BTC/USD H4 Daily Technical and Fundamental Analysis for 04.24.2025

Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

BTC-USD trading today may be significantly impacted by several USD economic events. The speech from Federal Reserve Bank of Cleveland President Beth Hammack may provide critical insight into future monetary policy, particularly regarding the Federal Reserve's balance sheet management, affecting USD strength. Additionally, key economic releases such as Initial Jobless Claims, Durable Goods Orders, and Existing Home Sales are expected to create volatility in the USD. BTC traders should closely monitor these USD developments as they may indirectly influence cryptocurrency market sentiment and BTCUSD volatility.

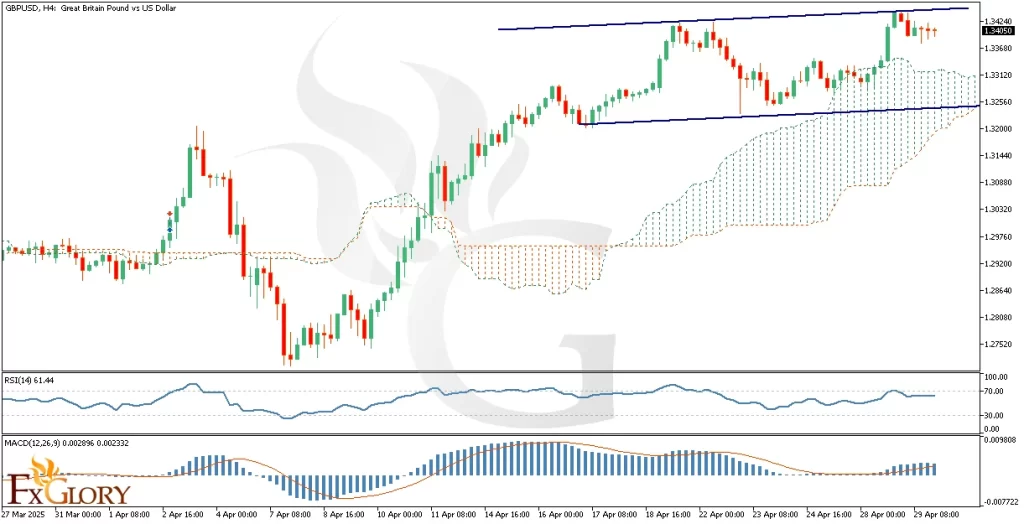

Price Action:

BTCUSD has recently broken its previous downward trend and initiated a bullish trajectory on the H4 chart. After a notable upward move, BTC/USD is currently undergoing a corrective phase, pulling back toward a critical technical support area at the intersection of two trendlines. Recent candlestick patterns with extended upper and lower wicks indicate considerable price instability and indecision among traders, signaling potential volatility ahead.

Key Technical Indicators:

Parabolic SAR: The Parabolic SAR dots are placed below the BTCUSD candlesticks, indicating ongoing bullish momentum. However, the decreasing spacing between dots suggests the momentum could be weakening, hinting at a potential trend reversal if price continues correcting.

RSI (Relative Strength Index): RSI currently stands at 82.12, clearly within overbought territory. This implies that BTCUSD could be vulnerable to short-term corrections as buyers might begin to lose momentum, potentially providing entry points for traders anticipating pullbacks.

MACD (Moving Average Convergence Divergence): The MACD histogram remains positive but shows declining momentum as the bars gradually decrease. This signals diminishing bullish sentiment, and traders should watch for a possible bearish crossover that might indicate further downside risk.

%R (Williams Percent Range): The %R indicator is at -10.17, which is in the overbought region. This aligns with RSI, further indicating that BTCUSD may experience a corrective pullback or sideways consolidation in the near term.

Support and Resistance:

Support: Immediate BTCUSD support is identified near the critical cross-point of two trendlines around the $92,000 area, closely followed by a psychological support at $90,000.

Resistance: Key resistance for BTCUSD is observed near the recent high of approximately $94,500, beyond which further bullish acceleration might target the significant psychological level of $95,000.

Conclusion and Consideration:

The BTC-USD H4 chart currently maintains bullish momentum, supported by technical indicators such as the Parabolic SAR and MACD. However, the price action coupled with RSI and %R in overbought territory strongly suggests that a short-term correction or consolidation could occur before any further significant bullish continuation. Traders should remain vigilant of upcoming USD economic news events today, as they may significantly influence BTCUSD market sentiment and volatility.

Disclaimer: The analysis provided for BTC/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on BTCUSD. Market conditions can change quickly, so staying informed with the latest data is essential.

FXGlory

04.24.2025

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks