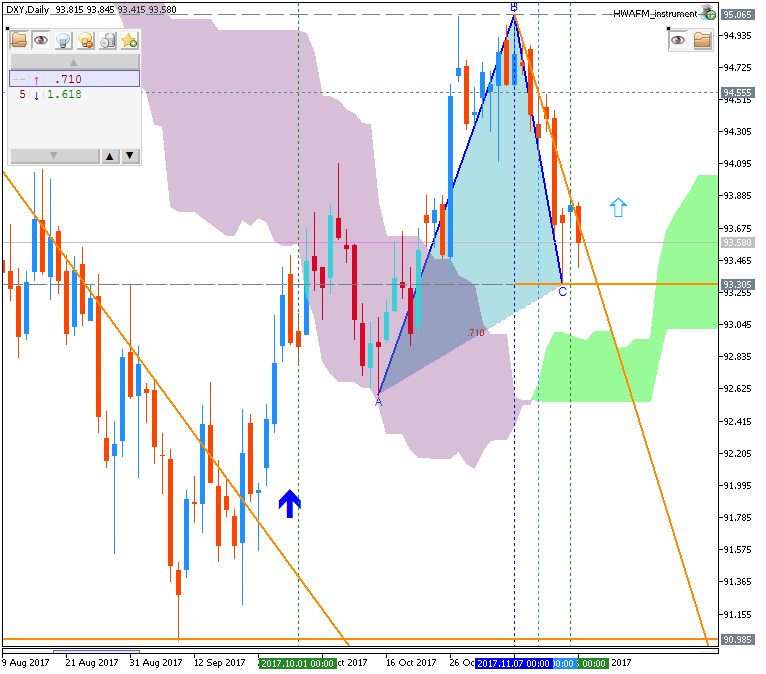

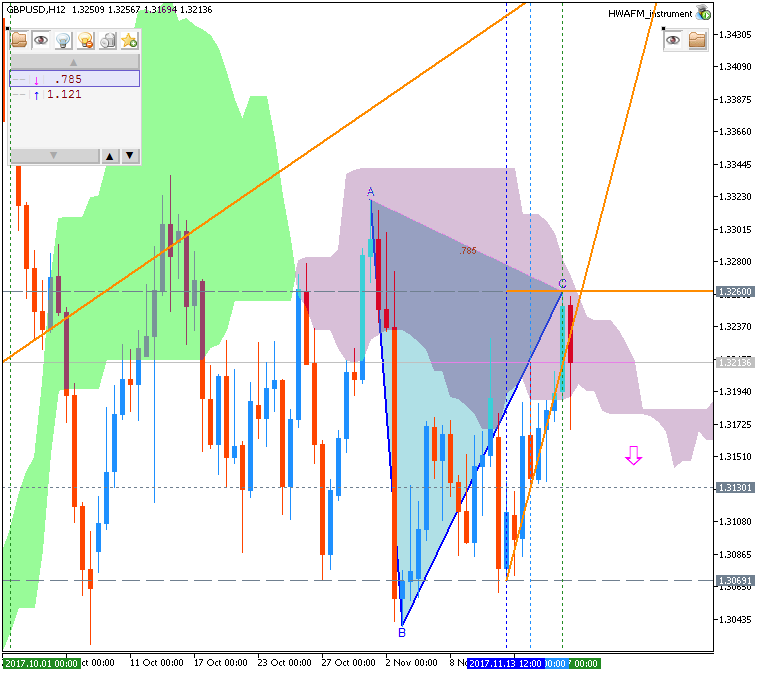

The US dollar had a mixed week amid all-important inflation numbers. The upcoming week features US durable goods orders, housing data, speeches from Yellen and Draghi, and the FOMC minutes as we head into Thanksgiving. Here are the highlights for the upcoming week.

- Mario Draghi testifies Monday, 14:00. The president of the ECB faces European MPs in Brussels and may lay out an updated view of the euro-zone economies and the inflation situation. The next meeting of the ECB is only in mid-December, so Draghi will not be constrained by a “quiet period”.

- US Existing Home Sales: Tuesday, 15:00. An annual level of 5.42 million is on the cards.

- Janet Yellen talks, Tuesday, 23:00. The Chair of the Federal Reserve will speak in New York and may provide some interesting insights about the upcoming Fed meeting in December. Given she will be out of her job in February, Yellen may be freer to speak out.

- US Durable Goods Orders: Wednesday, 13:30. Both headline and core orders are expected to rise by 0.4%.

- US FOMC Meeting Minutes: Wednesday, 19:00. These are the minutes from the November meeting, which did not consist of new forecasts nor a press conference. While the Fed hinted that they are on course to raise rates in December, they changed their wording about inflation, describing it as “soft”. We will now get an insight into the discussion among the members. How worried are they about inflation? How pleased are they with job growth? It is unlikely that the minutes will change expectations about the December meeting, but the dollar will likely move.

- UK GDP (second release): Thursday, 9:30. The second release will likely confirm this growth rate.

- ECB Meeting Minutes: Thursday, 12:30.

- Thomas Jordan speaks Thursday, 16:30. The Governor of the Swiss National Bank will give a speech in Basel and will discuss the high current account surplus. The SNB continues intervening in the franc from time to time maintaining the surplus, keeping inflation from falling too much and helping Swiss exports.

the source

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks