EUR/USD Price Action: Is the Euro Ready to Break Resistance?

Introduction to EUR/USD

The EURUSD pair represents the exchange rate between the Euro and the US Dollar, two of the most influential currencies in global markets. As one of the most traded currency pairs in the world, EUR-USD holds significant importance for traders and investors. Understanding the fluctuations of this pair is essential for market participants, as it reflects not only the relative strength of the two economies but also broader geopolitical and monetary trends. The nickname for this pair is "Fiber," derived from the Euro's name in the Forex market, and it is highly sensitive to global economic developments.

EURUSD Market Overview

The EUR USD currency pair has recently been experiencing upward momentum, breaking through key resistance levels and approaching the long-term resistance line, which has held for years. Economic news from the U.S. has been influential, with Federal Reserve Chair Jerome Powell making statements at the ECB Forum on Central Banking in Sintra, sparking potential market volatility. Investors are keenly watching for hints regarding future monetary policy decisions, particularly as the U.S. labor market shows resilience, with positive job openings reports and inflation indicators expected. Meanwhile, European economic data, including manufacturing indices, is expected to play a critical role in determining whether the Euro can maintain its strength against the U.S. Dollar. The next few days are crucial for EUR/USD, as the market will likely react to speeches from key central bank figures, including European Central Bank President Christine Lagarde, whose tone could influence the Euro's short-term outlook. As we approach the upcoming data releases, the balance of monetary policy expectations between the ECB and the Fed will drive short-term price action.

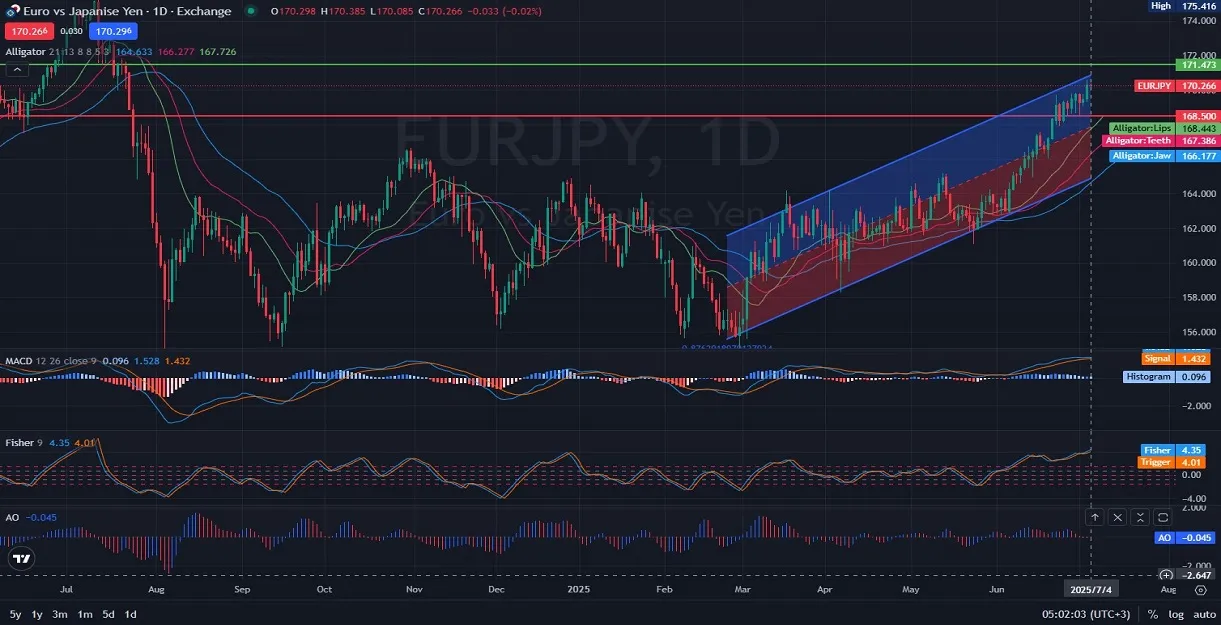

EUR/USD Technical Analysis

Looking at the daily chart of EUR-USD, the price is currently approaching a long-term resistance level, one that has been in place for the past four years. Despite the strong momentum in the recent uptrend, it seems unlikely that the price will break this resistance level on its first attempt. However, if the momentum continues, there is a possibility of a breakthrough on a retest. Should the price correct, the first target would likely be the trend line at around 1.14881, and if further decline occurs, we could see a retracement towards 1.10823. The Awesome Oscillator (AO) currently indicates strong bullish momentum, suggesting that buying pressure remains in play. The Fisher Transform indicator is signaling a continuation of this upward move, with values supporting a possible breakout. On the other hand, the Average True Range (ATR) is showing relatively low volatility, which may point to a period of consolidation before any significant price movements.

Final Words about EUR vs USD

In conclusion, EURUSD has entered a critical phase, where the price is testing a long-standing resistance level. While immediate breakout potential may seem limited, the current bullish momentum and economic drivers, such as central bank speeches and U.S. labor market data, suggest that the Euro might continue its strength against the U.S. Dollar. Traders should monitor price action closely at this resistance level and be prepared for either a breakout or a correction toward the trend line. The upcoming economic data from both sides of the Atlantic will be key to shaping the direction of this currency pair in the near future.

07.01.2025

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks