today’s Sector Strength appears in Materials, Industrials, and Energy along with Health Care.

It’s a mixed message without a clear direction from Risk-On and Risk-Off (defensive) sectors.

Our weakest sectors today include Consumer Discretionary and Technology – along with defensive Staples.

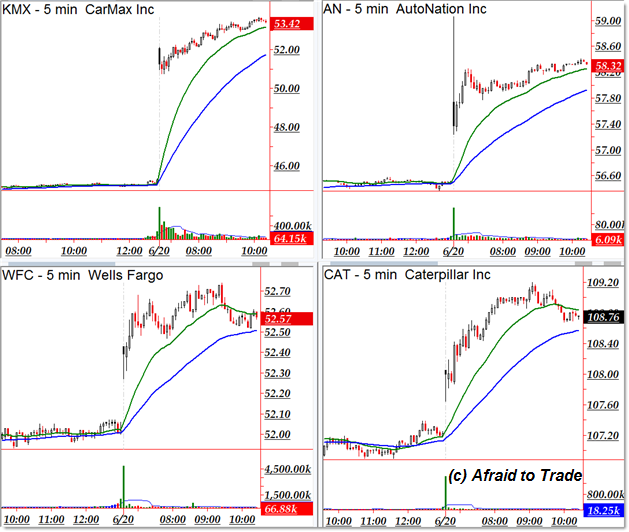

Despite the sideways action, there are always bullish candidates to trade from our scans:

Carmax (KMX), AutoNation (AN), Wells Fargo (WFC), and strong stock Caterpillar (CAT)

Bearish candidates include the following:

We see a ‘repeat offender’ Whole Foods Market (WFM) along with cable companies Viacom (VIAb), Discovery (DISCA), and CBS.

Email Blog Entry

Email Blog Entry