Euro area banks expect the demand for loans from businesses and households to increase further in the final three months of this year, survey data from the European Central Bank showed Tuesday.

more...

This is a discussion on EUR News within the Analytics and News forums, part of the Trading Forum category; Euro area banks expect the demand for loans from businesses and households to increase further in the final three months ...

Euro area banks expect the demand for loans from businesses and households to increase further in the final three months of this year, survey data from the European Central Bank showed Tuesday.

more...

Everyone is waiting with bated breath for the conclusion of the European Central Bank's policy session on Thursday following which the bank's chief Mario Draghi is expected to announce a gradual reduction in the massive monetary stimulus as the euro area economic growth gains momentum.

more...

Belgium's economic growth slowed for a second consecutive quarter during the three months to September, preliminary figures from the National Bank of Belgium showed Monday.

more...

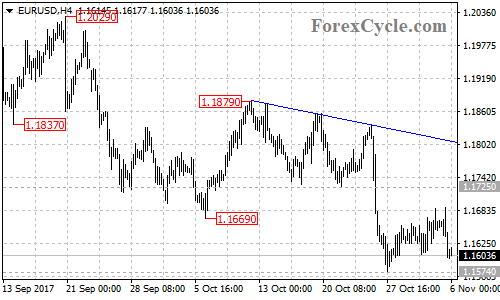

EURUSD is in consolidation for the downtrend from 1.1879. Range trading between 1.1574 and 1.1685 would likely be seen in a couple of days. Near term resistance is at 1.1685, as long as this level holds, the downtrend could be expected to resume and a breakdown below 1.1574 support could trigger another fall towards the resistance-turned-support trend line on the weekly chart. On the upside, a breakout of 1.1685 resistance will suggest that lengthier consolidation for the downtrend from 1.2092 (Sep 8 high) is underway, then further rise to 1.1800 area could be seen.

-- ForexCycle.com --

EURUSD is in consolidation of the downtrend from 1.2092 (Sep 8 high). Range trading between 1.1574 and 1.1725 would likely be seen in the coming days. As long as the support-turned-resistance level of 1.1725 holds, the downside movement could be expected to resume after the consolidation and a breakdown below 1.1574 could take price to 1.1400 area. On the upside, a breakout of 1.1725 resistance will indicate that lengthier consolidation for the downtrend is needed, then next target would be at the falling trend line on the 4-hour chart.

-- ForexCycle.com --

Germany's factory orders increased unexpectedly in September driven by foreign demand, while domestic orders remained weak. Factory orders grew 1 percent month-on-month in September, but slower than August's revised 4.1 percent increase, data from Destatis revealed Monday. This was the second consecutive rise and came in contrast to the expected decrease of 1.1 percent.

more...

Germany's industrial production declined more-than-expected in September, but the output expanded for the third quarter as a whole, signaling a robust underlying trend. Industrial production fell 1.6 percent month-on-month in September, in contrast to August's 2.6 percent increase, data from Destatis showed Tuesday.

more...

Eurozone economy maintained its robust growth momentum in the third quarter, suggesting that it is set to end the year on a strong note, and extend support to the European Central Bank's decision to reduce the size of its asset purchases at the start of next year even as inflation is away from its target.

more...

EURUSD failed in its attempt to breakout of 1.1879 resistance and pulled back from 1.1860. However, as long as the price is above 1.1740 support, the fall would possibly be consolidation of the uptrend from 1.1554, and another rise to test 1.1879 resistance is still possible after the consolidation. A breakout of this level will confirm that downtrend from 1.2092 (Sep 8 high) had completed at 1.1554 already, then the following upside movement could take price to 1.2000 area. On the downside, a breakdown below 1.1740 level will suggest that the short term uptrend from 1.1554 had completed at 1.1860 already, then deeper decline towards the resistance-turned-support level at 1.1690 could be seen. Below this level could trigger further downside movement towards 1.1554, followed by 1.1400.

-- ForexCycle.com --

Bookmarks