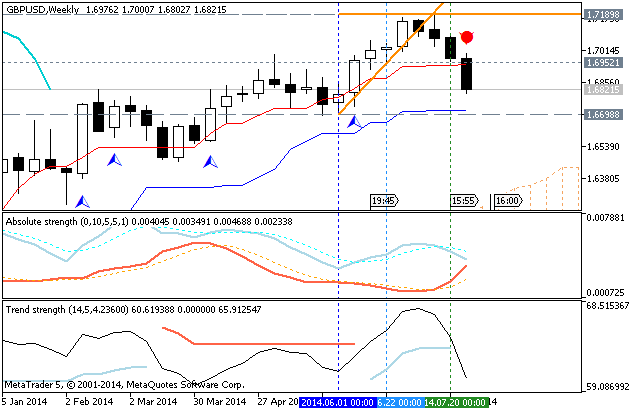

GBP/USD forecast for the week of August 4, 2014, Technical Analysis

The GBP/USD pair as you can see fell hard during the course of the week, slamming into the 1.68 level. We are now testing the very uptrend line that has shot this market higher, and as a result the next couple of weeks should be rather interesting. We quite simply need to see some type of supportive candle between here and 1.67 in order to stay positive. If not, we could have a rather significant correction. If we get that correction, we would expect the 1.65 level to be targeted first, and then the 1.62 level.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks