Gold (XAUUSD) resumes rally ó next target: 3,405 USD

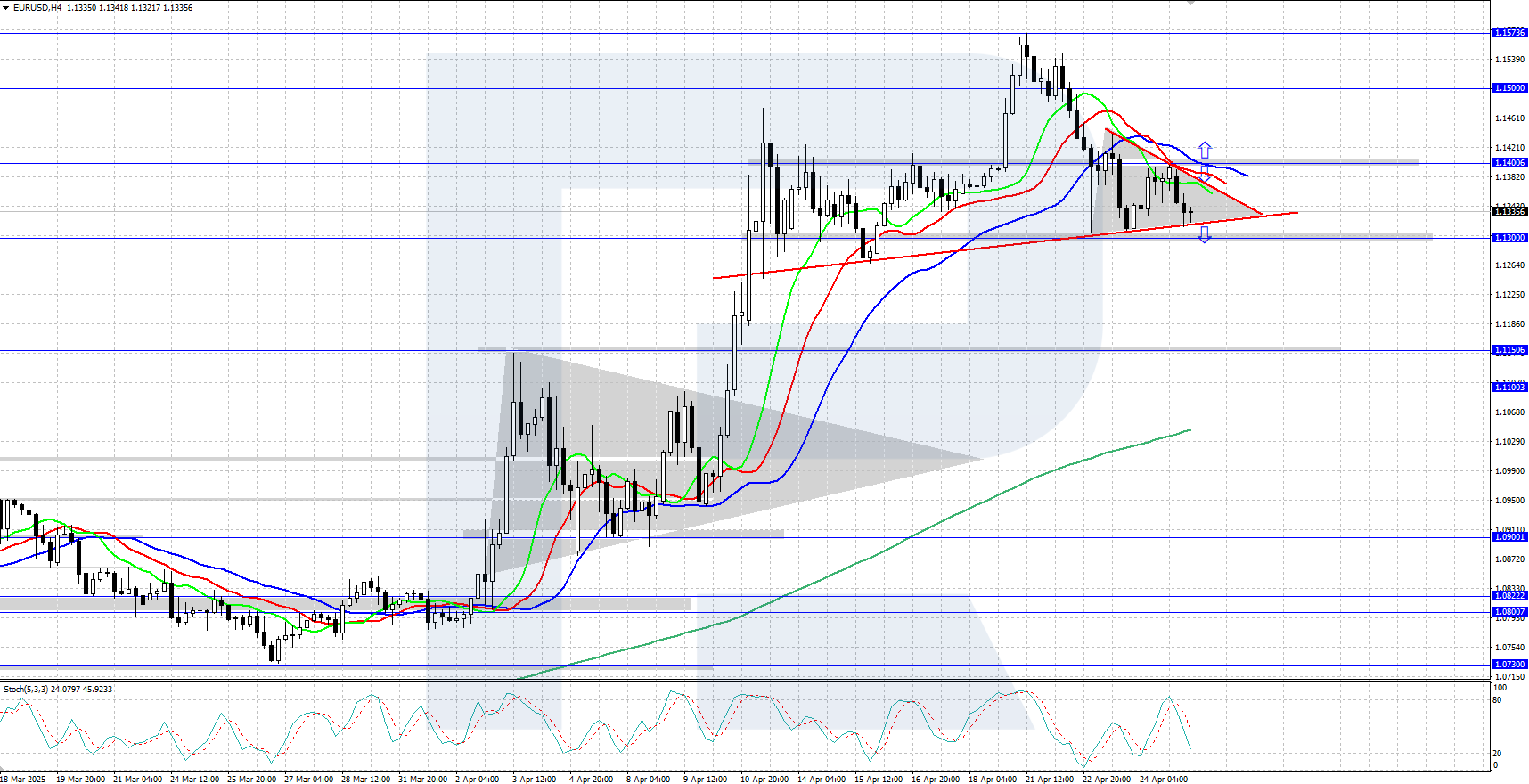

XAUUSD has broken above the upper channel boundary, signalling an end to the recent pullback. The current quote is 3,327 USD. Full analysis for 18 April 2025 below.

XAUUSD forecast: key trading points

- Gold remains in demand amid uncertainty over US trade policy

- Central banks and private investors continue to accumulate gold

- Goldman Sachs forecasts gold at 3,700 USD by year-end

- XAUUSD forecast for 18 April 2025: 3,405 USD

Fundamental analysis

XAUUSD is regaining strength following a short-term pullback, still trading firmly within an upward channel. Demand for gold remains high as market participants seek refuge from ongoing US trade policy uncertainty.

Investors are reacting to shifting signals from the Trump administration, which is reportedly considering new tariffs on semiconductor and pharmaceutical imports. Meanwhile, renewed trade talks with China are back in focus, with Beijing expressing willingness to resume dialogue ó albeit under certain conditions.

Analysts highlight continued strong demand for gold from both central banks and private investors. This provides a robust foundation for further price appreciation. According to Goldman Sachs, gold could reach 3,700 USD by the end of 2025.

RoboForex Market Analysis & Forex Forecasts

Attention!

Forecasts presented in this section only reflect the authorís private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks