ECB Disappointed Markets – Why?

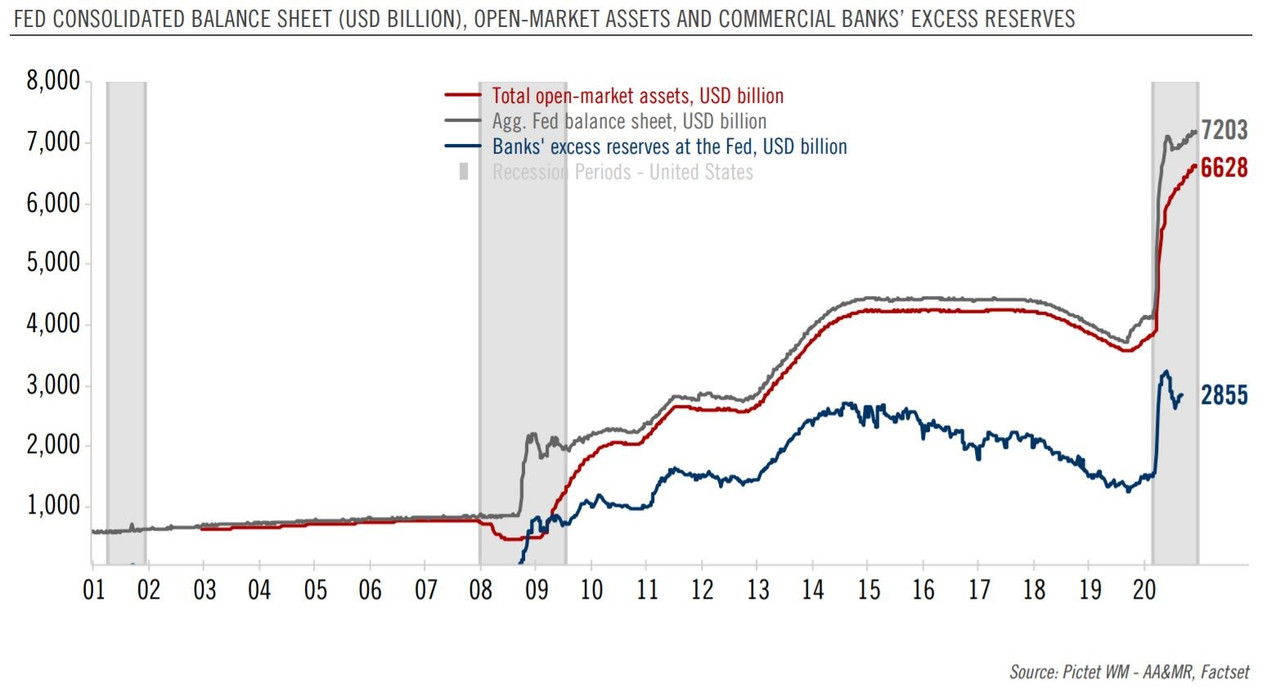

Last week’s main event, the European Central Bank (ECB) meeting, disappointed the market. The central bank pre-committed to ease the financial conditions already from October, but the markets remained with the feeling that the ECB did not do enough.

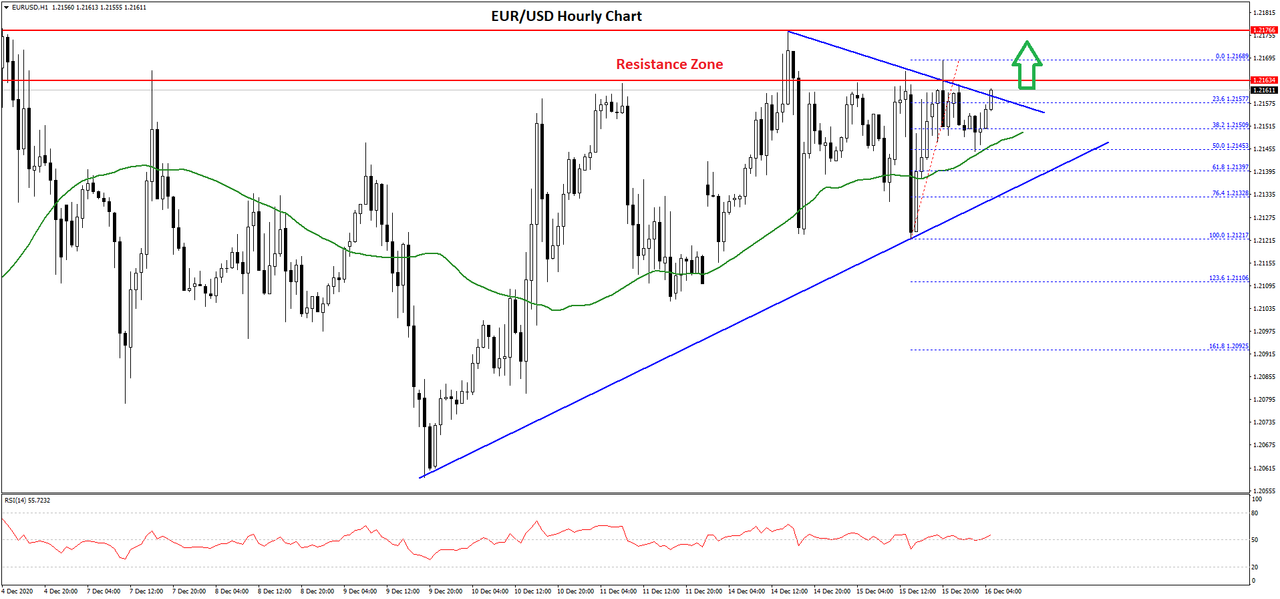

Yes, the central bank further eased the policy – it extended the Quantitative Easing (QE) program and offered better terms on its TLTROs. However, it was less than the market expected. Moreover, the market pushed the EURUSD exchange rate above the 1.20 level a week before the ECB, and the central bank did not give any clue that it is bothered by the move.

What Was Priced In?

The market expected the PEPP program, which basically is the QE program during the pandemic, to be extended by June 2022. Instead, the ECB extended it only by March 2022. The three months between the two dates when the ECB will not buy bonds represent a tightening rather than easing. As such, the market took the message as hawkish rather than dovish.

Moreover, the new TLTRO conditions for commercial banks to get access to the funds are tougher. In other words, few commercial banks will be able to meet the ECB’s terms so that they will get the funds needed. As a result, the ECB managed to deliver another hawkish message during a dovish statement.

Finally, the central bank suggested that it expects inflation to reach 1.2% in 2023, using the “core” approach, the one that does not consider energy prices. But that is well below the 2% threshold established by its mandate and may suggest that the ECB has a problem bringing inflation below but close to the target.

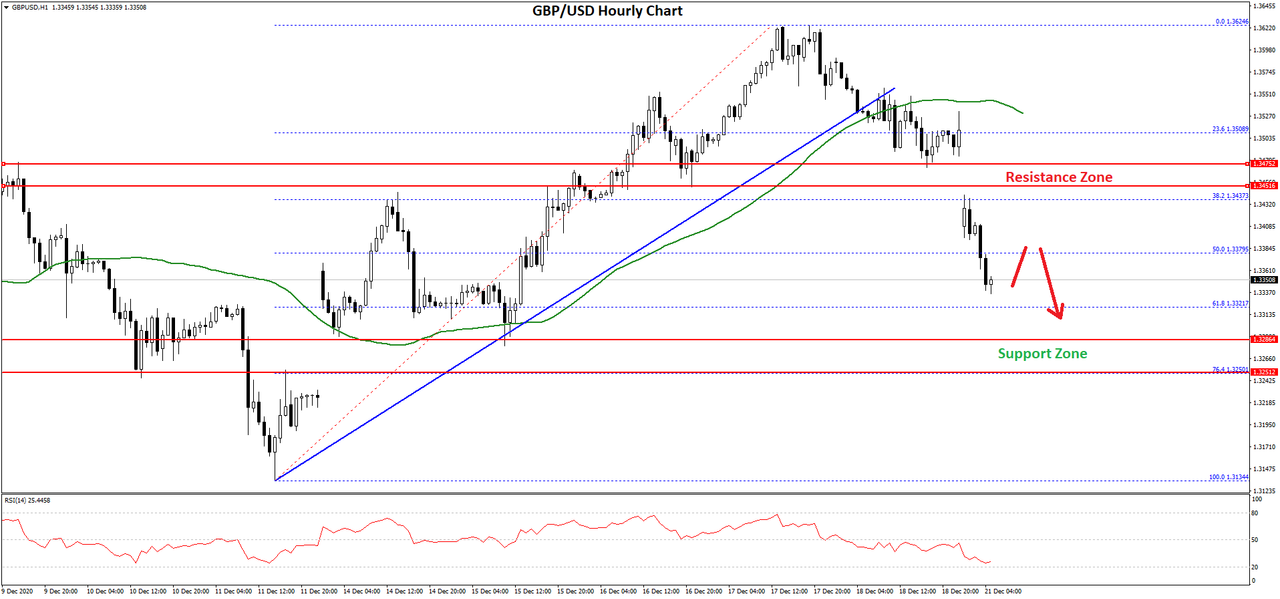

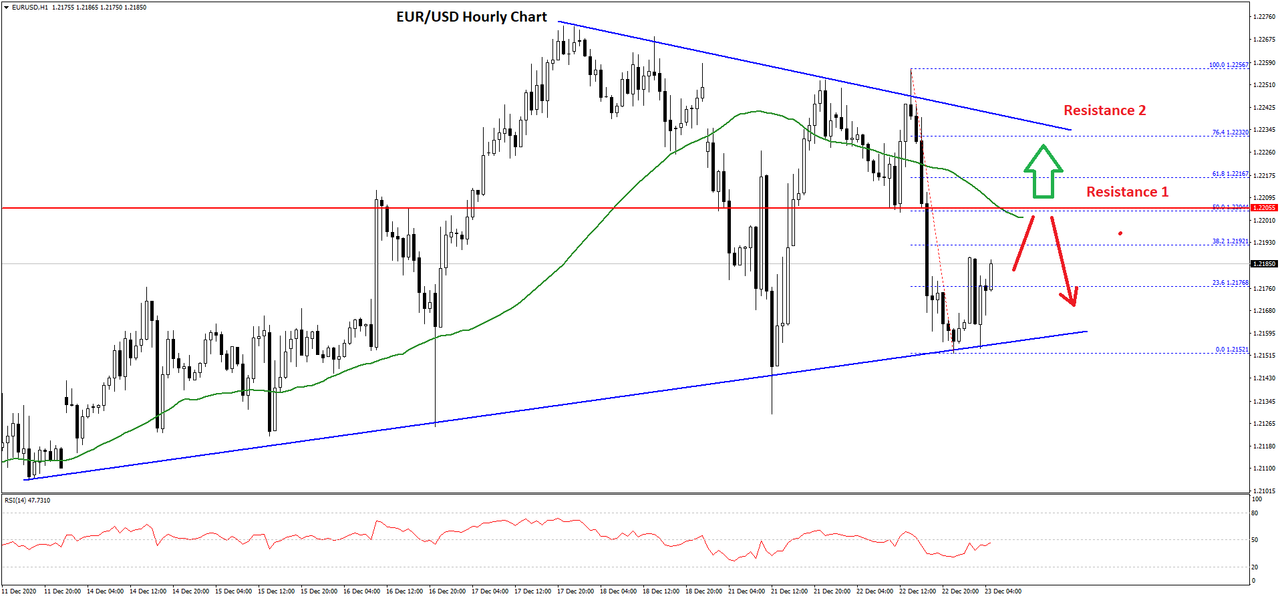

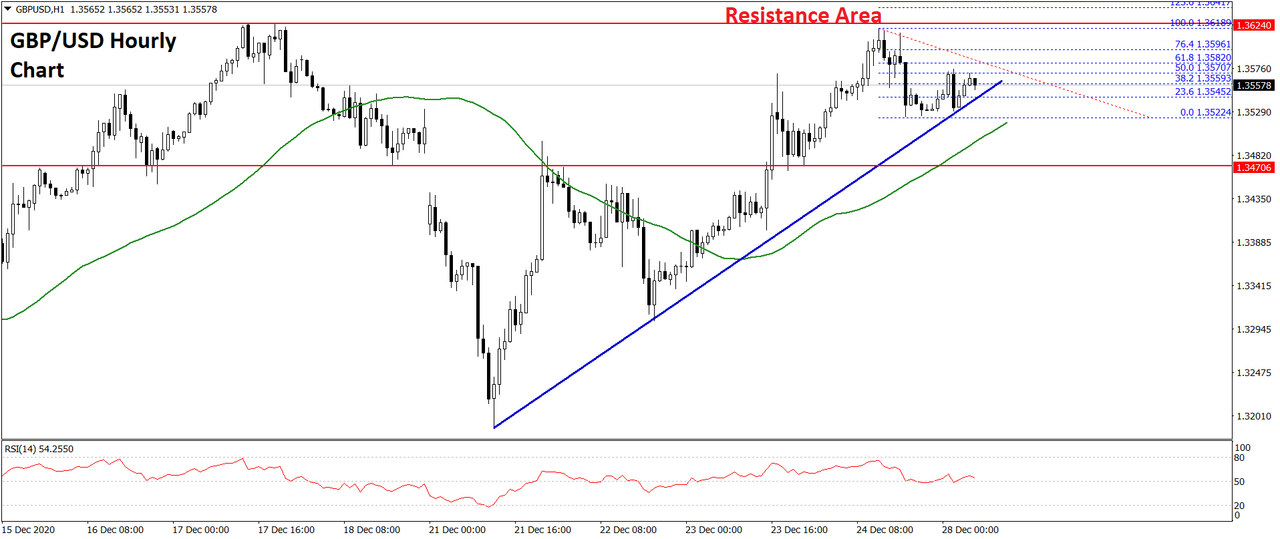

How About the EURUSD?

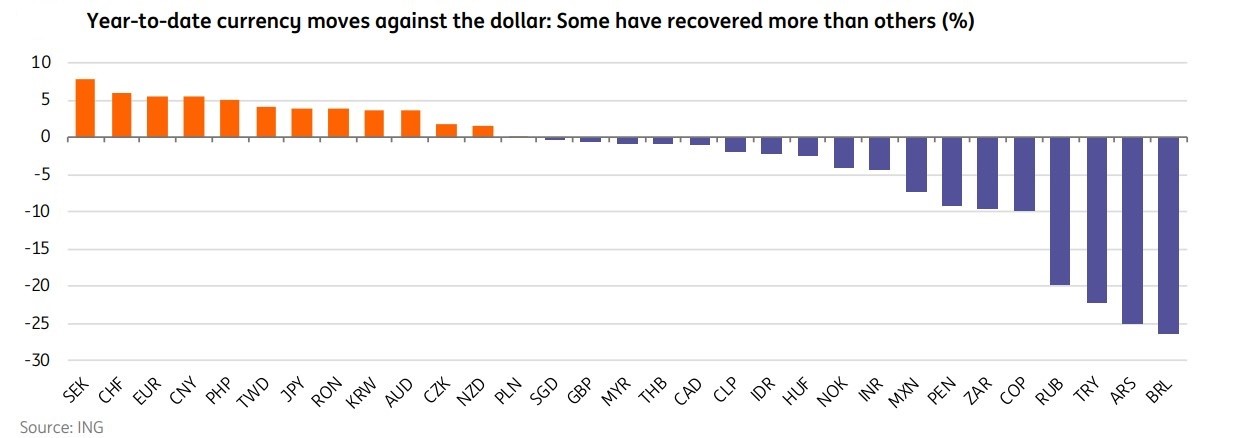

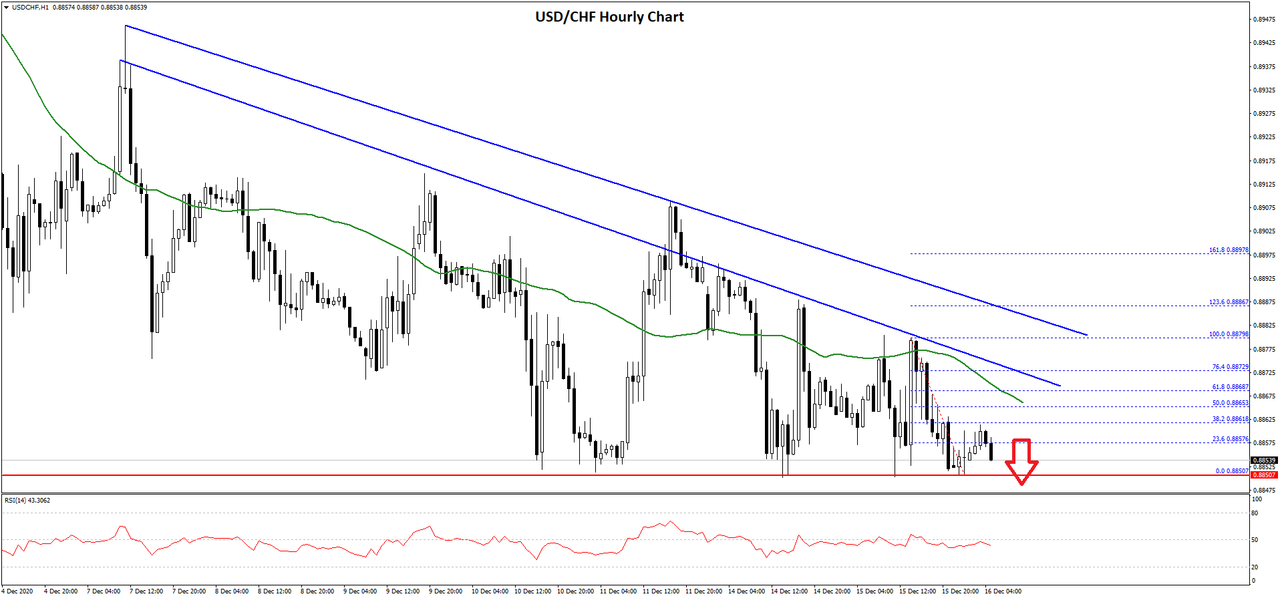

The EURUSD and a strong Euro represent such a problem. It is economics 101 that a stronger currency weighs on inflation. Thus, the ECB would have an easier task of reaching its inflation-targeting mandate if the Euro will not be that strong. In particular, the EURUSD is an ongoing concern for the ECB.

However, by only delivering more easing measures wrapped in hawkish statements, the ECB does nothing but fueling a stronger EUR. As such, we should not be surprised by the fact that the EURUSD rate at the 2020 highs two days after the ECB press conference ended.

FXOpen Blog

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks