EURUSD Faces Key Data and Technical Tests

The EURUSD currency pair, commonly referred to as the "Fiber" in forex trading circles, represents the economic interplay between the Eurozone and the United States. The pair remains highly sensitive to a series of key economic indicators and central bank communications. This morning, Eurozone data focused on services sector performance, with Spanish Services PMI at 52.8 (slightly below the previous 53.4), Italian Services PMI at 52.1 versus 52.9 prior, and stable readings from France and Germany’s final Services PMIs at 47.4 and 47.2 respectively, culminating in an overall Eurozone Final Services PMI of 48.9. These figures suggest modest expansion in some regions but ongoing contraction in others, likely weighing on the Euro. Later in the day, the spotlight shifts to the US with the ADP Non-Farm Employment Change releasing a solid 111K compared to 62K prior, alongside speeches from FOMC members Bostic and Cook, which may provide important clues on Fed policy direction. Additional data including the US Final Services PMI, ISM Services PMI, and Crude Oil Inventories will further influence USD demand. The Federal Reserve’s Beige Book at 7:00 pm will offer qualitative insight into economic conditions across the US. Given this mix, stronger US employment data and hawkish Fed rhetoric could boost the US Dollar, putting downward pressure on EURUSD, while softer Eurozone PMI readings add to the pair’s current challenges. Overall, today’s fundamental events are crucial for determining short-term momentum in EURUSD.

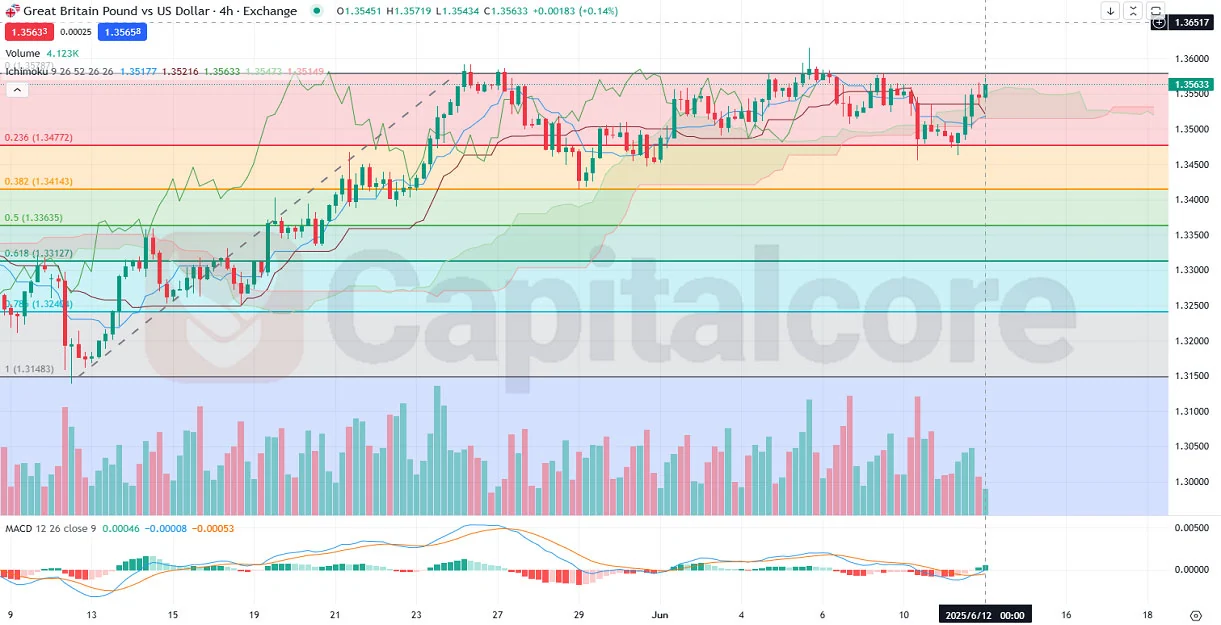

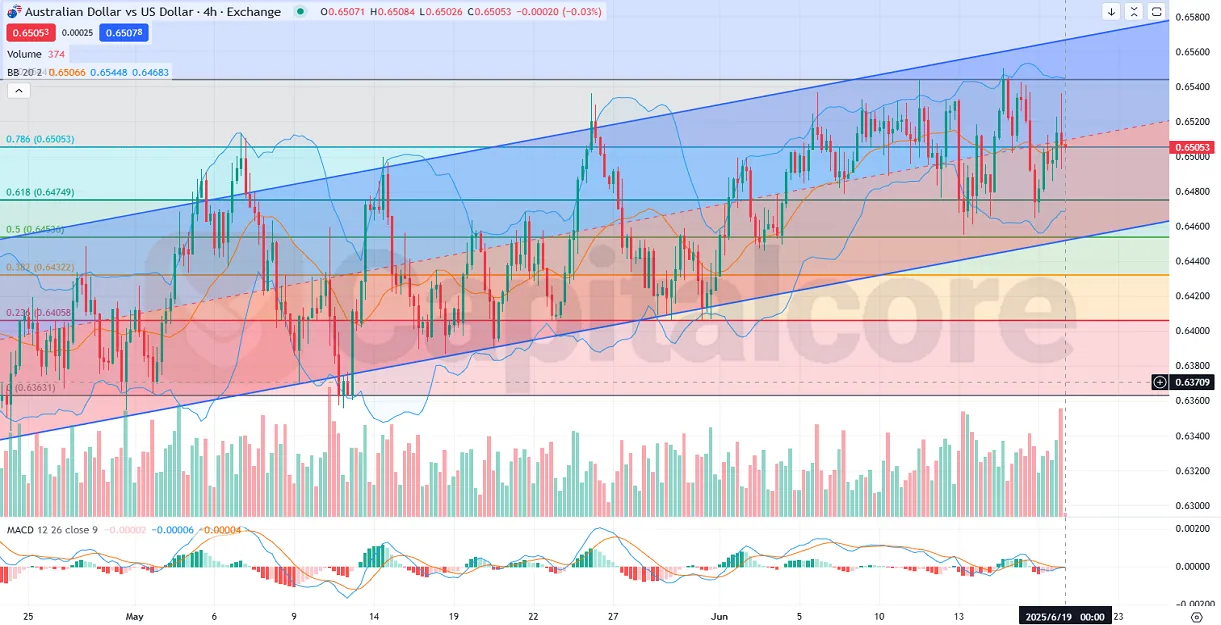

Chart Notes:

• Chart time-zone is UTC (+03:00)

• Candles’ time-frame is 4h.

On the technical front, the EURUSD pair is currently exhibiting a cautious bullish momentum on the 4-hour chart. The price is supported by a well-defined ascending trendline, which has held through recent pullbacks, indicating underlying buying interest. The pair is trading slightly above the 100-period moving average, which acts as dynamic support around the 1.12869 level. The Fibonacci retracement levels from the recent swing low at 1.07363 to the high near 1.15700 show that the price is hovering just above the 23.6% retracement at 1.13725, a critical short-term support level. The stochastic oscillator is positioned in the mid-range but trending downward, suggesting a potential pullback or consolidation phase in the near term. Overall, the EURUSD remains in an uptrend but is approaching a key decision zone near the 1.1370 level; a strong bounce here would reinforce bullish prospects, while a break below the trendline and Fibonacci support could invite a deeper correction toward the 38.2% retracement near 1.1250. Traders should watch for confirmation from price action and stochastic signals to gauge the next directional move.

•DISCLAIMER: Please note that the above analysis is not an investment suggestion by “Capitalcore LLC”. This post has been published only for educational purposes.

Capitalcore

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks