EURAUD H4 Technical Setup with Fundamental Drivers

The EURAUD forex pair, often referred to as the "Euro Aussie," represents the exchange rate of the Euro (EUR) to the Australian Dollar (AUD). This pair combines the stability of the Eurozone economy with the commodity-driven volatility of the Australian Dollar, making it a dynamic instrument for traders.

Today, the European consumer inflation data, including the German and Eurozone CPI releases, will dominate market sentiment. Higher-than-expected inflation numbers can strengthen the Euro as traders anticipate a more hawkish stance from the ECB. Conversely, dovish implications could arise from subdued CPI figures. On the Australian side, the RBA Governor Michele Bullock’s speech could influence sentiment, particularly if she signals a divergence in policy tone. The upcoming private capital expenditure report is another key release, with strong figures likely boosting AUD strength. With inflation and monetary policies as central themes, EURAUD could experience heightened volatility during today’s trading sessions.

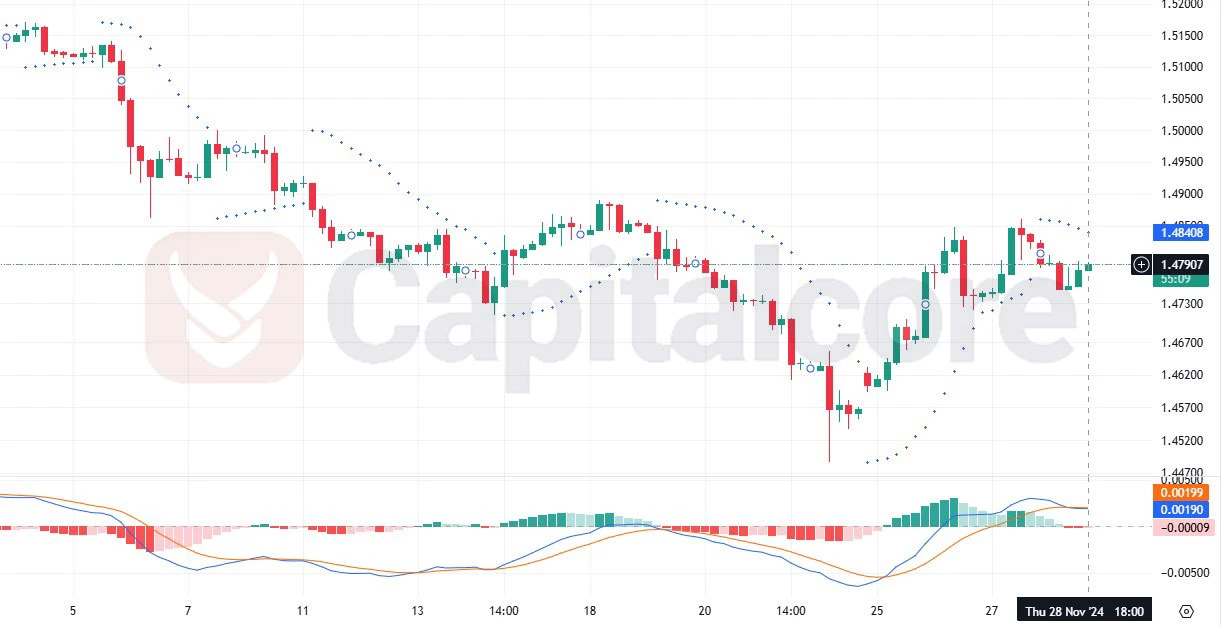

Chart Notes:

• Chart time-zone is UTC (+02:00)

• Candles’ time-frame is 4h.

The EURAUD pair on the H4 chart has shown bearish momentum recently, with seven out of the last twenty candles being bearish. A bullish reversal is in progress as the price breaks above the Ichimoku Cloud—a bullish signal. The Ichimoku Cloud has turned green but remains thin, reflecting weak bullish momentum. The price is currently trading between the 0.382 and 0.5 Fibonacci retracement levels. While it briefly touched the 0.5 level, it failed to break through. A successful breach of this level could see the price rally toward the 0.618 Fibonacci level, with potential to extend toward the 1.0 level. However, the Williams %R indicator signals overbought conditions, cautioning against aggressive bullish positions. Traders should monitor for a confirmed breakout or a rejection at these resistance levels.

• DISCLAIMER: Please note that the above analysis is not an investment suggestion by “Capitalcore LLC”. This post has been published only for educational purposes.

Capitalcore

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks