Forex Weekly Outlook July 21-25

Glenn Stevens’ speech, US housing data, inflation and industrial data, NZ rate decision, British GDP data are the main events on FX calendar this week. Here is an outlook on the main market-movers ahead.

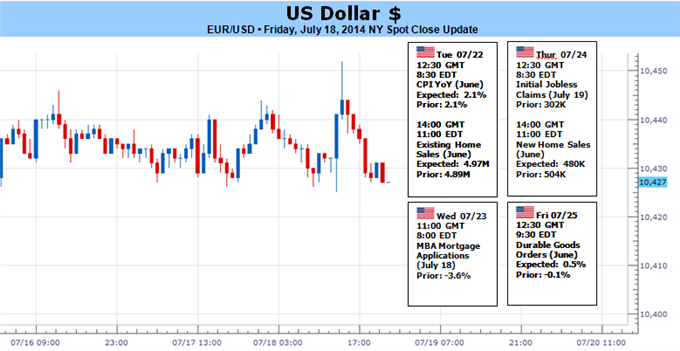

Last week the Philly Fed Index jumped to 23.9 points in July marking the highest reading since March 2011. Current activity rose to 23.9 from 17.8 in June, orders index jumped to 34.2 from 16.8. Economists expected the index to fall to 15.6. This release suggests manufacturing has accelerated across the board in the Philadelphia region heading towards a successful second half –year. More positive news came from the US employment market with a lower than expected release of 302,000 clams, down 3,000 from the prior week, beating expectations for a rise to 310,000. Will the US economy continue its upturn trend?

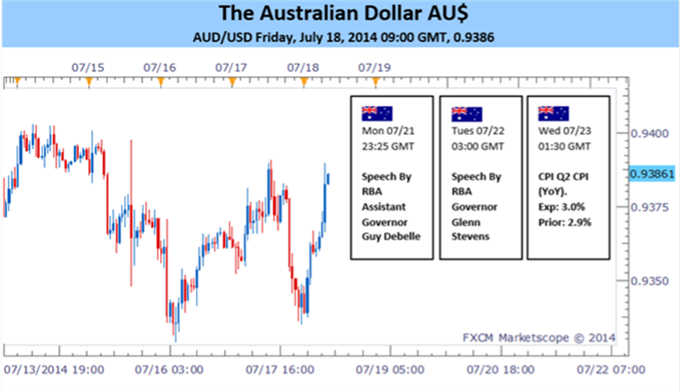

- Glenn Stevens speaks: Tuesday, 3:00. Governor Glenn Stevens, head of the Reserve Bank of Australia will speak in Sydney. He may talk about the increasing value of the Australian dollar. In a former speech Stevens noted that the zero interest rate policies of major central banks are partly to blame for the inflation of the Australian dollar, and also warned market participants that this was no reason to remain complacent on the value of the currency. He continued to say that the RBA still has room to cut interest rates when required.

- US inflation data: Tuesday, 12:30. U.S consumer prices edged up 0.4% in May, amid sharp rise in food prices. Economists expected a smaller increase of 0.2 %, getting close to the Fed’s target of 2.0%. Meanwhile, core prices also climbed more than expected, rising 0.3% from a 2.0% gain posted in April. In a yearly base, the core CPI increased 2.0 %, up from 1.8 % in April and the biggest gain since February of last year. The increase in prices, suggest the Fed may raise interest rates sooner than expected. U.S consumer prices are expected to gain 0.3% while core prices are predicted to increase by 0.2%.

- US Existing Home Sales: Tuesday, 14:00. The number of pre-owned home sales edged up in May to a nearly three year high, reaching an annualized rate of 4.89 million from 4.66 million posted in the previous month. Analysts expected a lower rise to 4.74 million units. The housing recovery continues amid higher income and lower housing prices, which increase affordability. A further rise to 4.98 million is expected this time.

- NZ rate decision: Wednesday, 21:00. New Zealand’s central bank announced a rate hike of 25 basis points in its June meeting, reaching 3.25%. This was the highest level since January 2009 and the third consecutive rise. The central bank said rates need to be higher as long as economic growth fuels inflation. Annual inflation slowed mildly to 1.5 % in the first quarter, while the RBNZ wants rates to be around 2 %, the mid-point of its 1-3 % target band. New Zealand’s central bank is expected to raise rates again to 3.50%.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment benefits declined 3,000 last week reaching 302,000, indicating the US labor market recovery is picking up. Analysts expected claims to reach 310,000 last week. The four-weak average fell 3,000 to 309,000, the lowest level since June 2007. Yellen warned that the Fed may kike rates sooner than planned in case the labor market continues to strengthen. The numer of claims is expected to rise to 310,000.

- US New Home Sales: Thursday, 14:00. Sales of new U.S. single-family homes climbed to a six-year high in May, reaching a seasonally adjusted annual rate of 504,000 units, 18.6% more than in the previous month, beating predictions for 442,000 units. The high mortgage rates seen in the second half of 2013 are beginning to settle increasing affordability. The median price of a new home increased 6.9% from May since inventory remained unchanged, but prices are beginning to settle and should help to stimulate demand for houses. Sales of new homes is predicted to reach 485,000.

- Eurozone German Ifo Business Climate: Friday, 8:00. German business climate index declined to 109.7 in June from 110.4 in May, posting its second consecutive monthly fall. Economists expected a minor drop to 110.3. German manufacturers fear the potential consequences of the crises in Ukraine and Iraq. More than 6,000 German companies are related to Russia and business and trade bodies have warned that further escalation in tensions over Ukraine may result in catastrophic losses for firms. Business sentiment is expected to edge down to109.6.

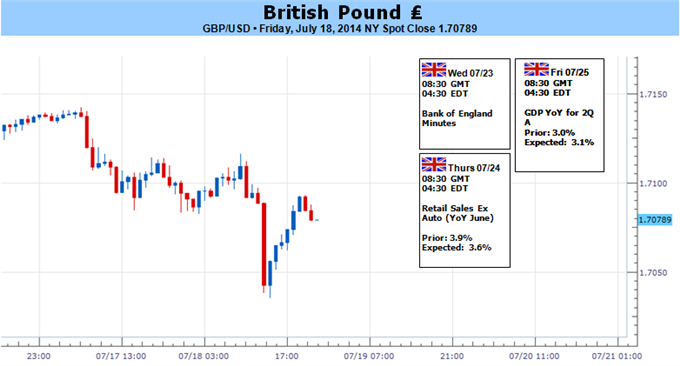

- UK Prelim GDP: Friday, 8:30. In Q1 2014 the UK economy expanded by 0.8% in the first quarter and by 3.1% when compared with 2013 Q1. This was the fifth consecutive rise, the longest growth period since the economic downturn reaching 0.6% below its pre-downturn peak in Q1 2008. The main contributor to growth was the services industry, which grew by 0.9% on the quarter. The labor market also performs well. UK economy is predicted to expand 0.8% in the second quarter.

- US Core Durable Goods Orders: Friday, 12:30. Orders for U.S. durable goods fell 1 % in May amid a sharp decline in demand for military equipment. The reading was worse than the 0.1% drop predicted by analysts and lower than the previous release of 0.6%. However, excluding defense-related goods, orders actually rose, and orders in a key category that signals business investment also increased. Meanwhile core orders excluding transportation, declined by 0.1%, while expected to rise 0.3%. Durable goods orders are expected to rise 0.4%, while core orders are predicted to gain 0.6%.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks