The Bank of Spain warned on Thursday that the political tensions surrounding the referendum being held for Catalonia's independence could hurt economic activity.

more...

This is a discussion on EUR News within the Analytics and News forums, part of the Trading Forum category; The Bank of Spain warned on Thursday that the political tensions surrounding the referendum being held for Catalonia's independence could ...

The Bank of Spain warned on Thursday that the political tensions surrounding the referendum being held for Catalonia's independence could hurt economic activity.

more...

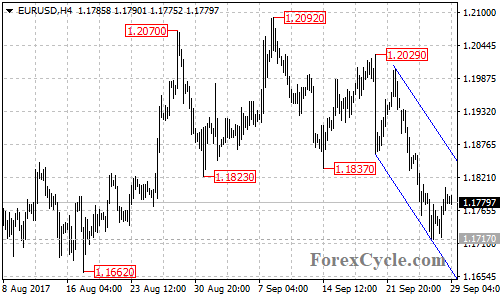

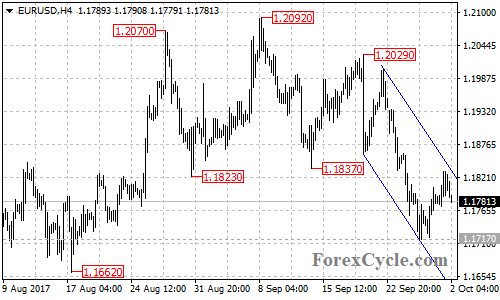

EURUSD remains in the downtrend from 1.2029, the bounce from 1.1717 is likely consolidation of the downtrend. Near term resistance is located at the top trend line of the price channel on the 4-hour chart, now at around 1.1860. As long as the price is in the channel, the downside movement could be expected to continue, and another fall to test 1.1662 support is still possible after the consolidation. Below this level could take price to the resistance-turned-support trend line on the weekly chart, now at 1.1420. On the upside, a clear break above the channel resistance could indicate that the downtrend had completed at 1.1717 already, then the following upside movement could bring price back towards 1.2092 previous high resistance.

-- ForexCycle.com --

EURUSD stays in a descending price channel on its 4-hour chart and remains in the downtrend from 1.2029. As long as the price is in the channel, the bounce from 1.1717 could be treated as consolidation of the downtrend. Further decline to test 1.1662 key support would likely be seen after the consolidation. A breakdown below this level could take to the resistance-turned-support trend line on the weekly chart, now at 1.1420. On the other side, a breakout of the top trend line of the channel would indicate that the short term downtrend had completed at 1.1717 already, then the pair would find next resistance level at 1.1940, followed by 1.2092.

-- ForexCycle.com --

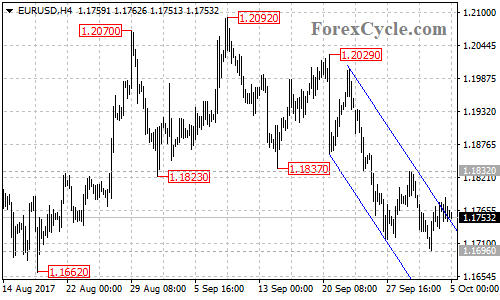

EURUSD moved out of the descending price channel on its 4-hour chart, indicating that lengthier consolidation for the downtrend from 1.2029 is underway. The price is expected to test 1.1832 resistance, above this level could signal completion of the downtrend, then the following upside movement could take price to 1.1900 area. Break through this level could trigger further upside movement towards 1.2092 previous high.

On the downside, as long as the price is below 1.1832, the price action in the trading range between 1.1696 and 1.1832 could be treated as consolidation of the downtrend, and a breakdown below 1.1662 key support would take price to the resistance-turned-support trend line on the weekly chart, now at 1.1420.

-- ForexCycle.com --

Eurozone banks are well equipped to cope with sudden or sharp changes in the interest rate environment, the European Central Bank said Monday, citing results from a test that used six different hypothetical interest rate shocks.

more...

Belgium's merchandise trade deficit for August narrowed from a year ago with exports growth exceeding the rise in imports, preliminary data from the National Bank of Belgium showed Monday.

more...

The European Central Bank do not have to wait until inflation reaches the target of 'below, but close to 2 percent' to normalize policy and now there are good arguments for slowing asset purchases, ECB Governing Council member Ewald Nowotny said in an interview published in an Austrian daily on Thursday.

more...

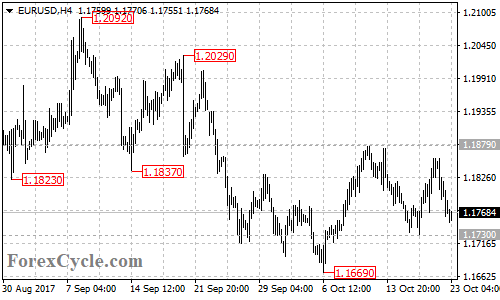

EURUSD moved sideways in a trading range between 1.1730 and 1.1879. As long as 1.1730 support holds, the side movement could be treated as consolidation of the uptrend from 1.1669 and one more rise towards 1.2029 resistance is still possible. Near term resistance is at 1.1879, a breakout of this level could signal resumption of the uptrend. On the downside a breakdown below 1.1730 support could take price to next support level at 1.1662 (Aug 17 low). Below this level will indicate that the whole upside movement from 1.0340 (Jan 3 low) had completed at 1.2092 already, then further decline towards the resistance-turned-support trend line on the weekly chart could be seen.

-- ForexCycle.com --

Eurozone consumer confidence strengthened for a third straight month in October to its highest level since 2001, preliminary data from the European Commission showed Monday.

more...

Belgium's business confidence recovered in October, led by a strong improvement in the morale in manufacturing, after several months of stagnation, survey data from the National Bank of Belgium showed Tuesday.

more...

Bookmarks