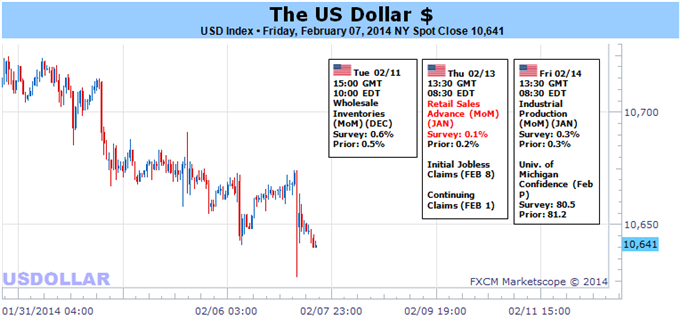

US Dollar Will Look to Volatility, Not Taper for Next Drive

Fundamental Forecast for US Dollar: Neutral

- NFPs posts a hefty 67,000-job miss in January but the unemployment rate also ticked down to 6.6 percent

- Volatility is a key measure for the market’s intentions for the dollar and equity markets

- Do you want to take a position on the Dollar and its Taper outlook without concentrated exchange rate risk, use a basket

Is the Fed’s fledgling Taper policy in jeopardy? In the wake of this past Friday’s NFPs miss, the US Dollar slipped further below a multi-month support while the S&P 500 attempted to recover from its 6 percent tumble with its first back-to-back rally over 1.2 percent since the opening days of 2013. This looks like the traditional response to levered monetary policy expectations that bolster risk appetite while simultaneously water down the greenback’s appeal. Yet, is this a true QE response or just a coincidental move to high-profile data? The answer to that question is critical to trading the dollar over coming week and weeks.

Between competing hypotheses, the one with the fewest assumptions is often the correct one. That is the principle behind Occam’s Razor. Given that precept, it would seem that a weak showing from the January non-farm payrolls – a media-favorite release – would be easily translated into a situation where the Federal Reserve is encouraged to ease off the stimulus brake to help the economy along. Yet, this is really only a ‘simple’ scenario because of the coverage the market affords to the data.

When we look to the S&P 500 (as a measure of general risk appetite) and the dollar’s response to speculated and actual changes to the monetary policy region over the past 8 months, it is clear that there is no simple casual relationship. For example, the S&P 500 tumbled after the September FOMC meet where the deferred an expected Taper, climbed after they announced the first Taper December 18 and offered a controlled decline through the follow up stimulus reduction on January 29. The greenback has behaved much the same with unexpectedly tame moves through the first $20 billion decrease (to $65 billion) in the central bank’s monthly asset purchases.

In the outlook for Fed policy, both the data and the central bank itself set the tone. While the 67,000 jobs miss by the NFPs was sizable, the 113,000-print was still positive. More importantly, the jobless rate slipped further to 6.6 percent. While many doubt the efficacy of this indicator given participation levels, it is still the benchmark the central bank uses when setting policy. And, we have already passed the 7.0 percent target issued last June associated to ‘ending QE’ and are very close to the 6.5 percent suggested as the point rate hike discussions come back into the picture. Where speculators should really look though is the commentary from the central bankers themselves. Chicago Fed President Charles Evans (the group’s most ardent dove) said the hurdle to stop the Taper is high. At the other end of the spectrum, Dallas President Fisher and Philadelphia President Plosser (voting hawks) said bigger reductions may be needed.

Given the lack of a short-term, high correlation reaction from the markets to the stimulus policy; some may believe it simply isn’t important / market moving. That couldn’t be further from the truth. Restrain on the world’s largest safety net removes a prolific stabilizing force from the backdrop. Often, we don’t recognize its absence until it is already too late. The scales tip when the Fed’s still-substantial presence, support from other major central banks and modest market drawdowns are overshadowed by the scale of leverage, the fundamental-price deviation is questioned and volatility elevates permanently.

A moderation in support is not necessarily an active catalyst for ‘fear’ that encourages deleveraging. It feeds the sentiment shift. The reversal is more likely to begin through a concerted market adjustment that seems as if it originates with an event that can be major or even insignificant (the Butterfly Effect). While we should take stock of all the high-level potential catalyst, it is important to measure the risk move that escalates fear and in turn fans the demand for the safe haven dollar. That is why we watch volatility.

The VIX, FX-VIX and other activity gauges are objective measures of speculative development. Fear is more infectious than greed, and therein is a bearish bias to increases in volatility levels. That is perhaps why the three-month correlation between the S&P 500 and VIX is -0.86 (they move heavily in opposite directions) while the USDollar – FX VIX relationship has been above +0.65. There are a few high profile events this week – Janet Yellen testimony, investor sentiment, European GDP – but nothing that stands out like NFPs or a Fed decision. That may allow volatility levels to further default (boost stocks, ease the dollar), but there isn’t much premium left to cull…

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks