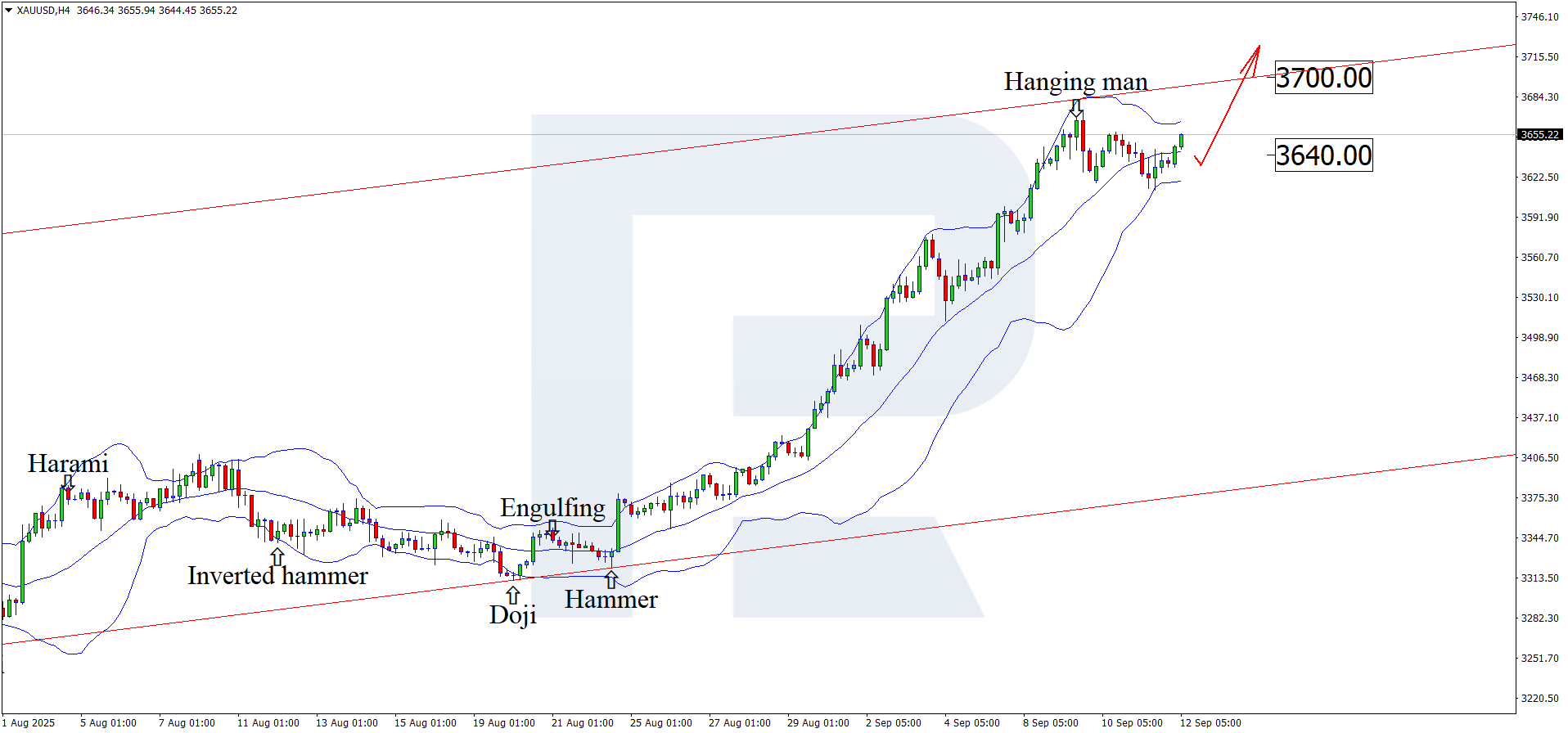

Gold (XAUUSD) continues its rally: Fed rate outlook provides support

Gold (XAUUSD) prices stand at 3,550 USD by the end of the week. Pressure on the Fed is opening new opportunities for the precious metal. Find more details in our analysis for 5 September 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) prices continue to climb, hitting new record highs

- Expectations of more aggressive Federal Reserve rate cuts provide strong support for gold

- XAUUSD forecast for 5 September 2025: 3,564 and 3,578

Fundamental analysis

Gold (XAUUSD) rose to 3,550 USD per ounce on Friday and remains near record highs, showing a weekly gain of over 3%. Support for the metal comes from expectations of Federal Reserve rate cuts and increased demand for safe-haven assets.

Weakness in the labour market Ė falling job vacancies, rising layoffs, and an increase in initial jobless claims to a two-month high Ė has strengthened expectations of Fed easing. The market is now pricing in not only a September rate cut but also up to three moves by the end of the year. This is favourable for gold, as lower rates reduce the opportunity cost of holding a non-yielding asset.

RoboForex Market Analysis & Forex Forecasts

Attention!

Forecasts presented in this section only reflect the authorís private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks