Forex Weekly Outlook May 26-30

The dollar and the pound enjoyed a positive week and the euro continued to grind lower. European Parliamentary Elections, US Durable Goods Orders, Consumer Confidence, GDP figures form the US and Canada as well as US employment data are the main market movers this week.

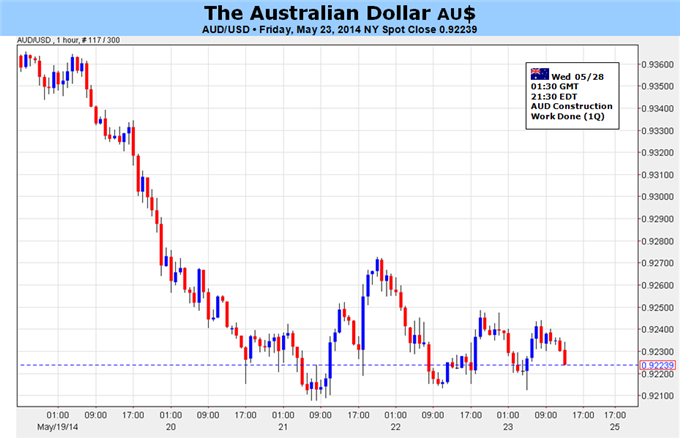

The FOMC meeting release failed to bring surprises. The main focus was on normalizing monetary policy after the Fed finishes its asset purchase tapering. The Fed expects growth will continue to accelerate in 2014 despite the unexpected softness in the first quarter attributed to bad weather conditions. The euro was pressured lower once again, through a combination of unimpressive data and more talk from the ECB regarding an imminent rate hike. In the UK, mostly positive data kept the pound bid, and cable still has a shot on 1.70. The Aussie showed weakness despite a positive surprise from China. Where will currencies go in the last week of this turbulent month?

- European Parliamentary Elections: The European Parliament elections takes place every five years. This time 751 MEPs will be elected and the voters will have more of a say in the appointment of the next Commission president. According to recent surveys, only 37 percent of Europeans believe their voice counts in Brussels. Policymakers in Brussels are trying to democratize the election process, and for the first time, the election results will be linked to the selection of the European Commission president. The major risk is that Euro-skeptic parties from the right will gain ground, thus undermining the decision making processes in the union.

- US Durable Goods Orders: Tuesday, 12:30. Orders for long lasting U.S. manufactured goods increased more than expected in March, jumping 2.6%, higher than the 2.1% rise estimated, while Core orders edged up 2.0%, beating forecasts of a 0.6% increase. Capital spending plans increased significantly indicating a pickup in growth in the second quarter. This report correlates with other manufacturing data indicating expansion. Durable goods orders are expected to decline by 0.5%, while core orders are expected to rise 0.2% this time.

- US CB Consumer Confidence: Tuesday, 14:00. US consumer confidence came below market consensus in April reaching 82.3 from 83.9 in the previous month. Analysts expected a slightly stronger reading of 82.9. Consumers assessed current business and employment conditions less favorably than in March, however the short-term outlook remained strong. Consumer confidence is expected to rise to 83.2.

- Haruhiko Kuroda speaks: Wednesday, 0:00. BOE Governor Haruhiko Kuroda will speak in Tokyo. Kuroda stated last month that consumer inflation may exceed the central bank’s projection in the fiscal year that ended in March. BOE Governor is confident that Japan’s economy is progressing in line with the banks forecasts. Kuroda may explain the BOJ’s decision of maintaining monetary policy. Market volatility is expected.

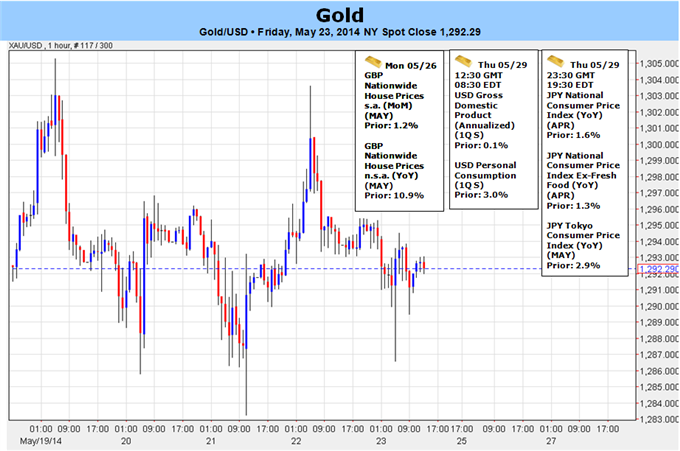

- US GDP (second release): Thursday, 12:30. The preliminary estimate of GDP growth for the first quarter of 2014 showed a weak growth rate of 0.1% dragged down by lower demand and unusually harsh weather conditions. Nevertheless, consumer spending increased 3.0% in the first three quarters. With weather conditions back to normal, housing and corporate investment should rebound sharply. GDP growth estimate for the first quarter is expected to show a 0.6% contraction and this could weigh on the dollar.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment benefits edged up by 28,000 last week to 329,000, but still remaining at low levels suggesting a steady pace of hiring. The four-week average declined 1,000 to 322,500 indicating an increase in job openings. The pickup in hiring may help boost economic growth for the rest of 2014. Jobless claims are expected to reach 321,000 this time.

- US Pending Home Sales: Thursday, 14:00. Contracts to buy existing U.S. homes edged up in March by 3.4% following a 0.8% contraction in the prior month. The reading was well above expectations for a 1.0% rise. This was the first good sign in nine months that the housing market is recuperating. The strong reading suggest that the housing market will continue to support growth in the US economy. Pending home sales are expected to rise further by 1.1%.

- Canadian GDP: Friday, 12:30. The Canadian economy expanded by 0.2% in February after a 0.5% growth in January. The reading came in line with market forecast, indicating a modest recovery from the 0.4% contraction in December. However estimate for the first quarter growth stand at 1.7%-to 1.9%. February’s growth is credited to the mining and oil and gas industries. The agriculture and forestry sector contracted 1.5%. Manufacturing rose 0.6% after increasing 1.6% in January, and goods production climbed 0.5%. GDP for March is expected to reach 0.1%.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks