USDCAD H4 Technical and Fundamental Analysis for 02.06.2025

Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis

The USDCAD currency pair is experiencing volatility due to key economic events today. The US Dollar (USD) is impacted by multiple speeches from FOMC members Michelle Bowman, Philip Jefferson, and Christopher Waller, which may provide monetary policy signals affecting market sentiment. If their comments are hawkish, the USD could strengthen, while dovish remarks may lead to USD weakness. Additionally, Initial Jobless Claims, Challenger Job Cuts, and Productivity Reports will offer insights into the US labor market, potentially adding further USD volatility. On the Canadian Dollar (CAD) side, the Ivey PMI report is crucial; a higher-than-expected reading could strengthen CAD, driving USDCAD lower, while a weak reading could weaken CAD, pushing USD CAD higher.

Price Action Analysis

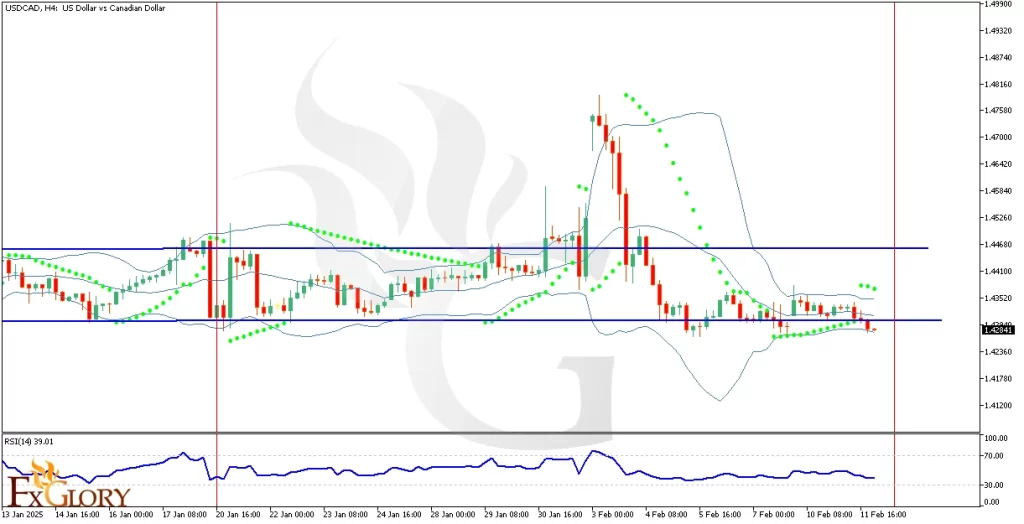

The USDCAD H4 chart shows a sharp bearish trend, followed by a minor correction in the last five candles. Four of these candles are bullish but relatively small, indicating a weak recovery attempt. The USD/CAD Price has found support at 1.4280, leading to a slight bounce, but the lack of strong bullish momentum suggests that this is likely a temporary consolidation rather than a reversal. The downtrend remains intact, and unless buyers push above key resistance levels, further bearish pressure could emerge.

Key Technical Indicators

Moving Averages (MA 9 - Blue & MA 17 - Red): The short-term MA (9) has crossed below the long-term MA (17), forming a bearish crossover, confirming a downtrend continuation signal. The moving averages are both sloping downward, reinforcing selling pressure. Despite the recent small bullish candles, the USD CAD price remains below both moving averages, meaning the bearish trend is still dominant unless price reclaims the moving averages.

Relative Strength Index (RSI 14): The RSI is at 41.82, signaling bearish sentiment but not yet oversold conditions. This suggests there is still room for further downside before the market reaches oversold territory. If the RSI remains below 50, bears remain in control, and a drop below 30 would indicate oversold conditions, potentially leading to a short-term reversal or consolidation.

Awesome Oscillator (AO): The AO is at -0.014, confirming that negative momentum is still dominant, although the histogram bars are shrinking, indicating a possible slowdown in bearish momentum. If AO turns positive, it could suggest a trend shift, but for now, the bearish trend remains intact.

Support and Resistance

Support: Immediate support is located at 1.4280, which has acted as a bounce level in recent price action, and if broken, it could push the USD/CAD price further down.

Resistance: The first resistance level is 1.4385, which aligns with recent price rejections and the 9-period moving average, while the next major resistance level is 1.4440, corresponding to the previous breakdown zone. A break above this level would challenge the bearish scenario and indicate potential bullish momentum.

Conclusion and Considerations

The USDCAD H4 technical analysis suggests a bearish trend continuation, with the bearish moving average crossover, RSI below 50, and AO still negative reinforcing the downside bias. The recent minor bullish correction lacks strong momentum, indicating a possible continuation of the downtrend unless buyers push above key resistance levels. Upcoming fundamental news events, including Ivey PMI for CAD and FOMC speeches, could drive volatility, making it crucial to monitor USDCAD price reactions. Traders should watch for a breakout or rejection at resistance levels, while a break below 1.4280 could trigger further bearish movement. Proper risk management is crucial, given the upcoming news releases that may cause sharp price fluctuations.

Disclaimer: The analysis provided for USD/CAD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on USDCAD. Market conditions can change quickly, so staying informed with the latest data is essential.

FXGlory

02.06.2025

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks