Hi All,

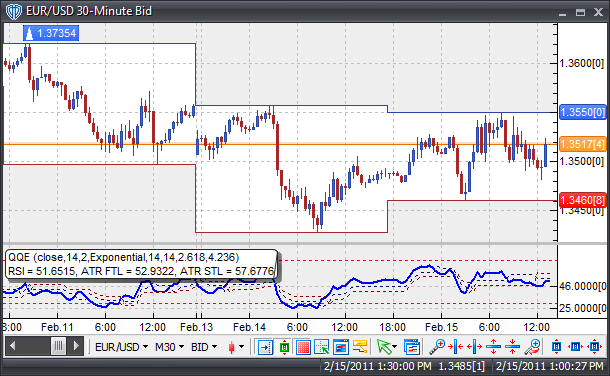

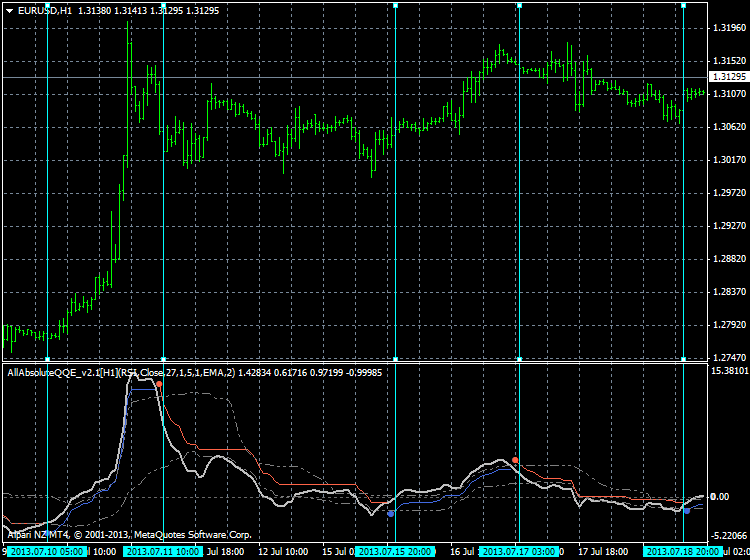

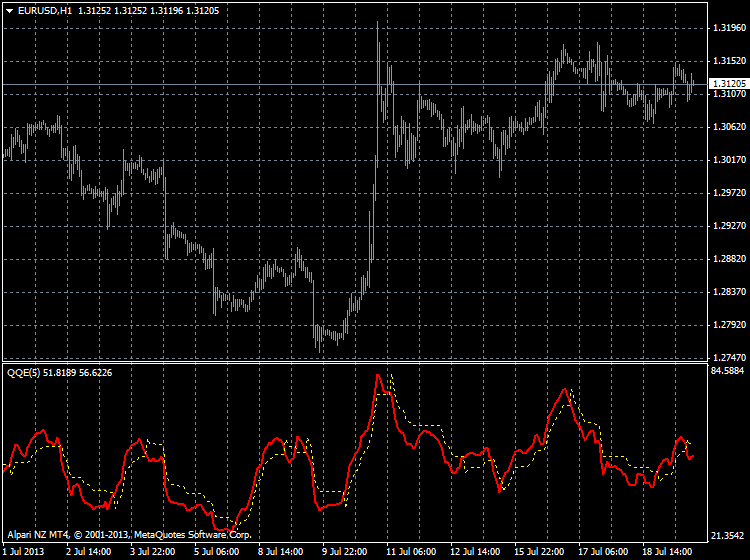

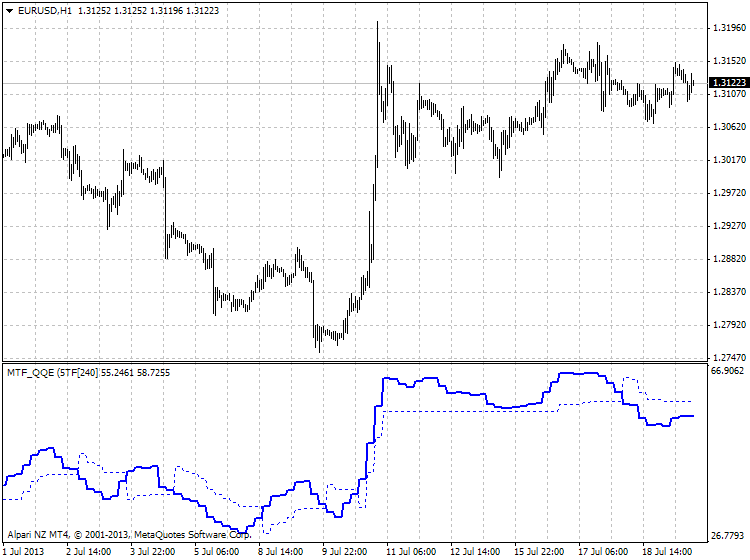

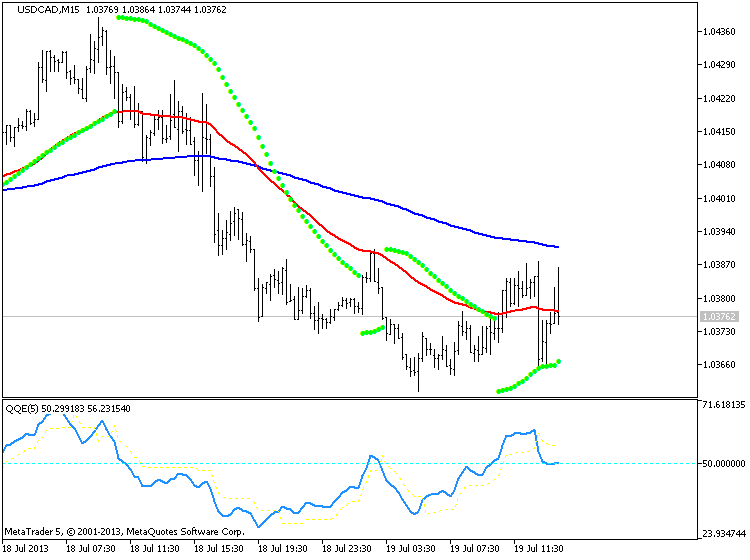

Please take a look at one more interesting stuff - AllAbsoluteQQE, which is a continuation of the well-known QQE and similar TrendStrength and TrendRSI. As written here the author of the Quantitative Qualitative Estimation (QQE) is unknown but luckily you know who is the author of the TrendStrength and TrendRSI.

Code:extern int TimeFrame = 0; // TimeFrame in min extern int MathMode = 0; // Math method: 0-RSI;1-Stoch;2-DMI extern int Price = 0; // Price = 0...6 (see List of Prices) extern int Length = 27; // Period of evaluation extern int PreSmooth = 1; // Period of PreSmoothing extern int Smooth = 5; // Period of smoothing extern int MA_Method = 1; // According to list above extern int RangeAvgLength = 27; // Average Range Period extern double Multiplier = 4.236; // Average Range Multiplier extern int SignalMode = 1; // 0-off,1-on extern int LevelsMode = 2; // Levels Mode: 0-Standard OverBought/OverSold // 1-StdDev Bands // 2-High/Low Channel extern double OverboughtLevel = 80; // Overbougt Level (ex.70) extern double OversoldLevel = 20; // Oversold Level (ex.30) extern int LookBackPeriod = 20; // LookBack Period for LevelsMode=1,2 extern double UpperMultiplier = 1; // Upper Band Multiplier for LevelsMode=1 extern double LowerMultiplier = 1; // Lower Band Multiplier for LevelsMode=1

Regards,

Igor

UPDATES:

2013.04.22 - version v2.1: 1 minor bug fixed.

21Likes

21Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks