AUDUSD reaches new lows: market pressures mount on the Aussie

The AUDUSD pair is rapidly falling, with the market testing the 5 August low. Find out more in our analysis for 14 November 2024.

AUDUSD technical analysis

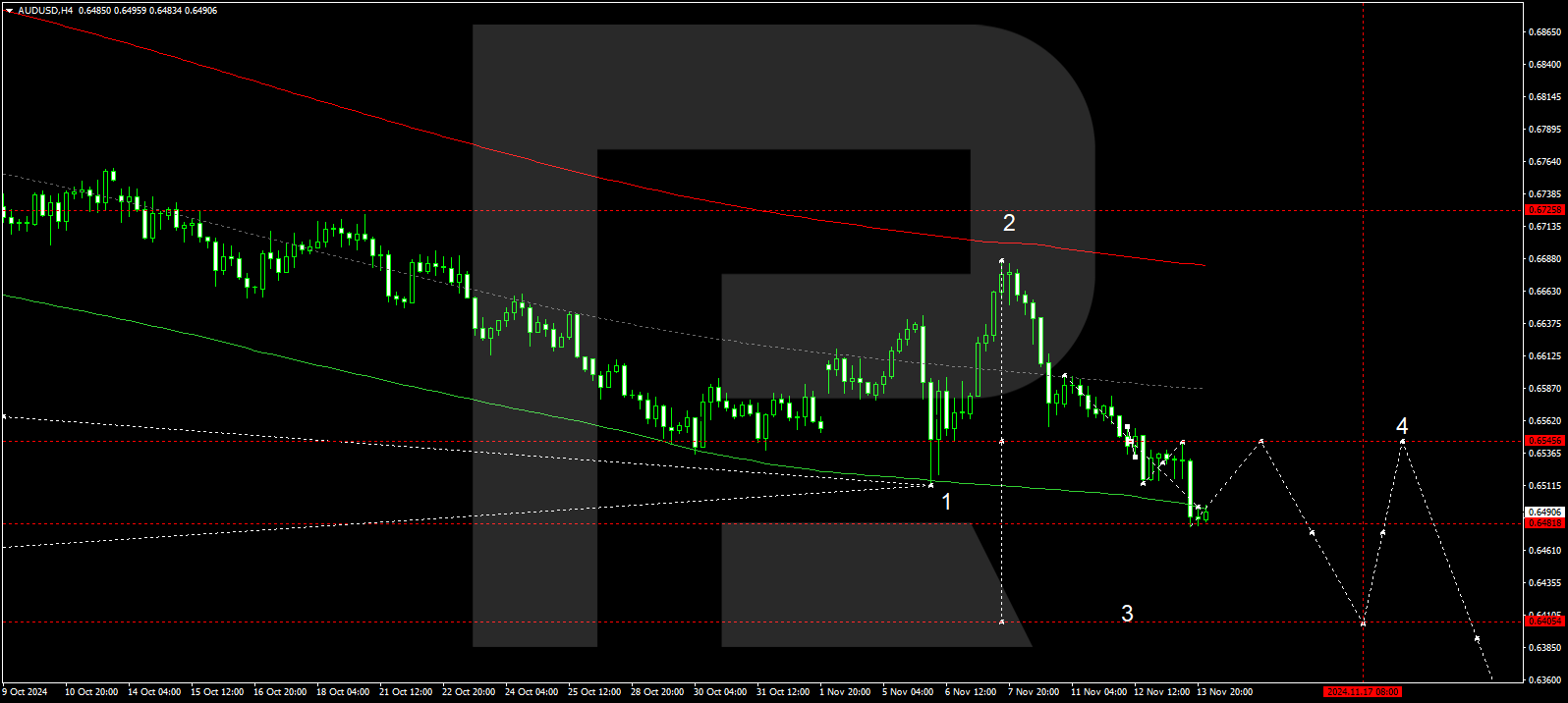

The AUDUSD H4 chart shows that the market has completed a corrective wave, reaching 0.6545 and, after rebounding from this level, dropped to 0.6480. A narrow consolidation range is expected to develop at the current lows of a downward wave today, 14 November 2024.

The AUDUSD pair appears weak and has reached three-month lows.

Read more - AUDUSD Forecast

Attention!

Forecasts presented in this section only reflect the authorís private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks