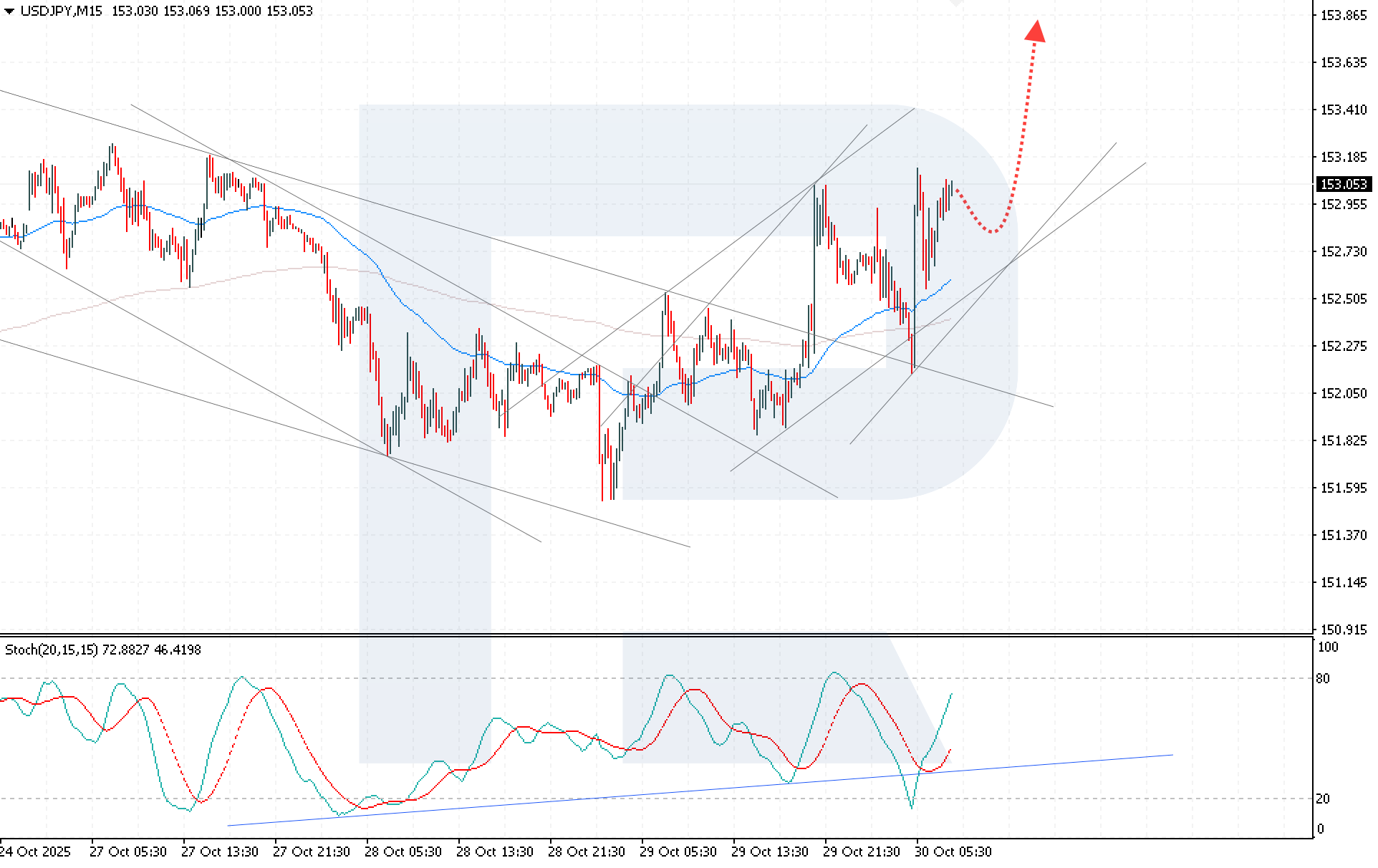

Investors buy USDJPY ahead of BoJ policy decisions

The USDJPY pair continues to strengthen amid ongoing political uncertainty and expectations of the upcoming Bank of Japan meeting, currently trading at 151.56. Find out more in our analysis for 21 October 2025.

USDJPY technical analysis

The USDJPY pair continues its upward trajectory after breaking above the upper boundary of a Head and Shoulders reversal pattern. Buyers have confidently held the price above the 151.00 resistance level, confirming a sustained bullish momentum.

Political uncertainty in Japan and investor focus on the upcoming Bank of Japan meeting continue to drive demand for the US dollar.

Read more - USDJPY Forecast

Attention!

Forecasts presented in this section only reflect the authorís private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks