GBP/USD H4 Technical and Fundamental Analysis for 05.08.2025

Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The GBPUSD pair today is impacted by several key economic releases. For the GBP, significant data such as the RICS House Price Balance and HBOS House Price Index could lead to notable volatility, as higher-than-expected readings generally strengthen the Pound. Moreover, the recent Bank of England Monetary Policy Report, Monetary Policy Summary, and Interest Rate decision further shape traders' expectations about future monetary policy. On the USD side, upcoming releases such as Initial Jobless Claims and Wholesale Inventories can impact the USD valuation; a lower number of jobless claims would typically bolster the US dollar, reflecting a healthier labor market.

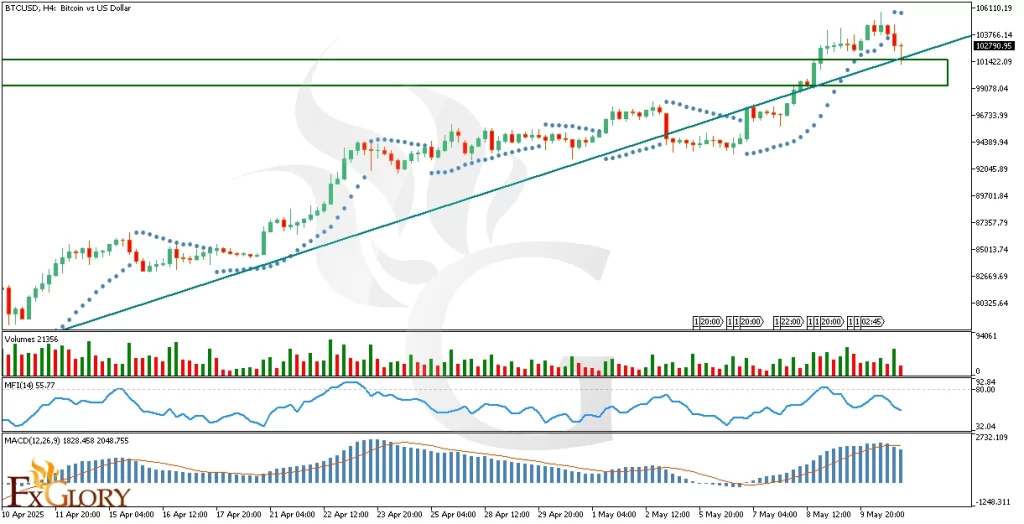

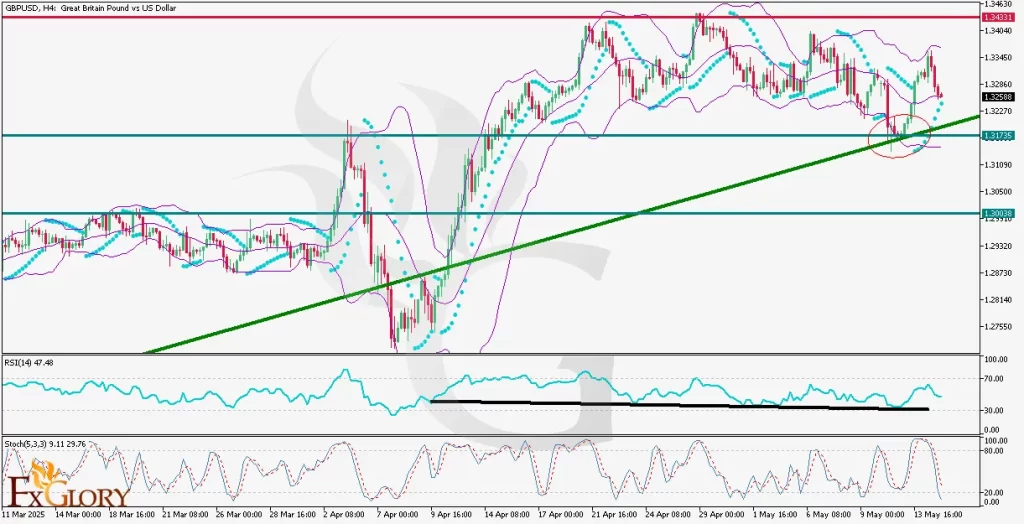

Price Action:

Analyzing the GBP-USD H4 chart, the price has been consolidating sideways within a clear support zone. Currently, a new green bullish candle indicates a reaction from the support zone around 1.3257. If the upper boundary of this zone fails to sustain price, a move downward toward the previously broken resistance line around 1.3220 could provide stronger support. However, given the distance from the existing upward trend line, the overall bullish trend remains intact.

Key Technical Indicators:

Parabolic SAR: Currently above the candles, indicating short-term bearish momentum. A shift below the candles would confirm a renewed bullish stance.

RSI (Relative Strength Index): The RSI reading is at 45.17, signaling neutral momentum. There's room for price movements in both directions, without imminent overbought or oversold conditions.

MACD (Moving Average Convergence Divergence): The MACD histogram is slightly negative but approaching the zero line, indicating weakening bearish momentum and a potential bullish crossover soon, suggesting buyers may regain strength.

Stochastic Oscillator: Stochastics at 20.58 (main line) and 32.13 (signal line) indicate oversold conditions, suggesting a potential bullish reversal may occur soon.

Support and Resistance:

Support: Immediate support lies at 1.3257, with a stronger support zone at 1.3220, coinciding with previous resistance turned support.

Resistance: Immediate resistance is near the recent swing high at 1.3385, providing the first significant barrier for bullish continuation.

Conclusion and Consideration:

The GBP/USD technical and fundamental daily chart analysis indicates the pair is consolidating within a robust support area. The potential for a bullish reversal from current support is bolstered by oversold Stochastics and a weakening bearish MACD signal. However, traders must closely monitor today's GBP and USD economic releases for increased volatility and directional clarity. Caution is advised due to the mixed signals from technical indicators, highlighting the importance of waiting for confirmed price action signals.

Disclaimer: The analysis provided for GBP/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on GBPUSD Market conditions can change quickly, so staying informed with the latest data is essential.

FXGlory

05.08.2025

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks