GOLD (XAU/USD) H4 Technical and Fundamental Analysis for 04.10.2025

Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

Gold prices are heavily influenced by economic data releases and central bank speeches, especially from the US. Today, traders are closely monitoring critical data from the US, including the Consumer Price Index (CPI) excluding food and energy, CPI overall, initial jobless claims, and several Federal Reserve members' speeches. A higher-than-expected CPI reading or hawkish comments from Fed officials could strengthen the USD and exert downward pressure on Gold, whereas weaker economic data and dovish comments might boost Gold as a safe-haven asset.

Price Action:

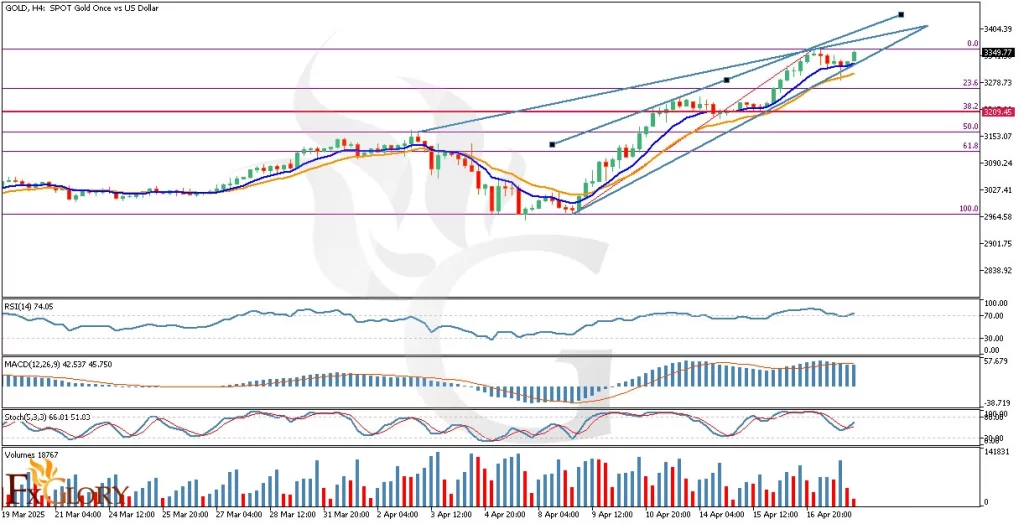

Currently, GOLD H4 analysis shows price breaking the previous support trend line, indicating a bearish shift. The recent bullish movement has retraced to the upper band of the Bollinger Bands, coinciding with the critical 23.6% Fibonacci retracement level. A red bearish pin bar confirms selling pressure, suggesting a potential move downward toward the 38.2% Fibonacci retracement level and possibly lower.

Key Technical Indicators:

Bollinger Bands: Gold price touched the upper band and is now showing signs of retracement. The narrowing of bands indicates decreasing volatility, suggesting an upcoming significant price move, likely bearish in the short term.

Parabolic SAR: The dots are currently beneath the price candles, indicating recent bullish momentum. However, the proximity of price action suggests a possible imminent reversal to a bearish stance.

RSI (Relative Strength Index): The RSI is at 57.21, above the neutral midpoint but not yet at overbought levels, suggesting that there is still room for upward movement, but caution is warranted as momentum may weaken.

MACD (Moving Average Convergence Divergence): MACD remains below the zero line with decreasing bearish histograms. This indicates diminishing bearish momentum and hints at a potential short-term consolidation or reversal.

%R (Williams Percent Range): Currently at -16.78, signaling that price is near overbought territory and may soon correct downward, aligning with bearish expectations.

Support and Resistance Levels:

Support: Immediate support at 3052.06 (38.2% Fibonacci), with deeper support seen at 3004.98 (50% Fibonacci).

Resistance: Key resistance at 3095.14 (23.6% Fibonacci), and further strong resistance at the psychological 3122.68 level.

Conclusion and Consideration:

Technical indicators and recent price action analysis on GOLD H4 indicate a bearish pullback scenario in the short term. With price reacting strongly to the Fibonacci and Bollinger Band resistance, the possibility of further downside remains significant. Traders should remain vigilant for today's US economic data and Federal Reserve speakers, as these events could significantly influence volatility and the directional bias of Gold.

Disclaimer: The analysis provided for XAU /USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on XAUUSD. Market conditions can change quickly, so staying informed with the latest data is essential.

FXGlory

04.10.2025

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks