I am continuing with the theory. Basicly I am not fully agree with those signals: because I know 6 signals, not 5; and because some signals (described by author of this indicator) are different from what I am explaining here ... but it is the other story and we will discuss it later. So, for now - some proven theory "as is".

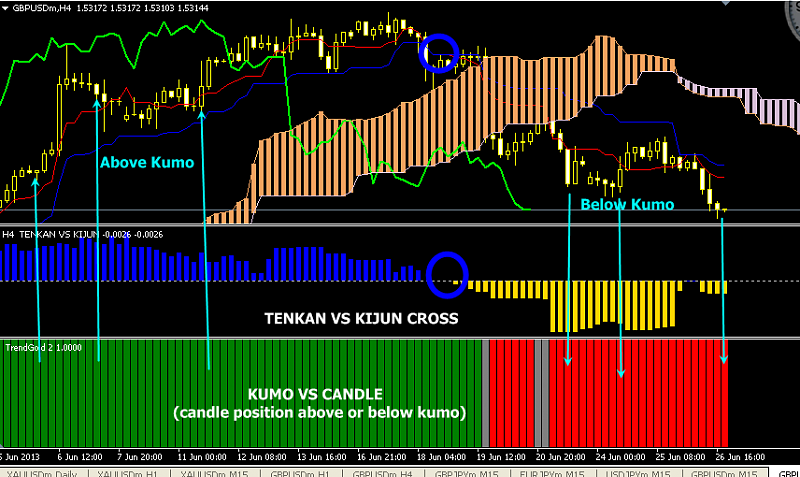

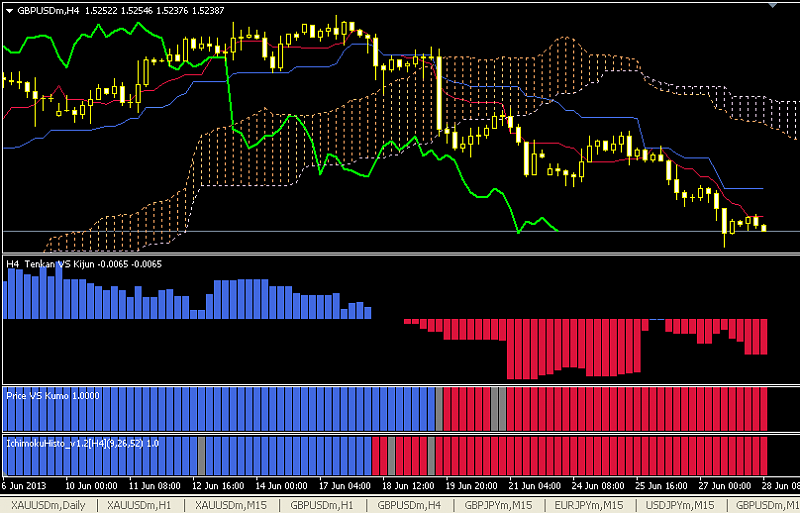

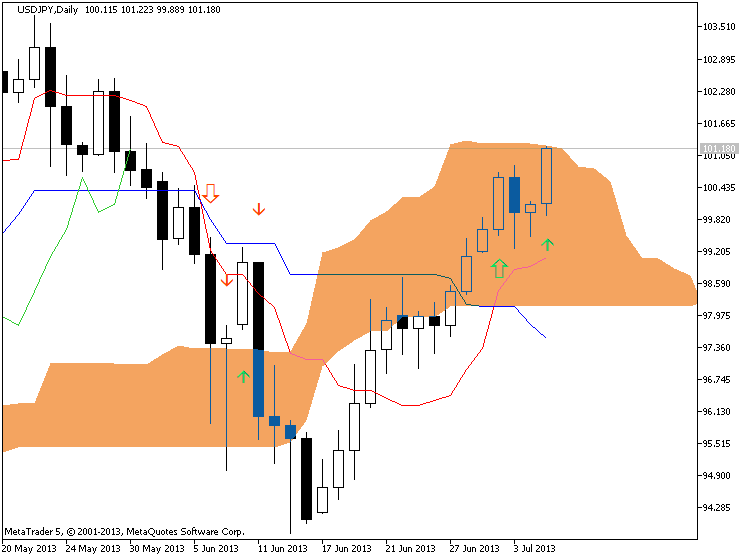

3. Kumo Breakout

The Kumo Breakout signal occurs when the price leaves or crosses the Kumo (Cloud).

3.1. A bullish signal occurs when the price goes upwards through the top of the Kumo.

3.2. A bearish signal occurs when the price goes downwards through the bottom of the Kumo.

12Likes

12Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks