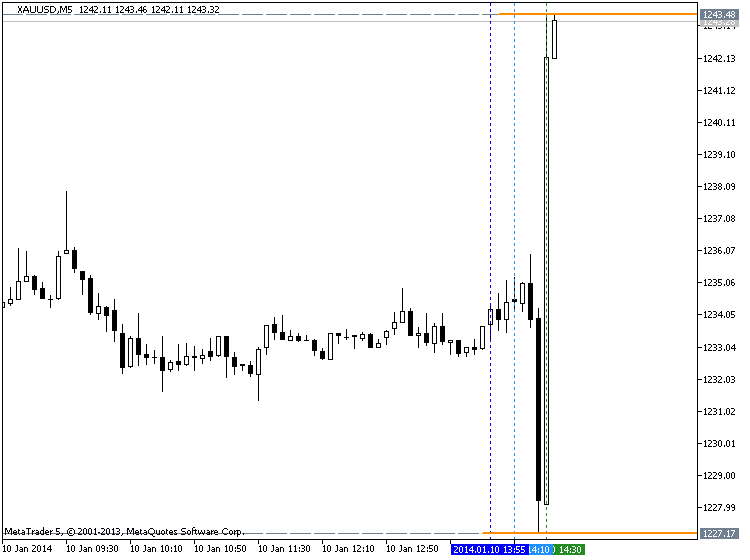

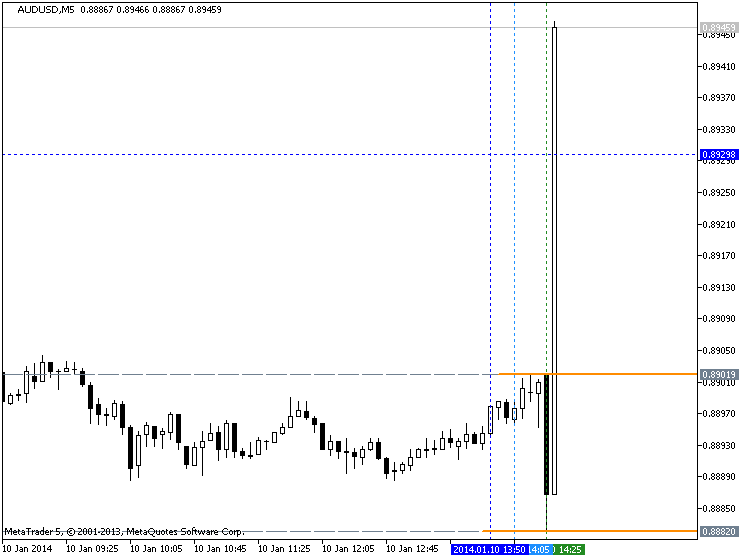

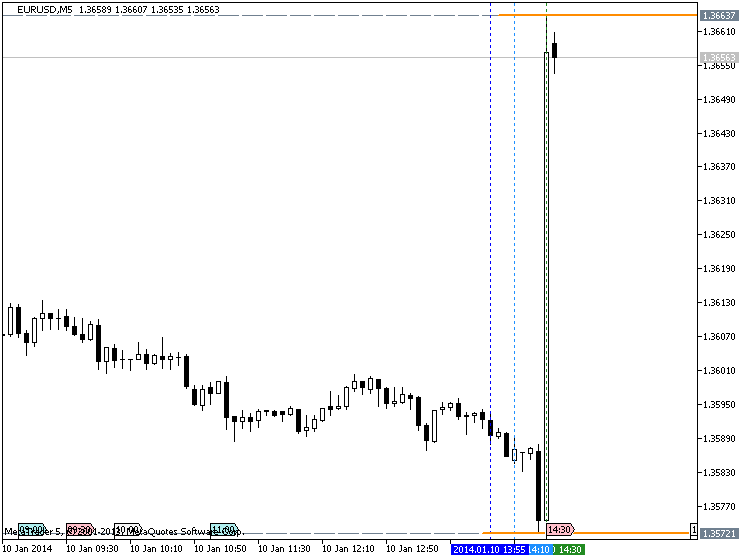

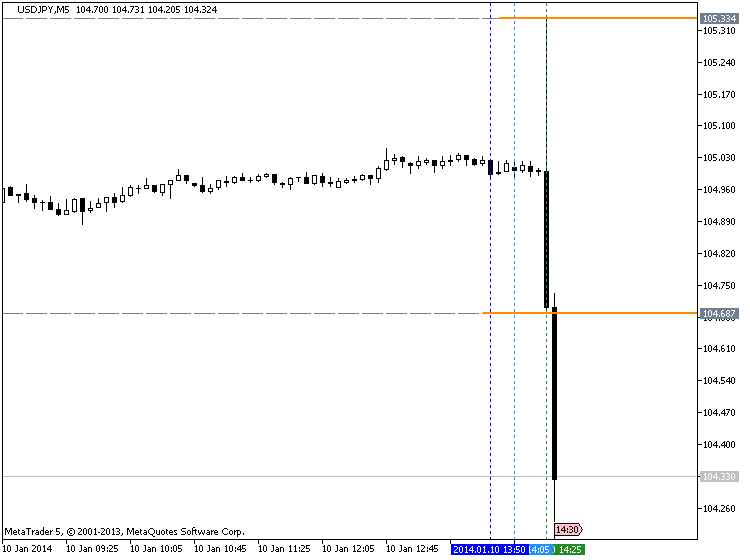

Employment in the U.S. increased by much less than expected in the month of December, according to a report released by the Labor Department on Friday. The report said non-farm payroll employment edged up by 74,000 jobs in December following an upwardly revised increase of 241,000 jobs in November.

More...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks