Brent fears oversupply: sell-off possible

Brent prices fell below 65 USD on Thursday as the market grew uneasy about a global oil glut. Find more details in our analysis for 5 June 2025.

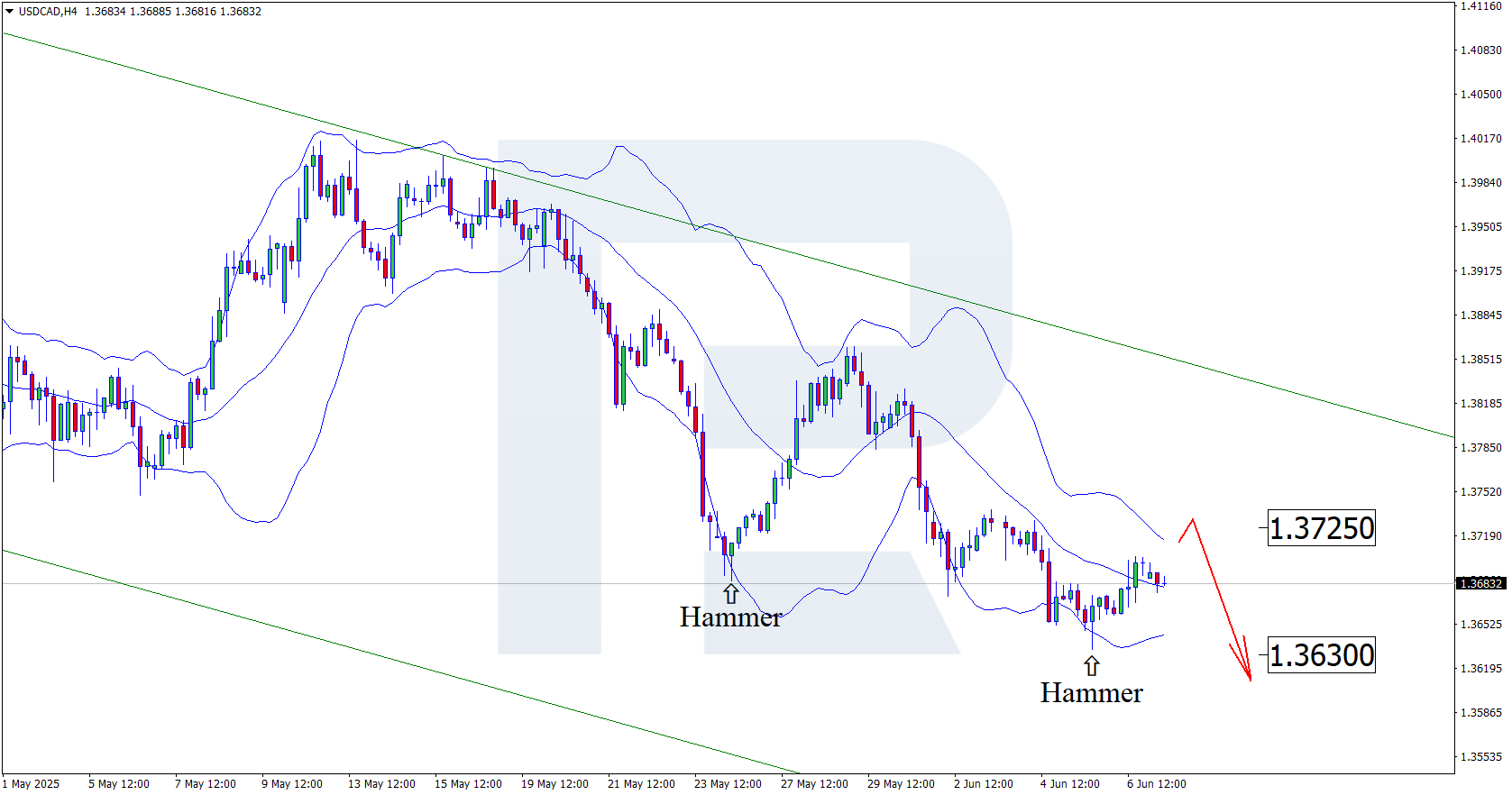

Brent technical analysis

On the H4 chart, Brent is setting up for a decline towards 64.04. A breakout below the 64.00-64.05 area could pave the way for further selling down to 63.63.

Brent prices are falling, with the market having plenty of justification.

Read more - Brent Forecast

Attention!

Forecasts presented in this section only reflect the authorís private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks