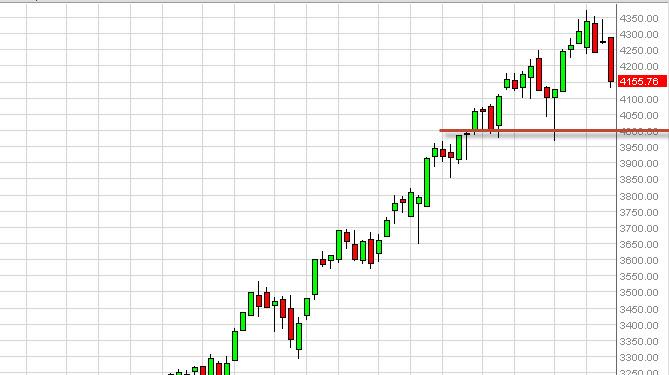

NASDAQ forecast for the week of March 31, 2014, Technical Analysis

The NASDAQ fell during the bulk of the week, breaking the 4250 level to the downside which of course triggered the cell position that traders could have had based upon the shooting star from last week. However, we had suggested previously that this market has plenty of support below, and as a result we are now looking at the market for support near the 4000 level, and perhaps even the 4100 level. Right now, we are on the sidelines but simply waiting for that supportive candle in order to start going long.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks